Cameroon Joins Africa Bond Sales With $550 Million Issuance

Cameroon sold $550 million of bonds Tuesday, the latest in a wave of African countries taking advantage of benign market conditions to raise fresh financing.

The seven-year dollar bonds were priced to yield 10.75%. The bonds were sold through a private placement.

Other African nations including Ivory Coast, Kenya, Benin and Senegal also sought funding this year. That’s after being effectively locked out of international debt markets for nearly two years as the US Federal Reserve was raising interest rates.

Sovereigns generally avoid issuing new debt at over 10%, so Cameroon deciding to do so now indicated “they must have needed the financing,” said Vikram Rahul Aggarwal, lead fund manager at Jupiter Asset Management. “The yields on their existing bonds are north of 10%, so it would have been difficult to issue a public deal.”

Citigroup Global Markets Ltd. was the sole placing agent on the debt deal. The bank and Cygnum Capital Middle East Ltd. were joint arrangers.

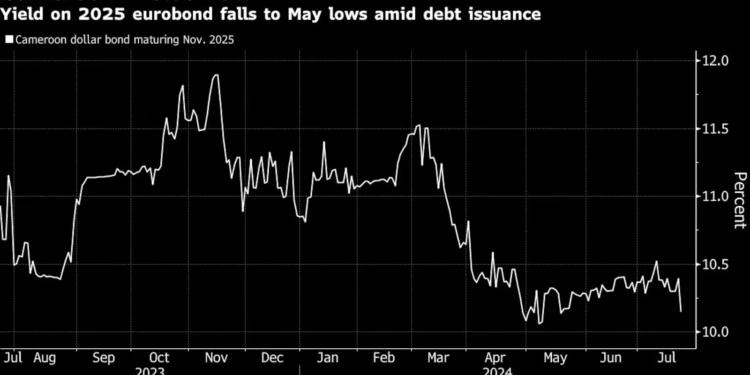

Yields on Cameroon’s dollar bonds due in November 2025 fell 36 basis points on Tuesday to trade at 10.53%, the lowest level in more than two months.

Cameroon’s credit rating was affirmed by Fitch at B in May, with a negative outlook. S&P rates Cameroon’s foreign currency debt at B-, with a stable outlook.

The country will use the proceeds to fund bigger spending this year, according to the presidency.

Presidential Decree

In a decree published in the state daily newspaper on Tuesday, President Paul Biya ordered Minister of Finance Louis Paul Motaze to raise 616 billion CFA francs ($1 billion) through domestic and international bonds to meet increased funding needs.

Last month, the government decided to boost this year’s expenditure by at least 7% to 7.2 trillion CFA francs to enable it carry out reconstruction projects in the country’s two English-speaking regions and the far northern region.

A war that started in 2016 between government forces and a group seeking to break away the Anglophone regions led to the destruction of public infrastructure and private homes. Terrorist attacks on the northern region have also vandalized property.

Matthew Greenman, an emerging-markets sovereign credit analyst at Thrivent, said while the private placement wasn’t a cheap way to raise funds, it gives authorities and markets greater clarity on the broader financing picture heading into an uncertain election year in 2025. The deal also alleviates concerns about any mid-term maturity walls.

Cameroon offered “an enticing yield for a shorter-duration bond from an issuer under an International Monetary Fund program, and one that’s also recently demonstrated an ability to continue tapping other sources of concessional finance,” said Greenman.