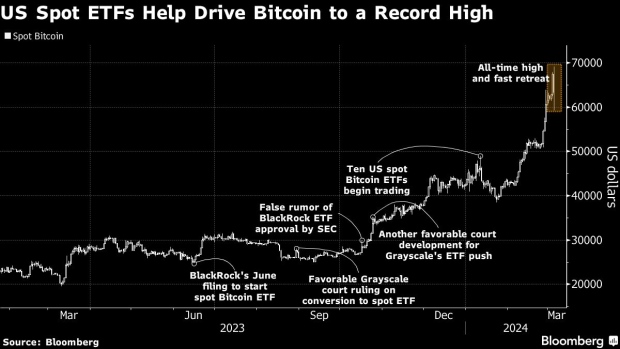

Bitcoin retreats after record-setting run that topped $69,000

Bitcoin surged to a record for the first time in more than two years before rapidly retreating as traders took some profits.

The largest digital asset topped out at $69,191.95 on Tuesday in the US but the ensuing selloff left some of the crypto faithful’s champagne on ice, sending Bitcoin to about $63,000 as of 10:58 a.m. Wednesday in Singapore.

The price swings underscore Bitcoin’s boom-or-bust nature. Inflows into US-spot Bitcoin exchange-traded funds, a looming reduction in the token’s supply growth and speculative derivatives bets fueled an eye-catching rally this year — leaving investor positioning stretched and hinting at the risk of a retrenchment.

“I expect we’ll likely see some range-trading take place for a few days at least, with Bitcoin prices continuing to chop around in the $60,000 range,” said Stefan von Haenisch, head of trading at OSL SG Pte in Singapore.

Leveraged Bets

Coinglass data show that about $880 million worth of bullish crypto wagers and $265 million of bearish bets were liquidated in the past 24 hours in derivatives markets — the combined daily figure of more than $1 billion is the highest since the pandemic-era bull run in digital assets, according to von Haenisch.

Even with the latest dip, Bitcoin’s 50% advance so far in 2024 outstrips global stocks, supporting optimism across the digital-asset market. A gauge of the largest 100 tokens is up more than 40% over the same period.

The US Securities and Exchange Commission permitted spot-Bitcoin ETFs in January after its effort to resist them suffered a legal defeat last year.

The move has widened the mass-market accessibility of Bitcoin, helping the crypto sector to turn the page following a bear market in 2022 and a string of subsequent bankruptcies, including the implosion of Sam Bankman-Fried’s FTX exchange. The industry used the term “crypto winter” to describe the turmoil.

ETF Inflows

A steady tide of money has poured into the ETFs issued by heavyweights including BlackRock Inc. and Fidelity Investments. The net inflow of about $8 billion is colliding with a looming slowdown in Bitcoin’s supply growth, the so-called halving due in April. One question now is whether the cohort of ETF investors will be unsettled by the latest price gyrations.

“ETFs brought in a diverse investor base, and inflows have been healthy,” said Cici Lu McCalman, founder of blockchain adviser Venn Link Partners. “Inelastic supply will continue to be solid support for Bitcoin’s scarcity value.”

Bitcoin’s comeback started in early 2023 and has helped to lift the overall market value of digital assets to about $2.5 trillion. The token’s previous peak was $68,991.85 in November 2021, according to data compiled by Bloomberg, a period when monetary and fiscal stimulus was oiling global markets.

“Many traders may have held onto their long positions through the depths of the crypto winter, and are now finally seeing an opportunity to exit at a profit,” said Caroline Mauron, co-founder of digital-asset derivatives liquidity provider Orbit Markets. “It is not clear how quickly this can be absorbed by new retail and institutional interest, but we do expect the all-time high and levels further up to be re-tested shortly.”