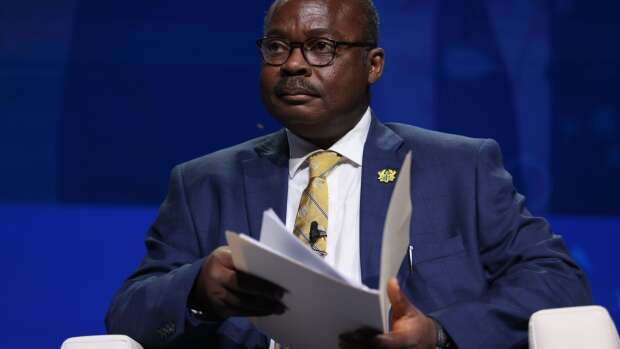

BoG Governor Emphasizes Innovative Policy Mechanisms for SME Growth

Dr. Ernest Addison, Governor of the Bank of Ghana, has underscored the importance of innovative policy mechanisms in unlocking the economic growth potential of small and medium enterprises (SMEs) at the 2024 SME Growth and Opportunity Summit.

Organized by the Ministry of Finance, the summit highlighted the need for steadfast commitment from all stakeholders to enhance the sector’s output.

Dr. Addison emphasized that the Bank of Ghana is leveraging its mandate to improve payment ecosystems through modern policy tools, including the regulatory sandbox.

This tool has been instrumental in implementing policy initiatives aimed at enhancing digitalized financial services and fostering economic inclusion for Ghanaian SMEs.

Innovative Financial Ecosystem

One notable initiative is the Ghana Integrated Financial Ecosystem (GIFE), launched in June 2022 as part of the broader Business Sans Borders (BSB) initiative.

In collaboration with the Monetary Authority of Singapore (MAS) and Development Bank Ghana (DBG), the BSB aims to provide domestic electronic commerce platforms and SME users with access to diversified trade opportunities and essential ecosystem facilities such as finance, accounting, and business referrals.

The initiative also includes a global innovation hub to support FinTech companies in developing new services and products.

“The BSB is designed to enable domestic electronic commerce platforms and SMEs users access to diversify trade opportunities as well as critical, quality ecosystem facilities such as finance, accounting, and business referrals, among others. The BSB also includes a global innovation hub to help FinTech companies develop additional innovative services and products,” he said.

The GIFE program offers comprehensive support to SMEs, including financial and digital literacy training and the opportunity to obtain trusted digital credentials.

This initiative aims to enhance SMEs’ access to financial services and cross-border trade connectivity, preparing local businesses with the necessary skills and endorsements to compete in the international market.

Role of SMEs in Economic Growth

SMEs form the core economic base of Ghana, significantly contributing to economic growth, employment generation, and poverty reduction.

However, the sector was severely impacted by the COVID-19 pandemic, with lockdowns halting their activities.

In response, the government implemented various policy interventions, including a GH¢560 million (US$100 million) Emergency Preparedness and Response Plan to support SMEs.

Future Prospects and Studies

Recognizing the vital role of SMEs in Ghana’s economy, the Bank of Ghana has commissioned a study in collaboration with the Development Bank of Ghana and the University of Ghana Business School.

This study aims to understand the constraints faced by SMEs and formulate targeted policies to ensure growth.

The research explored the credit demand needs of SMEs, the supply of liquidity, and how FinTechs can be leveraged to scale up lending.

Dr. Addison’s remarks at the summit reinforced the Bank of Ghana’s commitment to supporting the SME sector through innovative policies and collaborations, ensuring their sustainable growth and contribution to the broader economy.