- Brussels Airlines Counts on Summer to Soar Past Early-Year Setbacks

Brussels Airlines has reported a modest improvement in its financial performance for the first half of 2025, despite navigating a series of operational disruptions and cost pressures. The Belgian flag carrier posted an adjusted Earnings before interest and taxes (EBIT) of minus €46 million, representing a slight 2% year-on-year improvement, buoyed by strong demand on its European network and a double-digit rise in flights and revenue.

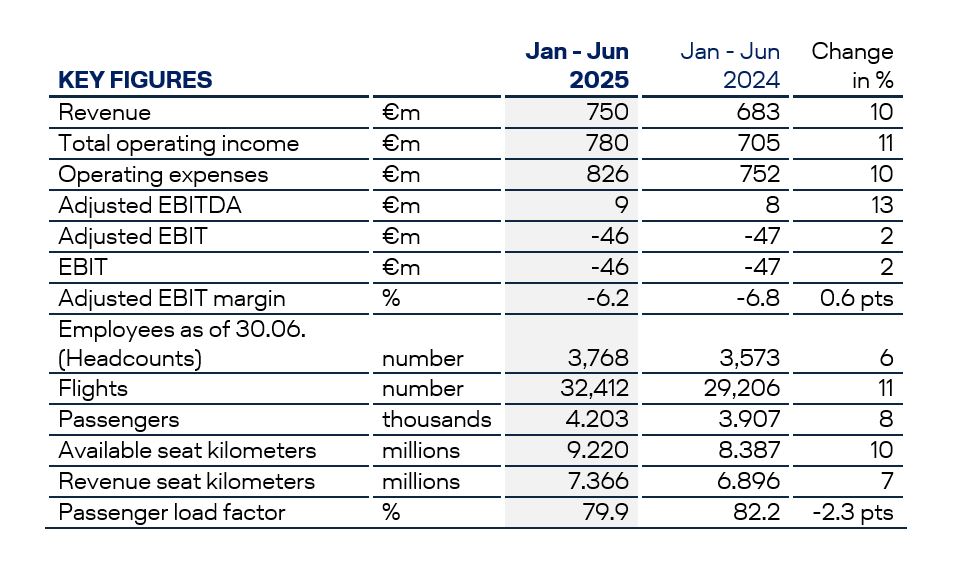

The Lufthansa Group subsidiary transported more than 4.2 million passengers between January and June, representing an 8% increase from the same period in 2024, across 32,412 flights, a notable 11% rise. Revenue climbed 10% to €750 million, while total operating income jumped 11% to €780 million. The airline’s adjusted earnings before interest, taxes, depreciation, and amortisation (EBITDA) rose 13% to €9 million, reflecting a modest improvement in operating profitability, even as expenses grew in tandem.

However, profitability remained elusive due to a confluence of external shocks. Nationwide demonstrations in Belgium, primarily in protest of government measures, severely disrupted operations, costing the airline an estimated €12 million. Additional headwinds came from a negative revaluation of assets, unplanned maintenance costs, and long-haul disruptions, dragging down overall margins.

“The last six months brought some unexpected challenges, which were mostly external and beyond our control,” said Nina Öwerdieck, Chief Financial Officer of Brussels Airlines. “The national manifestations have added a high financial burden on us. These are funds we can no longer invest in what truly matters: our passengers, our people, and the future of our company.”

Despite these setbacks, Öwerdieck reaffirmed the company’s confidence in achieving a “highly profitable full-year result” for the third consecutive year, banking on a strong summer travel season and a revamped fleet.

Summer Surge and Fleet Expansion

To meet rising demand during the peak summer months, Brussels Airlines expanded its operating fleet to 50 aircraft. This includes the addition of an Airbus A320, one Airbus A330, and four Airbus A220 aircraft operated under a wet-lease agreement with Air Baltic.

Staffing levels have also seen a strategic boost. More than 300 new employees, including cabin crew, pilots, and maintenance personnel, were recruited in the first half of 2025. In an innovative move, the airline deployed trained summer students as cabin crew for the first time, subjecting them to the same rigorous standards as full-time staff.

Operational efficiency has similarly been upgraded. The capacity of the bag drop area at Brussels Airport was doubled, contributing to shorter queues and improved passenger throughput.

Long-Haul Drag vs European Strength

While medium-haul operations across Europe continued to post robust growth, driven by a healthy rebound in intra-European travel, the long-haul network struggled. According to the airline, the underperformance was largely attributable to maintenance-related disruptions and strategic realignments that weakened its transcontinental revenue base.

Passenger load factor, a key indicator of airline efficiency, dropped 2.3 percentage points year-on-year to 79.9%, even as total available seat kilometres rose 10% and revenue seat kilometres grew 7%.

The adjusted EBIT margin improved marginally from -6.8% to -6.2%, reflecting early signs of efficiency gains, though the margin remained negative. The increase in operating expenses, from €752 million to €826 million, is attributed to inflationary pressures, fuel volatility, and the cost of scaling operations to meet rising demand.

Investing Through the Storm

Employee count as of June 30, 2025, rose to 3,768—up 6% from a year earlier—as the airline repositions itself for long-term growth. This expansion in workforce and fleet signals Brussels Airlines’ intent to invest through adversity, despite short-term financial setbacks.

Öwerdieck noted that the challenges of H1 2025 had strengthened the airline’s resolve to reinforce its cost discipline and reallocate resources more strategically. “We are increasingly conscious that every euro must contribute to reinforcing our revenue base and passenger experience,” she said.

Brussels Airlines emphasised that operational excellence, network optimisation, and lean cost structures would remain central to its strategy in the months ahead.

Outlook: A Bet on the Summer Rebound

The airline is banking on strong summer travel demand to reverse the red ink of the first half. Early booking trends, especially across its leisure routes, have provided reason for optimism. Executives remain bullish that the full-year performance will validate their strategy of controlled expansion and investment in quality service.

Should the summer surge materialise as expected, Brussels Airlines could defy macroeconomic pressures and deliver a third consecutive annual profit, an achievement that would further strengthen its role within the Lufthansa Group’s broader European strategy.