Cedi Appreciation: Let’s Avoid Premature Jubilation and Seek Sustainability – Dr Ampaabeng

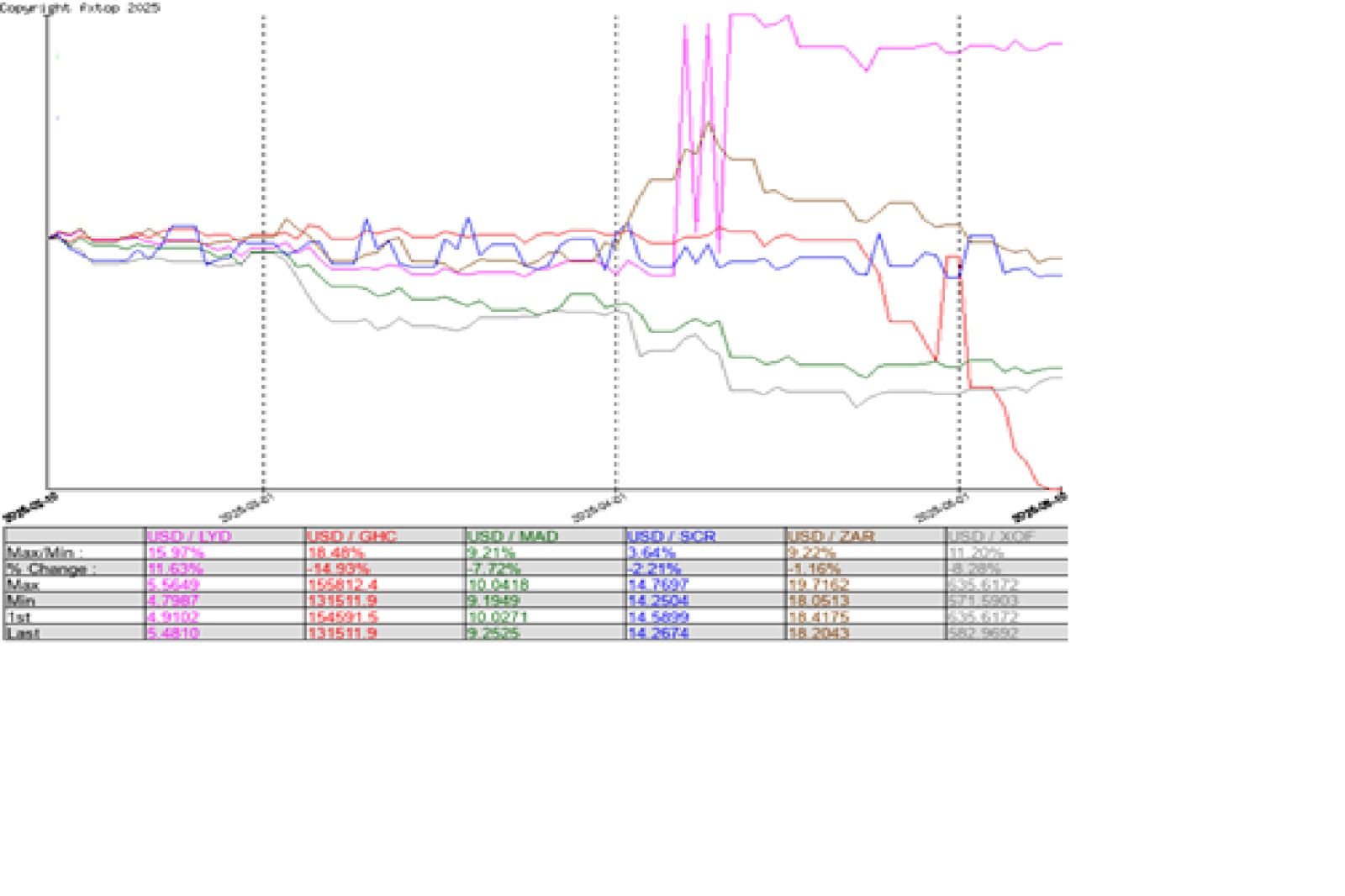

Many African currencies have recorded strong performances in the last few weeks against major trading currencies, however, that of the Cedi has been exceptional.

The Ghanaian cedi has seen a strong appreciation against major currencies, especially the dollar. Whilst this is positive for importers, the effect has not trickled down to consumers for prices of goods and services on the market.

Importers are cautious and may not readily pass this one because of uncertainty about its sustainability. I will leave this for the future, but let’s delve into what is happening to the Cedi – what’s making our currency so strong, especially in the first two weeks of May?

Whilst there are spillovers from the IMF program gains, the real cause of the appreciation cannot be attributed to any sound domestic macro-fiscal policies. Therefore, making good use of this gain and building relevant buffers and aligning policies to sustain it should be the utmost priority.

