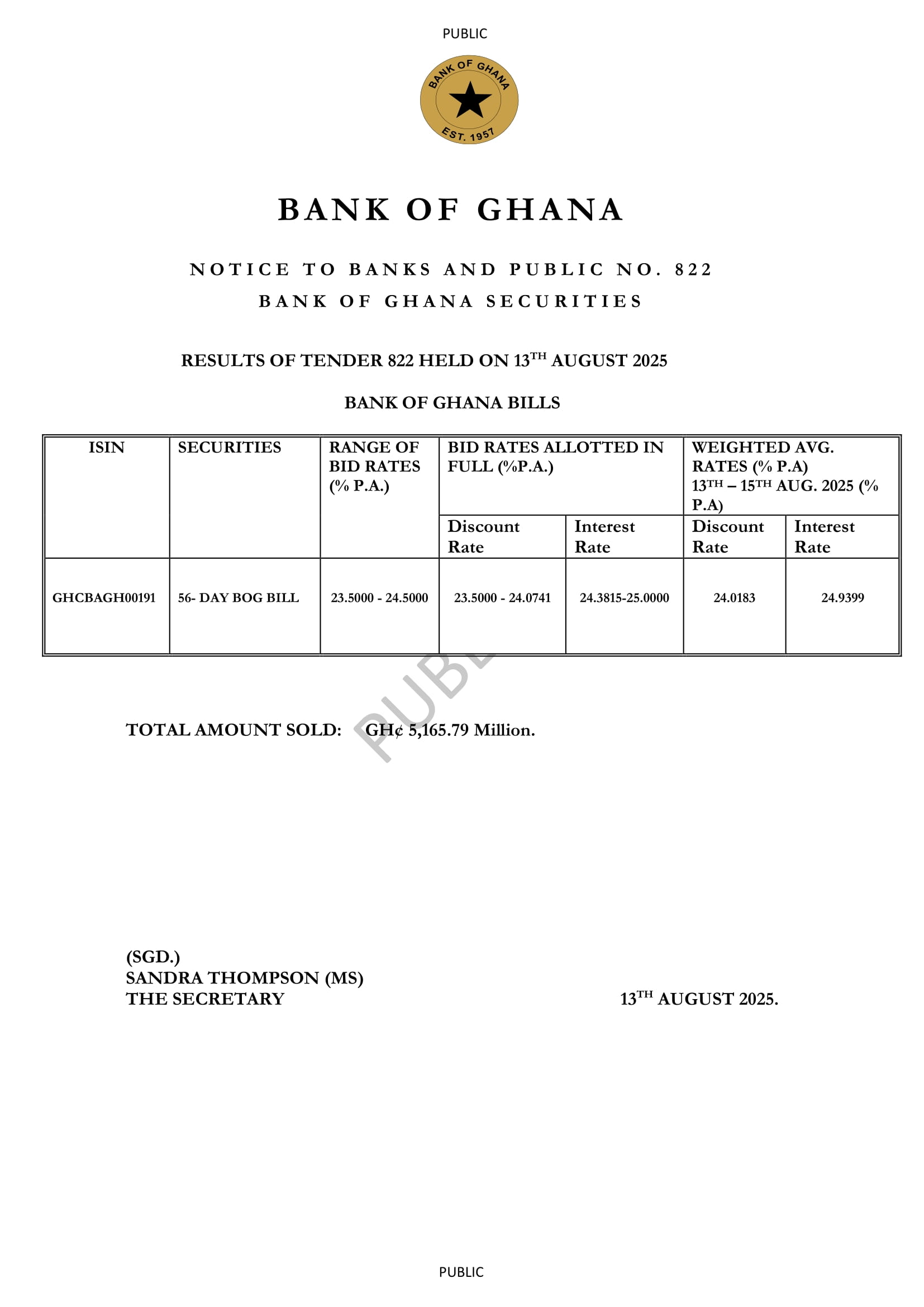

Bank of Ghana Raises GHS 5.16bn on Short-Term Bill Auction at 24.9% Interest Cost

The Bank of Ghana has raised GHS 5.16bn through the sale of 56-day bills, as the central bank continues to deploy open market operations to manage liquidity in the banking system.

The bills, auctioned on August 13 at an interest rate of 24.9 per cent, form part of the BoG’s short-term securities programme aimed at regulating money supply and influencing market rates. The auction results did not disclose the level of bids received or the issuance target.

Proceeds from such issuances are often channelled to the government to meet short-term financing needs, while the yields serve as a key indicator of the central bank’s monetary policy stance.