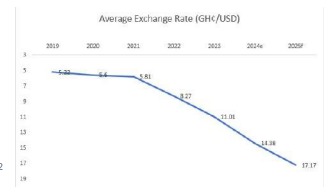

Cedi Projected to Weaken to GHS 17.23 by End of 2025

The Ghanaian cedi is forecasted to end 2024 at GHS 16.07 to the dollar and is projected to further depreciate to GHS 17.23 by the end of 2025, according to estimates by the Economic Intelligence Unit (EIU).

Current Bank of Ghana data as of December 23, 2024, indicates the cedi is trading at GHS 14.70 to $1.

The cedi depreciation trajectory has been attributed to multiple factors with Deloitte’s 2024 West Africa Focus report, titled “A Sneak Preview of 2025: What Lies Ahead?”, highlighting a decrease in cocoa exports and a higher import bill as key drivers of the cedi’s weakness towards the close of 2024.

In 2024, the cedi experienced significant volatility, losing about 25% of its value against the dollar in the first nine months—an improvement from 2022 when it depreciated over 50%, earning the title of the world’s worst-performing currency by Bloomberg. By August 2024, the cedi ranked as the fifth worst-performing currency globally.

This volatility has been largely driven by increased foreign exchange demand to import fuel, pharmaceuticals, and other essential goods. Nonetheless, Ghana recorded an accretion in gross external reserves, rising to $6.9 billion by mid-2024, sufficient to cover 3.1 months of imports. This is an improvement over the mid-2023 level of $5.9 billion, which covered 2.5 months of imports.

Looking ahead, Deloitte anticipates improved investor confidence in 2025, driven by a peaceful election, the conclusion of the government’s debt restructuring negotiations, periodic IMF disbursements, and higher gold export receipts which are expected to bolster Ghana’s international reserves and provide some stability to the cedi.

However, risks to the cedi’s exchange rate stability remain as rising imports from hydrocarbons and mining projects, coupled with a sharper-than-anticipated decline in cocoa exports, could narrow Ghana’s trade surplus and weaken its current account balance.

Ghana’s current account balance is forecasted to decline from an estimated $1.6 billion in 2024 to $700 million in 2025.

“A more stable exchange rate is positive for restoring investor confidence in an economy. The risk to a stable cedi arises predominantly from a rise in imports from the services sub-sector such as hydrocarbons and mining projects.

“Also, a more than-anticipated decline in cocoa exports could lead to a narrower trade surplus and a decline in the current account balance of the country as Ghana’s current account balance is forecast to decline to USD 700 million in 2025 from an estimate of USD 1.6 billion in 2024,” said Deloitte.