China firm seeks billions before giving Kenya SGR

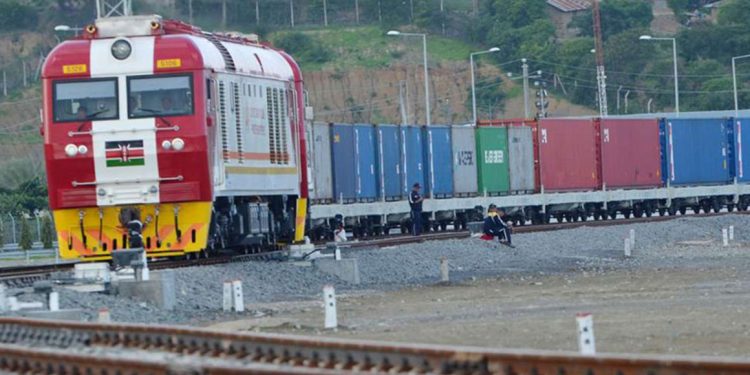

The Chinese operator of the standard gauge railway (SGR) has demanded billions of shillings in unpaid bills before handing over fully to Kenya.

Africa Star Railway Operation Company Ltd (Afristar), the Chinese company contracted to run the train service, has listed clearing of its debts as a condition before fully transferring operations of SGR to Kenya in May next year.

Parliament last year revealed that Kenya had not paid Sh38 billion to Afristar, which is majority-owned by China Road and Bridge Corporation (CRBC) and was contracted in May 2017 to run the passenger and cargo trains on the SGR.

“The negotiations between KRC and Afristar commenced in the year 2019 and an agreement has been reached that KRC (Kenya Railways Corporation) takes over obviously with some conditions including clearing of any outstanding payments,” KRC chairman Omudho Awitta told the Business Daily.

The billions of shillings in pending bills add to the Sh420 billion that Kenya borrowed to build the modern line from Mombasa to Nairobi and for purchase of engines and coaches.

The line, which started operations in 2017, was then linked with another new track, costing $1.5 billion (Sh162.9 billion) and also funded by Chinese loans, to Naivasha.

Afristar has been managing the ticketing system, landing and offloading of cargo and collection of passenger fares, including non-cash revenues like M-Pesa, under 2017 agreement.

Kenya from March started a gradual takeover of SGR operations from the Chinese firm.

It took over ticketing, security and fuelling functions on the SGR passenger and cargo trains as part of a deal to fully run operations on the track by May next year.

Ahead of May, Kenya will need to settle the billions of shillings in unpaid bills or restructure the liability into a debt that will be repaid over a longer period.

Read This: BoG lists penalties for non-compliance to M&A directive by banks and SDIs

The pressure to settle the Afristar dues comes when the Covid-19 pandemic has hit Kenya’s government revenues and limited access to commercial loan markets, forcing the country to turn to the World Bank and the International Monetary Fund (IMF) for direct budgetary financing.

Kenya had kept away from direct budget funding from institutions like the IMF and the World Bank during the administration of former President Mwai Kibaki, which preferred project support.

Now, the cash flow situation that is marked by flat revenues and worsening debt service obligations has forced the country to return to these loans, which have conditions attached to them. The economy has been picking up after likely posting a slight contraction of 0.1 percent in 2020, the IMF said.

The IMF forecast a sharp swing to growth of 7.6 percent in 2021 and 5.7 percent in 2022, but said Kenya continued to face challenges returning to durable growth, and its past gains in poverty reduction had been reversed.

Kenya has already sought for an extension of the public loan repayment relief under the G20 debt suspension initiative to December from the initial deadline of June. The cost of operating the SGR has been a concern, with Transport ministry data showing that taxpayers spend an average of Sh1 billion per month on the operations of the Mombasa-Nairobi railway alone.

But the cost could rise up to Sh1.8 billion due to variables such as the price of lubricants and fuel, loading and unloading fees, maintenance charge and other management fees.

Revenue collection by Afristar has trailed expenditure—exposing taxpayers to a huge bill for sustaining operations.

For instance, in the three years to May 2020, the SGR posted a combined operating loss of Sh21.68 billion, having netted Sh25.03 billion in revenue over the period against operational costs totalling Sh46.71 billion — a gap that taxpayers have to plug.

The SGR operation agreement requires the government to foot a fixed service monthly payment, which is made quarterly in advance at a rate of $28.8 million (Sh3.12 billion)

Apart from the operating fees, Kenya is obligated to honour repayment of the Sh324 billion it borrowed for the project from the Exim Bank of China in May 2014 and started repaying last year after expiry of the five-year grace period.

Parliament last year recommended that the SGR operating costs be cut by half and the terms of the loan taken to finance its construction renegotiated to ease pressure on taxpayers.

I think this is among the most vital information for me. And i’m glad reading your article. But wanna remark on few general things, The web site style is wonderful, the articles is really excellent : D. Good job, cheers

Normally I do not learn post on blogs, however I would like to say that this write-up very forced me to take a look at and do it! Your writing taste has been amazed me. Thanks, quite great article.