Bond Traders Buckle Up for ‘No Landing’ After Jobs Surprise

The “no landing” scenario – a situation where the US economy keeps growing, inflation reignites and the Federal Reserve has little room to cut interest rates – had largely disappeared as a bond-market talking point in recent months.

It only took a blowout payrolls report to revive it.

Data showing the fastest job growth in six months, a surprising drop in US unemployment and higher wages sent Treasury yields surging and had investors furiously reversing course on bets for a larger-than-normal half-point interest-rate reduction as soon as next month.

It’s the latest wrenching recalibration for traders who had been setting up for slowing growth, benign inflation and aggressive rate cuts by piling into Fed rate-sensitive short-term US notes. Instead, Friday’s report revived a whole new set of worries around overheating, spoiling the rally in Treasuries that had sent two-year yields to a multiyear low.

“The pain trade was always higher-front end rates due to less rate cuts being priced in,” said George Catrambone, head of fixed income, DWS Americas. “What could happen is the Fed either delivers no more rate cuts, or actually finds itself having to raise rates again.”

Much of the recent market debate had centered on whether the economy would be able to achieve the “soft landing” of deceleration without recession, or veer into the “hard landing” of a severe downturn. The Fed itself had signaled a shift in focus toward preventing a deterioration in the job market after fighting inflation for more than two years, and its pivot to rate cuts began with a half-point bang in September.

But Friday’s payroll report provided ammunition for those who see a disconnect in the Fed cutting rates when stocks are at record high, the economy is expanding at a solid pace and inflation has yet to return to the Fed’s target. In short, a no-landing scenario.

A number of prominent investors and economists, including Stanley Druckenmiller and Mohamed El-Erian, cautioned that the Fed shouldn’t be boxed in by market projections for lower rates or its own projections, with El-Erian warning “inflation is not dead.” Former Treasury Secretary Larry Summers said in a post on X Friday that “no landing” and “hard landing” are risks the Fed has to reckon with, saying last month’s outsized cut was “a mistake.”

For some, the Fed’s outsized reduction last month, combined with China’s surprising stimulus blitz, tilt the balance away from growth concerns.

“The 50-basis-point cut should be out of question now,” said Tracy Chen, portfolio manager at Brandywine Global Investment Management. “The Fed’s easing and China’s stimulus increases the likelihood of a no landing.”

Meanwhile, inflation concerns are reviving after crude oil surged. The 10-year breakeven rate, a measure of bond traders’ inflation expectations, reached a two-month high, rebounding from a three-year low in mid-September. That’s ahead of key data on consumer prices due next week.

Swap traders are pricing in 24 basis points of easing for the November Fed meeting, meaning that a quarter-point reduction is no longer seen as guaranteed. A total of 150 basis points of easing is priced in through October 2025, down from the expectations of reductions about 200 basis points in late September.

The scaling back of Fed expectations has poured cold water on the bond buying frenzy that helped Treasuries clock in five straight monthly gains, the best stretch since 2010. Ten-year Treasury yields have jumped more than 30 basis points since the Fed’s meeting last month, approaching 4% for the first time since August.

“The Fed has highlighted the importance of the labor market in its dual mandate, which prompted the jumbo cut last month and now here we are with evidence that the labor market is in fine fettle,” said Baylor Lancaster-Samuel, chief investment officer at Amerant Investments Inc. “It is definitely somewhat in the category of ‘Be careful what you wish for.’”

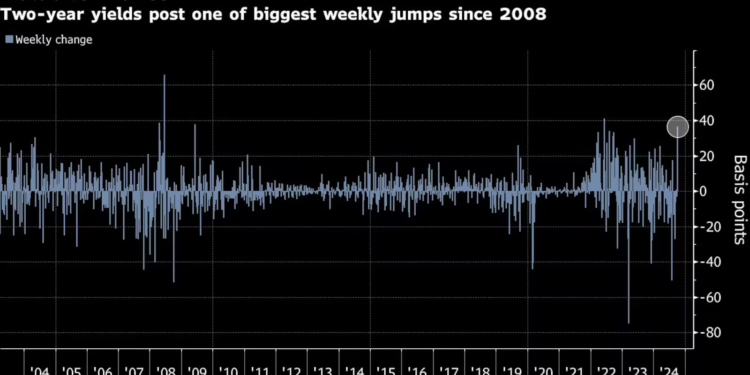

The shifting narrative also upended a recent popular strategy to bet on aggressive Fed easing: so-called curve steepening. In such a strategy, traders wager short-term notes would outperform longer-maturity debt. Instead, two-year yields jumped 36 basis points last week, the most since June 2022. At 3.9%, the two-year yields are only 6 basis points below 10-year notes, narrowing from 22 basis points in late September.