China’s largest bank to provide $41 billion in tourism financing

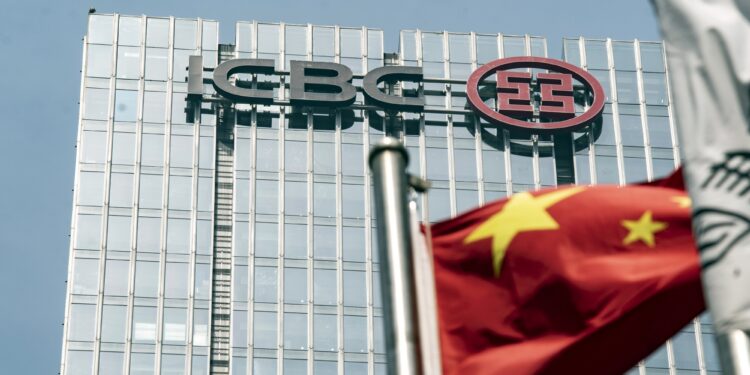

The Industrial & Commercial Bank of China Ltd. will offer 300-billion yuan ($41 billion) in financing to boost the nation’s tourism sector amid sluggish consumer spending in the world’s second-largest economy.

The country’s biggest bank signed a cooperation pact with China’s culture and tourism ministry on Tuesday to “stimulate” tourism investment and spending, according to a statement posted on the ministry’s official WeChat account.

The bank, also known as ICBC, and ministry will work together on key tourism-related construction projects, according to the statement. Some tourism agencies based in several Asian cities including Seoul, Tokyo and Thailand also signed agreements with ICBC’s branches.

China’s economy has been hampered by deflationary pressure and a protracted property crisis, dampening consumer spending. Tourism, however, has been a rare economic bright spot.

The country saw domestic tourism trips soar 93.3% last year from 2022, with spending reaching 4.91 trillion yuan, a year-on-year increase of 140.3%. During February’s eight-day Lunar New Year holiday, domestic trips rose 19% from the pre-Covid 2019, while spending climbed 7.7%.

Still, while overall trip spending has jumped, per capita travel spending is down compared with pre-pandemic years.

Inquiry regarding the conditions and procedures for financing a recreational tourist resort project.

Dear CEO,

We are honored to contact you to inquire about the available conditions and procedures for financing a recreational tourist resort project in the Al-Ula region of the Kingdom of Saudi Arabia.

Awaiting your positive response, we look forward to a successful collaboration.

Best regards.

Ben Alaya Mourad

LOS TOURISM COMPANY

JEDDAH KSA