𝑪𝒂𝒖𝒔𝒆𝒔 𝒐𝒇 𝒄𝒆𝒅𝒊 𝒂𝒑𝒑𝒓𝒆𝒄𝒊𝒂𝒕𝒊𝒐𝒏

𝑼𝑺 𝒕𝒓𝒂𝒅𝒆 𝒘𝒂𝒓𝒔

The US trade wars, here, I referred to as the ‘the Trump effect’ is at the forefront of the FX gains in Ghana.

The sudden tariff increases and the uncertainties surrounding ‘what’s coming next’ have unsettled the global capital market and dented investor confidence.

The US bonds, traditionally referred to as the safest investment, [contrary to economic theories of rising during such uncertainties] has taken a nosedive, losing almost 5% in value in the first few weeks of Trump’s wholesale tariff applications.

As investors’ confidence shatter, the effect is simple – a fall in the dollar. This happened in Ghana when the government implemented the DDEP to address the debt service challenges – the cedi tumbled. Hence a heavily dollarized economy like Ghana automatically enjoys a currency appreciation from a declining dollar emanating from falling global capital market investor confidence. This is not a rocket science.

𝑫𝒐𝒍𝒍𝒂𝒓 𝒊𝒏𝒋𝒆𝒄𝒕𝒊𝒐𝒏𝒔.

Aside the trade wars, Government has injected a huge amount of dollars into the economy, erasing fears of dollar scarcity, a move which usually increases the strength of the Cedi. Here, the simple demand and supply theory should tell you that, ‘abundance of dollar’ will automatically reduce its strength against the cedi. Reports suggest an amount of $490m, was injected into the economy by the central bank in April, to ease forex market pressures.

Again, an amount of $360m is expected in the next few weeks following the successful IMF ECF’s fourth review, as well as the DPO payments from the World Bank. An increase in gold prices and a surge in its exports also could cushion the cedi against other trading currencies.

Furthermore, the strong reserves build up in the last few years, has a positive impact on the strength of the currency. Ghana more than tripled its gold reserves in just 12 months period, moving from 8 tonnes in 2023 to about 30 tonnes by December 2024. The current regime has added almost 2 tonnes, which signal a clear intent to continue the reserves build-up.

Such a move equally helps to further shore up the cedi against the dollar, our main trading currency. The country’s overall buffer has improved substantially with total foreign exchange reserves of about $9.4bn accumulated to support financial stability.

𝑵𝒐𝒏-𝒑𝒂𝒚𝒎𝒆𝒏𝒕 𝒐𝒇 𝒍𝒂𝒓𝒈𝒆 𝒄𝒐𝒏𝒕𝒓𝒂𝒄𝒕𝒐𝒓𝒔

Over the years, payment to contractors directly correlates to the cedi’s performance. So far, no major contractor has been paid in 2025. Most contractors do import materials and therefore payments are usually converted into dollars for such imports.

Aside this, others have appetite for holding on to the hard currencies in periods of uncertainties – both have negative impact on the cedi. Delaying payment has equally contributed to the strength of the cedi as ‘big dollar spenders’ are not able to do so.

𝑾𝒂𝒚 𝒇𝒐𝒓𝒘𝒂𝒓𝒅

Whilst an appreciation is not the only yardstick for measuring economic health, it’s at least worth keeping low as an import dependent economy like ours. On 12th May 2025, US and China finally made some inroads on their trade wars. This means the story could change sharply in the coming days/weeks for Ghana as the dollar is likely to pick up soon.

Despite GUTA calling its members to reduce prices, unfortunately, this WILL NOT happen until there’s a clear sign of sustainability on the exchange rate gains. Therefore, what is required is managing the gains and making it sustainable so businesses can start to pass on.

A sustainable forex management will require not politicisation and premature jubilation, but real action to keep such gains;

- First, government must continue the reserves build up. This is the most realistic way to sustain this for the long term.

- Second, manage contractor payments – Paying all or most BIG contractors simultaneously could erode the gains overnight. On the other hand, delaying payment also costs government, especially on interest payments. There should be a fair balance to dealing with this. In all cases, such payments must be well managed to ensure the effects are minimal.

We are concerned about the dollar, because of over-dependence on imports. The solution to stable currency therefore rests on long-term clear government policies – import substitution. 1D1F was surely the direction.

With this government comes several similar programs – this should go beyond political slogans and move to ensure a sustainable import substitution measures to not only improve our position but create a decent and sustainable jobs for the teeming youth of the country.

To conclude, the elephant in the room is how to manage the ‘Abochi’ menace. As majority of Ghanaians celebrate a low dollar rate, the black market is equally busy building dollar buffers for future resale, making any gains unsustainable. A clear policy direction to deal with the black market is another way to building a sustainable forex market.