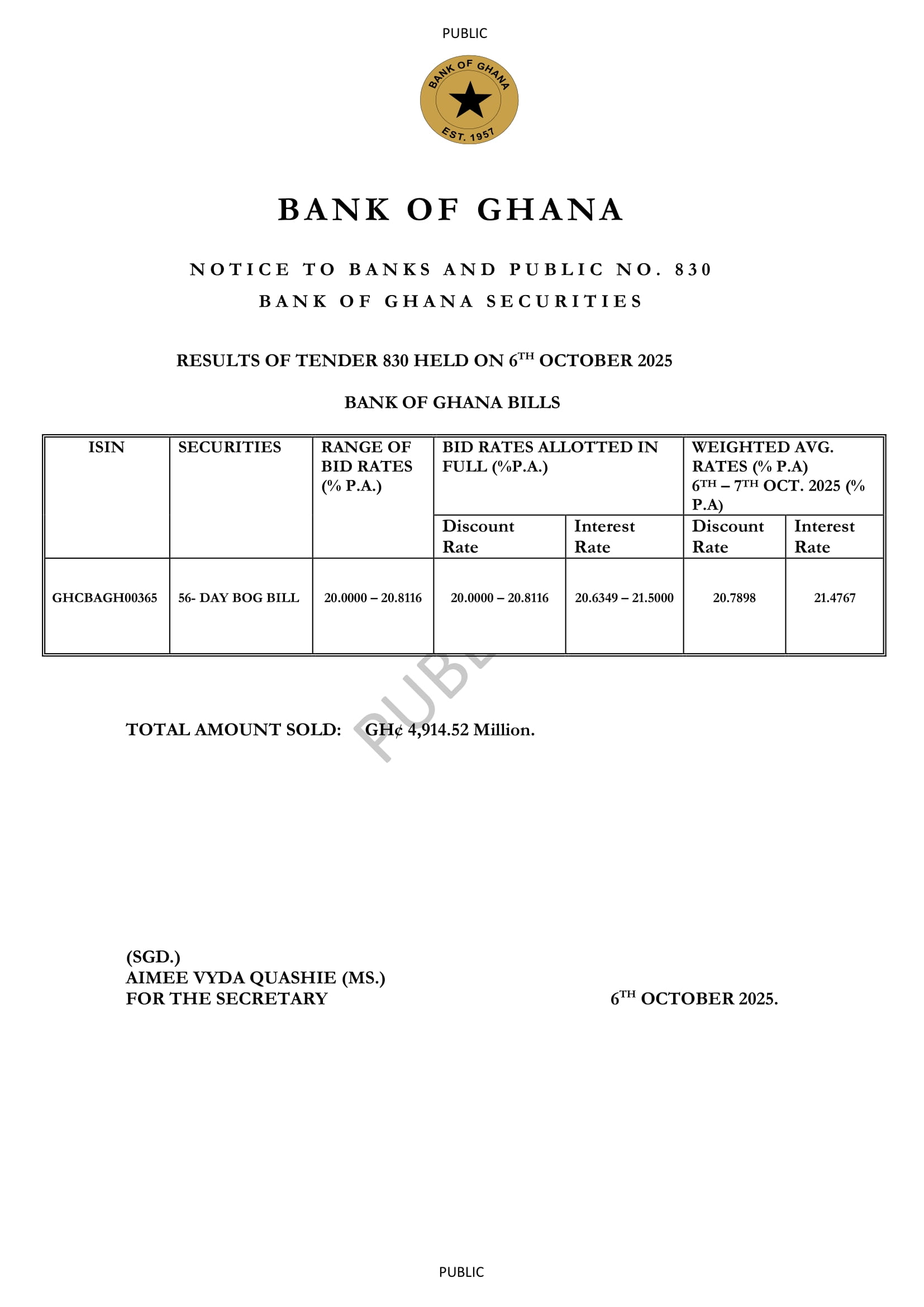

Bank of Ghana Sells GH¢4.91bn in 56-Day Bills at 21.48% Yield

The Bank of Ghana (BoG) raised GH¢4.91 billion from the sale of its 56-day bills on October 6, 2025, as the central bank continued efforts to manage short-term liquidity in the financial system.

According to auction results released by the Bank, successful bids were allotted within a discount rate range of 20.00% to 20.81% with the weighted average discount rate at 20.79%. The interest rate for the auctioned bill, however, stood at 21.48%.

The relatively elevated yield suggests continued tight liquidity conditions and investors’ preference for short-dated government paper amid expectations of sustained monetary policy easing.

The central bank’s bill issuance forms part of its open market operations to absorb excess liquidity and maintain stability in short-term interest rates.