Bank crisis, sticky inflation to spur rate hikes in Africa’s biggest economies

Central banks in Africa’s biggest economies are poised to raise interest rates this month to contain sticky inflation and deter a selloff in their assets exacerbated by the collapse of US lender Silicon Valley Bank and stress at Credit Suisse Group AG.

Nigeria, South Africa, Egypt, Morocco and Kenya are projected to raise borrowing costs in the next two weeks. Monetary authorities in nations such as Ghana and Angola, where inflation is on a downswing are predicted to hold. Six smaller African economies will stake out different approaches to bring prices under control and deal with the contagion caused by the global banking crisis.

A gauge for government dollar bonds in Africa has dropped every day of the past seven, pushing the yield on the average security on the continent up 164 basis points to 14.36%. That’s the highest level since Nov. 3. All the bonds in the index are rated junk. While investors have rushed to the safety of bonds in general amid the crisis, they have favored quality credit and sold sub-investment grade securities.

The Federal Reserve’s rate path will also be key in decision making. An expected slowdown in monetary tightening in the US because of the banking turmoil could weaken demand for the greenback, which would cut developing nations’ cost of servicing their dollar-denominated debt, make their imports less costly and help them draw more international investment.

Angola, March 21

- BNA rate: 18%

- Inflation rate: 11.5% (Feb.)

The Banco Nacional de Angola’s monetary policy committee will likely hold its key interest rate after a 150 basis-point cut in January, the steepest since July 2018, said Euriteca Andre, an economist and university lecturer.

The committee will be concerned about the impact of SVB’s collapse, a drop in the price of Brent crude, Angola’s main foreign-exchange earner, and how external economic uncertainties will impact the local currency, she said. A slump in the kwanza could reverse a downswing in inflation.

Nigeria, March 21

- Policy rate: 17.5%

- Inflation rate: 21.9% (Feb.)

- Inflation target: 6%-9%

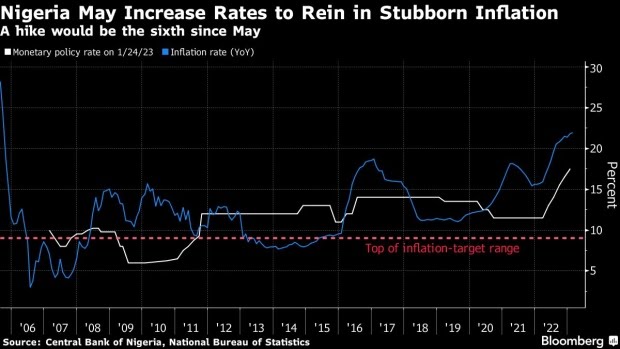

Policymakers in Nigeria are expected to extend their longest phase of monetary tightening in more than a decade to tame inflation that’s still near an 18-year high, said Mohamed Abu Basha, head of macroeconomic research at Egyptian investment bank EFG Hermes. Rates have been increased by a cumulative 6 percentage points since May.

The decision will be the first since the All Progressives Congress’s candidate Bola Tinubu won last month’s presidential elections. Tinubu, who is due to take office in May, pledged to remove fuel subsidies and “carefully review and better optimize” the nation’s system of multiple exchange rates — a central bank policy he’s described as “somewhat arbitrary.” Both reforms could initially keep prices elevated.

Economists polled by a Bloomberg expect the MPC to lift rates by 50 basis points.

Morocco, March 21

- Benchmark rate: 2.5%

- Inflation rate: 8.9% (Jan.)

The Bank Al-Maghrib is set to raise interest rates for a third consecutive meeting to rein in inflation that’s at a 30-year high and more than double its 3.9% target for 2023 stoked by an acute drought and rising input costs.

Three of the Morocco’s major financial institutions predict the central bank will increase the benchmark rate by 25 to 50 basis at its quarterly meeting.

Ghana, March 27

- Policy rate: 28%

- Inflation rate: 52.8% (Feb.)

