Cedi posts 51% average depreciation rate against the world’s 3 major trading currencies

The Ghana cedi at the end of the month of October recorded an average depreciation rate of 51% against the world’s three (3) major trading currencies.

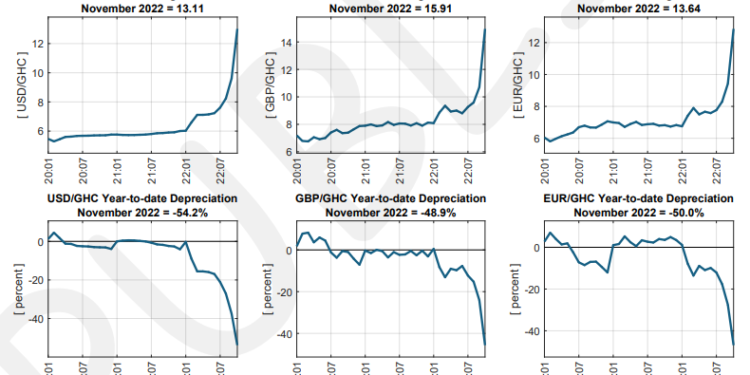

According to the November 2022 Summary of Economic and Financial Data, the local currency depreciated by 54.2% against the dollar; 48.9% against the pound and 50% against the euro.

The aforementioned depreciation rates represent significant decline in the value of the cedi when compared to the previous year’s depreciation rates of 2.4% against the dollar; 2.6% against the pound and 3.5% against the euro.

Per the BoG’s November 2022 Summary of Economic and Financial Data report, the value of the cedi at the end of the month October stood at GHS 13.10 to the dollar; GHS 15.9 to the pound and GHS 13.64 to the euro.

At the moment and per official rates on the retail forex market, the value of the cedi as at November 26, stands at GHS 14.50 to the dollar; GHS 17.53 to the pound and GHS 15.10 to the euro.

Meanwhile, the depreciation of the cedi to the dollar has increased the country’s external debt stock by some GHS 93bn.

According to the Minister for Finance, Ken Ofori-Atta, the country’s external debt currently stands at GHS 271bn reflecting the impact of the depreciation of the cedi.

The country’s external debt currently represents 44.15% of Gross Domestic Product (GDP).

Domestic debt on the other hand, represents 31.79% of Gross Domestic Product (GDP).

Cumulatively, the country’s debt stock as a proportion of GDP stands at 75.9% which in monetary terms is GHS 467bn.