Saudis said to hand about 60% of Aramco offer to foreign funds

Foreign investors are set to be allocated about 60% of the shares on offer in Saudi Aramco’s $11.2 billion stock sale, people familiar with the matter said, marking a turnaround from the oil giant’s 2019 listing that ended up as a largely local affair.

The deal generated strong demand from the US and Europe, according to the people, who declined to be identified as the information is private. Funds from the UK, Hong Kong and Japan also backed the share sale that drew orders worth more than $65 billion in total, the people said.

During the oil giant’s listing, overseas investors had largely balked at valuation expectations and left the government reliant on local buyers. The $29.4 billion IPO drew orders worth $106 billion, and just 23% of shares were allocated to foreign buyers.

Representatives for Aramco weren’t immediately available to comment.

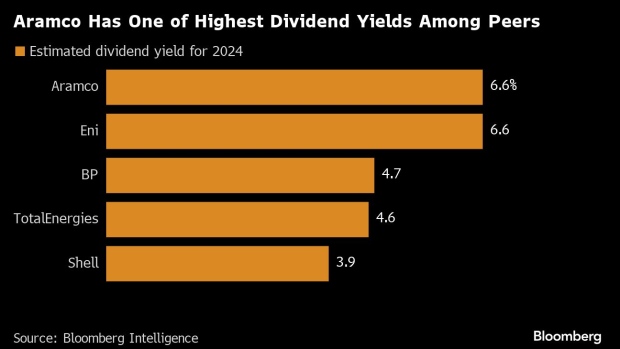

A key draw this time is the firm’s dividend, which is one of the world’s biggest. Investors willing to look past a steep valuation and the lack of buybacks would cash in on a $124 billion annual payout that Bloomberg Intelligence estimates will give the company a yield of 6.6%.

Saudi Arabia drew enough bids to cover all shares within hours after it kicked off the deal. The offer closed Thursday and the kingdom stands to net at least $11.2 billion in proceeds, excluding over-allotments — cash that will help fund a multitrillion-dollar push to transform the economy.

The final pricing was towards the bottom half of a proposed range of 26.70 riyals to 29 riyals, though Aramco’s stock has been trading below the top end since the deal was announced and closed at 28.30 riyals on Thursday.

The extent of foreign participation was closely watched, with Aramco’s top executives holding a series of events in London and the US to drum up demand.

The Saudi government owns about 82% of Aramco, while the Public Investment Fund holds a further 16% stake. The kingdom will continue to be the main shareholder after the offering.