- Inflation target: 8% +/- 2 ppts

After lifting the benchmark interest rate by a combined 14.5 percentage points since November 2021, economists surveyed by Bloomberg expect the Bank of Ghana’s MPC to stand pat.

Ghana’s currency, which whipsawed in 2022 over concern about its ballooning debt load and then optimism about a provisional International Monetary Fund bailout, has been relatively steady this year, helping to keep inflation in check.

The inflation rate has declined for two straight months and may fall more sharply to below 40% by April due to base effects, said Mark Bohlund, a senior credit research analyst at REDD Intelligence.

Kenya, March 29

- Central bank rate: 8.75%

- Inflation rate: 9.2% (Feb.)

- Inflation target: 5% +/- 2.5 ppts

Kenyan policymakers will likely increase the key rate to battle inflation and shield the local currency, which has depreciated more than 4% against the dollar since they last met in January.

A 50-basis-point hike “would be the wise decision at this point” to combat “rising inflation and the weakening shilling,” said Lydia Ndiho, a wealth manager at Nairobi-based Moran Capital. Inflation has breached the 7.5% upper limit since June.

Egypt, March 30

- Deposit rate: 16.25%

- Inflation rate: 31.9% (Feb.)

- Inflation target: 7% +/- 2 ppt

Egypt’s central bank is poised to deliver a jumbo rate hike after inflation quickened faster than expected and food prices in the Middle East’s most populous country surged at a record pace, stoked by a series of currency devaluations.

Economists expect the central bank to increase rates by between 200 and 300 basis points.

“Containing inflation expectations and, in particular, improving domestic FX liquidity to ease chronic pressure on the Egyptian pound will require the Central Bank of Egypt to pursue tighter monetary policy in the coming months,” Farouk Soussa, an economist at Goldman Sachs Group Inc., said in a report.

South Africa, March 30

- Repurchase rate: 7.25%

- Inflation rate: 6.9% (Jan.)

- Inflation target: 3%-6%

The South African Reserve Bank’s fight against inflation is unlikely to be derailed by weakness in the global banking system.

Policymakers nearing the end of the interest-rate hiking cycle, will probably raise the benchmark by 25 basis points to address potential risks to the inflation outlook, said Sanisha Packirisamy, an economist at Momentum Investments. They include the knock on effects of a weaker currency, with the rand having weakened about 7% against the dollar this year.

Average inflation expectations for the year stand at 6.3%, well above the central bank’s 4.5% target.

While traders have pared bets for a quarter-point increase, that’s largely in line with expectations of less tightening by the Fed after the collapse of SVB.

South Africa’s MPC may take direction from the European Central Bank, which delivered a 50 basis-point hike last week. The ECB “made a loud statement to markets to suggest that fighting inflation is their top priority but they stand ready to support the financial sector if needed through financial stability tools,” Packirisamy said.

Africa’s Smaller Economies

Zimbabwe will likely cut the world’s highest interest rate for a second time this year, said Prosper Chitambara, a Harare-based economist. The recent adoption of blended consumer prices, which tracks costs in US and Zimbabwean dollars, rather than just the local-currency, means a deceleration in inflation will continue, he said.

Neighboring Mozambique is set to hold its benchmark interest rate even as double-digit inflation will endure until the end of the first half of 2023 partly because of the devastation wrought by Cyclone Freddy, said Gerrit van Rooyen, economist at Oxford Economics Africa. The MPC’s proactive response to inflation has meant that despite the uptick its real rate is among the highest in Africa.

Further south, Eswatini and Lesotho whose currencies are pegged to South Africa’s rand, will probably match the Reserve Bank’s move.

Island nations Mauritius and Seychelles are poised to keep their key rates unchanged. Seychelles inflation is close to a three-year low and price growth in Mauritius is easing after five successive rate increases.

Hiking again “could be trickier amid instability within the global banking system following the implosion of Silicon Valley Bank,” said Bhavik Jugurnath, an independent economist. “I think the MPC would want to wait at least a quarter and see how this plays out,” he said.