Carry Trades: What Are They And Why Are They Impacting The Global Economy?

A welcome period of relative stability in global markets has been upended by a sudden plunge in stock prices.

It began on 5 August in Japan and rippled quickly through Asia, Europe and the US, setting traders on edge over fears of a recession in the US.

So far, so simple – but behind those fears of a US slowdown was concern over the stability of an investment strategy known as a “carry trade”.

Concern over carry trade returns sparked a sudden slump in stock prices.Image: Reuters

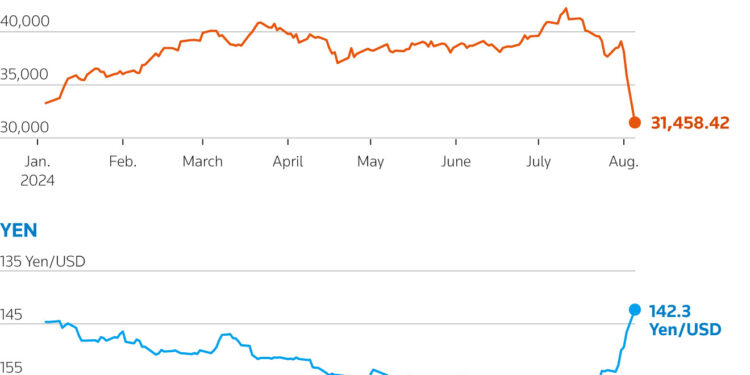

By the end of the day’s trading, Japanese stocks listed on the Nikkei Index had seen their biggest daily fall in history, eclipsing the devastation of “Black Monday” way back in 1987.

Alongside the fall in stock prices, the value of Japan’s currency spiked. To understand the significance of these entangled metrics, we need to unpack the concept of the carry trade and how it can lead to such volatility.

What are carry trades?

A carry trade is an investment strategy that involves borrowing money in a currency with low interest rates and using it to invest in stock and bonds based on a currency with higher interest rates, the Associated Press (AP) explains. The goal is to profit from the difference in interest rates while hoping for favourable exchange rate movements.

Reuters says the Japanese yen has been a popular choice for carry trades due to Japan’s long-standing policy of maintaining extremely low interest rates. Investors borrow yen at these low rates and use it to buy currencies like US dollars, Mexican pesos, or New Zealand dollars, which offer higher yields. They then invest in bonds or other financial instruments in these higher-yielding currencies.

Carry trades can be quite lucrative when conditions are right, Reuters notes. For instance, the difference between US and Japanese interest rates has allowed investors to potentially earn annual returns of 5% to 6% on dollar-yen carry trades.

So what went wrong?

There are several interlinked factors at play in the recent unravelling of yen-based carry trades.

Firstly, the Bank of Japan recently raised interest rates from nearly zero to 0.25%, marking a shift in its long-standing monetary policy. While this may seem like a small change, it has big implications for carry trades.

The impact of Japan’s decision was amplified by expected interest rate cuts in the US over fears of a looming recession. This led to a strengthening of the yen against other currencies, including the US dollar. The yen has appreciated by 13% in just one month, according to Reuters.

Now, remember that carry trades rely on wide gaps between interest rates and currency prices to deliver a return for investors. According to Reuters, the combined effect of the recent market moves was “completely wiping out the slim gains in pure yen-dollar carry trades”.

This evaporation of profits sparked a sell-off as traders looked to offload high-risk assets, which now burdened them with higher borrowing costs, low-zero profit margins and losses in asset values, as shares spiralled downwards.

“A massive global carry trade unwind was the spark that lit the fuse for this market Armageddon,” Stephen Innes of SPI Asset Management told AP. “One defining characteristic of these self-perpetuating market melts is the vicious cycle where a sell-off increases realized volatility.”

What’s likely to happen next?

The World Economic Forum’s Chief Economists Outlook for May 2024 suggests overall optimism about the global economy, but there are warning signs for carry trades.

While the interest rate gap between Japan and the United States remains significant, it’s expected to narrow in the coming months. This shift could continue to impact carry trades and, by extension, global markets.

Although recent days have seen some stabilization, with Japan’s Nikkei 225 rebounding 3.4% on 13 August, analysts remain divided on whether market volatility has truly subsided.

Carry trades have played a role in financial markets for decades, sometimes with dramatic consequences. The 2007-2008 Icelandic financial crisis and the recent 6% fall in the Mexican peso serve as stark reminders of their potential impact.

As we’ve seen, carry trades can be a double-edged sword in the global financial system. While they can offer attractive returns in stable times, they also have the potential to amplify market turbulence when conditions are less certain.