Bond investors are lining up to fund the war against Putin

Bond investors are urging squabbling European Union leaders to get their act together on defense spending and make the bloc’s trillion-euro bond program permanent.

That means demand won’t number among the challenges faced by EU politicians at loggerheads over whether to boost shared military capabilities by issuing joint bonds. Fund managers starved of AAA-rated securities say they’re clamoring for more European issuance.

Investors point out that these instruments would enable the spending boost that is becoming ever more imperative to counter Russian belligerence, but without loading more debt onto individual member states. And there is also something in it for them, since EU bonds pay a premium over similarly rated sovereigns.

“Investors are thirsty for these bonds,” said Brian Mangwiro, a portfolio manager at Barings who owns EU debt.

The solution of a bloc-wide debt program is starting to be taken seriously in some capitals as European security officials warn that Vladimir Putin could move on to target their territory if he secures victory in Ukraine, while a decades-long shortfall in military spending leaves the continent dangerously unprepared.

Shared borrowing was described by EU Economy Commissioner Paolo Gentiloni last month as “a sound way” to deal with crises. The plan’s being championed by countries whose defense industries would be well-placed to benefit — like France — and countries whose proximity to Russia sharpens their sense of the threats — like Estonia — although it faces opposition from Europe’s more fiscally conservative states.

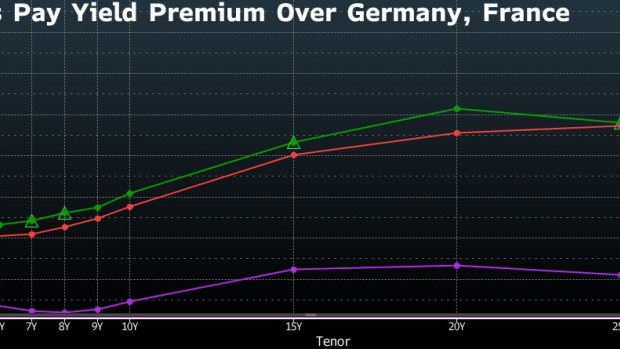

One reason investors are urging the holdouts to overcome these reservations is that AAA-rated paper is highly prized — and even more so since the US was stripped of its top-tier rating last year. An added bonus: for reasons that include the temporary nature of the issuance, existing EU bonds pay investors slightly higher yields than equally-rated Germany, and even than lower-rated France.

Bond-buyer enthusiasm is evident at virtually every sale. Last month, a €3 billion ($3.3 billion) EU bond received €81 billion in orders — at 27 times, that was the highest cover ratio ever recorded in Europe’s publicly syndicated debt market, according to data analyzed by Bloomberg. Even back in October 2020, the EU’s first joint issuance since the landmark pandemic bond deal recorded a €233 billion order book, the largest for any single deal in bond-market history.

The EU already has some €450 billion outstanding in bonds, mostly issued to finance the pandemic recovery fund. That program will cease to issue new bonds after 2026 but conviction is growing among investors that the EU bond issuance should become permanent.

That’s precisely what’s making some fiscally conservative countries skeptical. Many are opposed to anything that isn’t framed as a one-off. That was the rationale that triumphed during the pandemic when an acute crisis forced Germany and other wealthier EU states softened their habitual opposition to pooled borrowing.

Investors know much will depend on what happens on the Ukrainian battlefield in the weeks ahead, and are watching for whether the advance of Russian tanks toward the EU’s eastern border forces a wake-up call. “Unfortunately it always takes a crisis in Europe to make much traction,” said Guy Miller, head of market strategy at Zurich Insurance Co.

Germany and the Netherlands have rejected suggestions for a joint instrument to fund defense, and so far the increases in defense spending undertaken since Russian invaded Ukraine two years ago have been largely left up to member states themselves. That push has not without controversy, both domestically, and as EU members argue among themselves about who is — and isn’t — doing enough.

Earlier this week the commission allocated €1.5 billion from additional EU budget funds by way of joint spending, but that won’t get close to funding the step-change needed to repel Vladimir Putin from Ukraine — still less, to gear up for a putative attack on European soil in years ahead. EU industry commissioner Thierry Breton has urged the bloc to consider spending €100 billion.

Superior Returns

The irony of any new, joint defense issuance would be that the very thing attracting investors to EU debt — its yield premium — may moderate slightly, were they to initiate a larger, joint-funding plan. The temporary nature of the Covid relief program is one reason why they ask for higher returns to buy the notes.

But that may constitute yet another advantage for the bloc. EU bonds due 2034 trade with a 2.9% yield, while German notes maturing the same year pay less than 2.2%, and French 2033 securities yield 2.7%. That means at current bond prices the EU would incur an additional annual interest cost of about €7 million per €1 billion compared to Germany.

EU issuance would also reduce the need for individual sovereigns to raise borrowing. That’s crucial, given that interest payments already surpass defense spending in seven European NATO countries, according to Germany’s Ifo Institute. In highly indebted Italy, interest costs are three times annual military expenditure.

“The beauty of EU bonds is that the debt doesn’t appear in your national statistics, it doesn’t count toward Maastricht or the debt brake or anything like that,” said Moritz Kraemer, chief economist at German bank LBBW. “So in principle, you can get funding for whatever you think you need without having to incur the penalty.”

Maastricht refers to a bloc-wide treaty that seeks to limit budget deficits to 3% of GDP, while the debt brake is a borrowing cap enshrined in Germany’s constitution.

A debt-funded EU defense program “would be a very welcome development — an Hamiltonian moment so to say,” said Kaspar Hense, a senior portfolio manager at RBC BlueBay Asset Management, referring to the Treasury secretary who in 1790 helped turn the US into a federation by pooling the debt of various states. “I would not worry about there not being demand.”