BoG’s Gold Reserves Hit 31.37 Tonnes as Strategic Accumulation Drive Continues

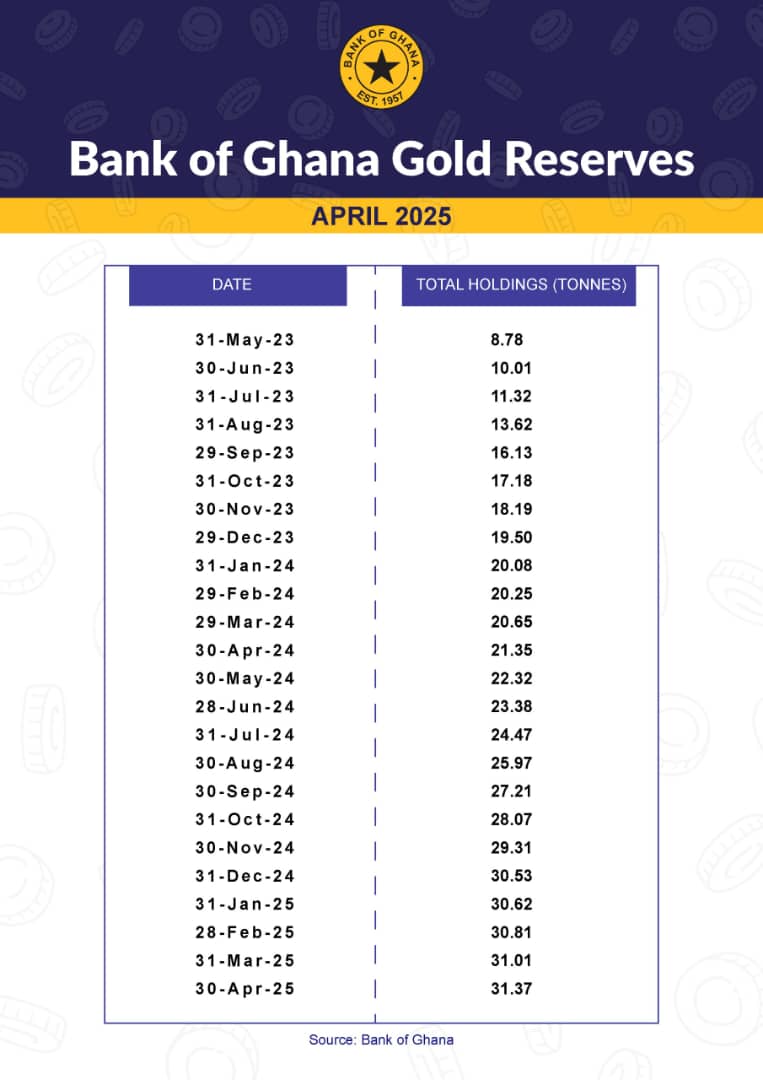

The Bank of Ghana (BoG) has increased its gold reserves to 31.37 tonnes as of April 30, 2025, marking a sustained upward trend in the central bank’s strategic effort to shore up the country’s foreign exchange reserves and enhance monetary policy credibility.

The April figure reflects a modest rise from the 31.01 tonnes recorded at the end of March 2025 and continues the growth trajectory observed since May 2023, when reserves stood at just 8.78 tonnes. The more than threefold increase within a two-year period signals a decisive policy shift by the central bank towards utilising Ghana’s gold-producing strength to support macroeconomic stability.

The accumulation has been driven primarily by the Domestic Gold Purchase Programme introduced by the BoG. The initiative is aimed at increasing the country’s foreign exchange buffers, boosting investor confidence, and reinforcing the Ghana cedi’s stability amid volatile global financial conditions.

At the launch of the programme, the BoG indicated that beyond bolstering reserves, it also sought to expand gold holdings to serve as collateral for securing cheaper sources of international financing, thereby improving short-term foreign exchange liquidity and reducing reliance on more expensive borrowing instruments.

The Bank’s strategy is also in line with ongoing efforts to diversify Ghana’s reserve assets, moving away from traditional holdings such as U.S. Treasury instruments and towards more intrinsic-value-based reserves.

Analysts say the accumulation of gold is a prudent response to rising global interest rates and capital flow volatility, noting that a robust gold reserve position enhances Ghana’s balance of payments resilience, provides a buffer against external shocks, and strengthens the central bank’s policy toolkit.

The BoG’s continued focus on gold is expected to play a pivotal role in long-term economic stability efforts, especially as the country navigates a complex post-DDEP recovery, a challenging external environment, and ongoing fiscal consolidation efforts.