Bright Simons Questions GoldBod’s Bullion Pricing Mechanism, Urges Publication of Operational Manuals

Policy activist and Honorary Vice President of IMANI Ghana, Bright Simons, has raised concerns over the operational transparency and pricing mechanisms of the newly established GoldBod, Ghana’s exclusive regulatory body for gold and precious mineral trading.

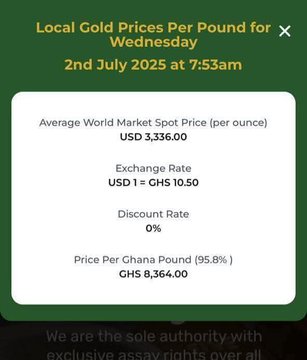

In a social media post on July 2, Mr Simons questioned the methodology employed by GoldBod in setting the foreign exchange rate for purchasing gold, describing the pricing structure as “baffling” and calling for the immediate publication of detailed operational manuals.

“There is some controversy about how Ghana’s GoldBod is setting the forex rate at which it intends to buy gold. As we have said repeatedly, the organisation needs to publish MANUALS for all key operations,” he asserted.

Expressing further bewilderment, Mr Simons drew attention to what he perceives as inconsistencies in the pricing of gold by GoldBod, specifically referencing the use of the term “Ghana pound” in recent promotional materials. He questioned whether this aligns with the internationally recognised measurement of a pound equivalent to 0.4536 kilograms, highlighting that the global spot price for a pound of gold exceeds $53,000, a figure he suggests is incompatible with the less-than-GHS 10,000 valuation being applied locally.

“To be effective, [GoldBod] needs the most tuned-up management system, and that STARTS WITH MANUALS. Public ones that can be used to benchmark market-facing operations,” Mr Simons stressed.

The IMANI Ghana Vice President further clarified that the significant gains recorded in Ghana’s gold export market from January to July 2025 are largely attributable to rising global gold prices rather than any direct interventions by the GoldBod. He noted that until recently, the gold export trade remained open to long-standing private sector players operating under the pre-existing regulatory framework of 2024.

“The GoldBod has only now issued licenses. It is not responsible for the boost in export volume and value between January and July 2025,” he emphasised, adding that some exporters may have expedited exports in anticipation of impending regulatory changes.

According to the new legal regime, GoldBod is now the sole institution authorised to license entities engaged in the trading of gold, diamonds, and other precious minerals in Ghana. As such, all existing market participants will be required to obtain fresh licenses or risk exclusion under the new rules.

Mr Simons warned that the real impact of the GoldBod’s market interventions will only begin to materialise in the months ahead, particularly if the government moves to invalidate existing export licenses and centralise trading activities through GoldBod-certified actors.

“It goes without saying that transparency would be hugely critical going forward so that we can monitor the GoldBod’s performance and gauge the effectiveness of the new law,” he advised.

The establishment of GoldBod forms part of government efforts to formalise Ghana’s mineral exports, enhance revenue generation, and tighten oversight over the country’s lucrative gold sector. However, critics like Mr Simons caution that without robust transparency, clear operational guidelines, and active stakeholder engagement, the initiative risks undermining the very stability and efficiency it seeks to foster.

Yes transparency critical and Standard operating procedures key!

Transparency and SOPs a necessary and sufficient condition!

The Goldboard needs ro hire Statisticians and Econometricians to to model the pricing mechanism and predict the international Gold market timely.