BHP faces a test of patience after $49 billion Anglo bid falters

Days after BHP Group failed to secure the $49 billion takeover of smaller rival Anglo American Plc, investors have one message for Chief Executive Mike Henry — keep your cool.

BHP argues it showed restraint in the battle for Anglo, a welcome attribute in a sector notorious for burning billions of dollars of on underwhelming projects and ill-timed acquisitions just over a decade ago. The question now is whether that discipline holds, even with all mining bosses gunning for more volume in copper, the single most coveted metal as the energy transition accelerates.

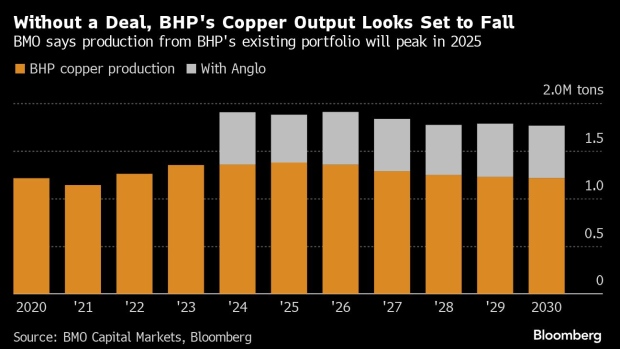

The Anglo tilt was an ambitious bid to transform the world’s largest miner into the top global producer of the red metal in one fell swoop. Having faltered, people familiar with the matter say BHP won’t rush into more — at least in part because there are few alternatives when it comes to copper. Major deposits are increasingly rare and costly to develop, while the most obvious acquisition targets are effectively out of reach, either because of ownership or valuation.

Anglo comes back into view in six months time under UK Takeover Panel rules, and BHP will wait until then and reconsider its options, said the people, who declined to be named as the discussions are not public.

“What is in BHP’s portfolio is going to take time to deliver and it’s not going to be cheap. That was one of the reasons why they saw an opportunity in Anglo to take their interest in three key assets in Chile,” said David Radclyffe, managing director at Global Mining Research. “Copper is one of those commodities everyone wants to be in, the problem being there aren’t many of those assets and it’s incredibly hard to deliver them.”

The battle over the past weeks has mesmerized the mining sector. A tussle between two of the industry’s largest players, it would have been the most significant tie-up in over a decade — and one of the most complex to boot. Under BHP’s all-share proposals, Anglo would have had to spin off its South African platinum and iron ore assets, before then being purchased by the Australian mining giant.

Anglo’s board rejected the repeated offers, and opted instead for its own turnaround plan.

That makes the next six months — and beyond, given the intricacy of Anglo’s plan — crucial. If the rescue blueprint falters, the company may be back on the table at a lower price. If it succeeds, Anglo may end up closer to the copper-focused company BHP had sought in the first place.

BHP’s Australian shares have dropped 1.8% since May 28, the day before the miner said it would walk away from the Anglo bid.

Rival Suitors

The trouble for BHP is that down the line other bidders could also step in, including rivals Rio Tinto Ltd., and Glencore Plc. Neither is perfectly positioned today, but both may well be later this year, as investors and executives warm to the idea of deals and Glencore completes its acquisition of Teck’s steelmaking coal business. All are eager to bump up copper production.

Industry bankers and executives have reviewed deals centered on the industrial metal for years, running the rule over copper-heavy like Antofagasta Plc, First Quantum Minerals Ltd and Freeport-McMoRan Inc — but either family owners or expensive valuations have held back approaches, especially in an industry where shareholders remember past profligacy only too well.

“There has been a longer-term positioning by BHP to do more acquisitions, but does that necessarily mean that sort of gives them a blank check to go and do acquisitions at elevated premiums? I don’t think so,” RBC Capital Markets analyst Kaan Peker said.

BHP’s scale, of course, means it does have options of its own. Iron ore remains a cash cow, and its $3.6 billion South Flank iron ore project expansion is on track to reach full production this year — good news even if concerns are growing about the longer-term demand prospects for the steelmaking material.

Its copper portfolio is also substantial, with its massive mines in Chile — including Escondida, the world’s biggest — and Australia churning out more than 1.2 million tons a year. BHP is expanding exploration across the Oak Dam project and drilling at Olympic Dam in South Australia, with its mineral resource estimate expected to be expanded later this calendar year.

But over the coming months, copper deals are unlikely to be far from executives’ minds.

“They’ve clearly shown their hand and basically confirmed what a lot of people have been saying, what companies themselves are saying,” said Sam Berridge, portfolio manager at Perennial Value Management Ltd., which doesn’t hold BHP because it’s negative about long-term iron ore demand.

The cost and the time it takes to build copper projects from scratch are simply too off-putting, Berridge said: “The hurdles there are so high that M&A is a much more appealing option.”