BoG Sells GHS 8.89bn in Short-Term Bills as Interest Rate Dips to 10.5%

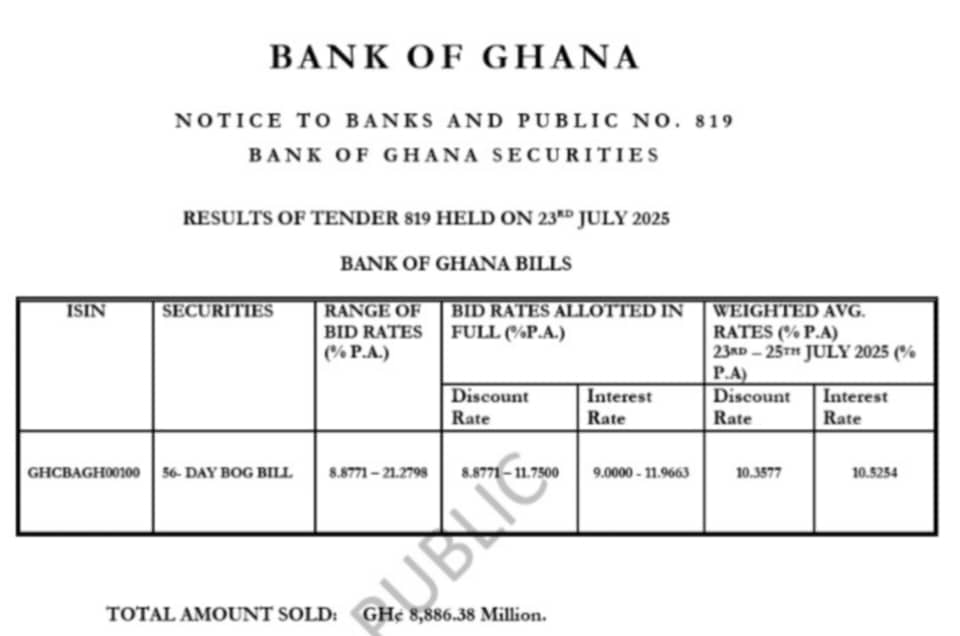

The Bank of Ghana raised GH¢8.89 billion in its latest securities auction held on July 23, 2025, as investor appetite for short-dated instruments remained resilient despite declining interest rates on the debt instruments.

According to auction results published by the central bank, the 56-day BoG bill cleared at a weighted average discount rate of 10.36% and an interest equivalent of 10.53%, significantly below prior interest rate levels.

The bid window saw investor submissions ranging from 8.88% to 21.28%, though bids accepted in full were within a narrower range of 8.88% to 11.75%, indicating the Bank’s preference for moderately priced liquidity.

The outcome suggests the BoG remains cautious in its liquidity operations, balancing the need to attract competitive bids while managing inflation expectations and stabilising the cedi under the ongoing IMF-backed fiscal consolidation programme.