- Central Bank Governor Cautions on Islamic Banking Rollout Without Robust Frameworks

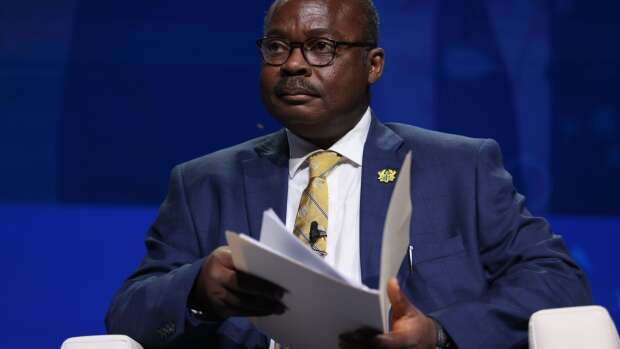

Governor of the Central Bank, Dr Ernest Addison, has remarked that Ghana is not ready to commence Islamic Banking activities.

According to him, the rollout of Islamic Banking activities require the provision of shariah-compliant regulatory and legal frameworks which the country does not have in place at the moment.

The Governor answering a question posed to him on Islamic Banking by norvanreports at the recent 117th MPC press briefing said, “Islamic Banking is an issue that has been raised on a few occasions, but we need to work on the appropriate regulatory framework and legal regime which involves specific shariah governance arrangements shariah liquidity management arrangements as well as risks management tools associated to Islamic Banking.

“So it’s not a simple matter, it’s an issue we have looked at and I don’t think we want to roll anything out as of now, but definitely if technical people come up with some final reports on that, I am sure we will act on it. But I cannot put a timeframe on that,” he quipped.

Professor John Gatsi, Dean of the School of Business at the University of Cape Coast, during his inaugural address as a Professor of the University on the topic “Islamic Banking Options: Exploring An Inclusive Alternative or Complement”, made a compelling case for Ghana’s integration of Islamic Banking into its financial landscape.

In his address, Prof. Gatsi emphasized that Islamic Banking should not be perceived as a substitute but rather a complementary instrument to conventional banking systems.

Central to his argument was the potential of Islamic Banking to revolutionize public debt management. Drawing parallels with nations such as Saudi Arabia, UAE, and Algeria, where debt-to-GDP ratios remain notably lower, Prof. Gatsi underscored the possibility of Islamic Banking to alleviate Ghana’s debt burden while fostering fiscal sustainability.

“Islamic Banking aids practicing countries with their public debt management leading to reductions in their public debts as the debt-to-GDP ratios of such countries average 40%. Countries such as Saudi Arabia, UAE, and Algeria that practice Islamic Banking have debt-to-GDP ratios of 23.8%, 24.2% and 32% respectively,” he remarked.

In an era marked by economic volatility, Prof. Gatsi urged Ghana to reassess its debt management strategies, advocating for the inclusion of alternative financing mechanisms like Sukuk (Islamic Bonds) citing the nation’s over-reliance on the international capital markets (Eurobonds).

Acknowledging the international recognition of Islamic Banking by institutions such as the IMF and World Bank, Prof. Gatsi emphasized the need for Ghana to engage in Islamic finance. He highlighted the potential of Islamic Banking to combat poverty and foster inclusive economic growth, echoing global efforts toward socioeconomic advancement.

“Islamic Banking is recognized by the UN, IMF, and World Bank with the institutions engaging in Islamic Banking in some form to help reduce poverty, and so we have no say but to also do it,” he quipped.

He has also proposed the formation of a Shariah Supervisory Board to oversee financial products offered by Islamic Banks in the country should Ghana decide to practice Islamic Banking.

According to him, the Board will ensure that all financing products by Islamic Banks comply with the principle of Shariah laws notably the non-payment of interest on funds as in the case of conventional banking.

Prof Gatsi notes the Board will also determine the proportion of profit made from projects to be contributed towards Zakat which is similar to Corporate Social Responsibilities undertaken by companies.

Adding that, the Zakat, could be used to finance infrastructure in the country’s Zongo Communities.

“The Board will ensure that Islamic Banks comply with the Shariah law, and also determine how much to contribute to Zakat to build infrastructure for the Zongo communities,” he remarked.

While Ghana’s central bank remains cautious, the dialogue initiated by financial experts like Prof. Gatsi illuminates the path towards a more inclusive financial ecosystem. The discussions highlight the need for thorough research, stakeholder engagement, and the development of an appropriate regulatory framework as Ghana explores the potential benefits and challenges of integrating Islamic Banking into its financial system.