Citigroup sees silver lining to Nigerian, Angolan currency rout

Nigeria, Angola and Kenya are among African countries that could draw greater foreign investment flows in the wake of sharp declines this year for their currencies, according to Citigroup Inc.

“Countries where we’ve seen significant FX adjustments are clear winners from an investment perspective,” George Asante, Citi’s head of markets for Sub-Saharan Africa, said in an interview in Nairobi. “All these from a local market perspective offer opportunities.”

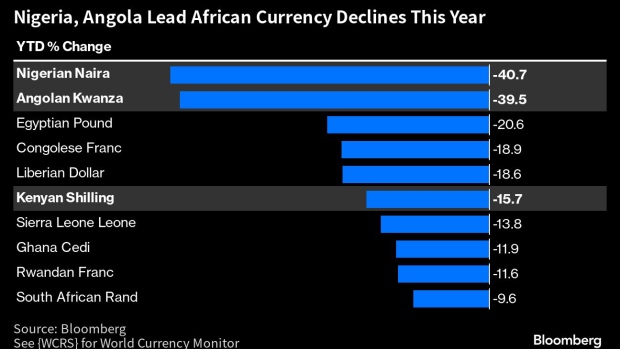

Nigeria’s naira is the worst-performing African currency this year, slumping more than 40% against the dollar as the country takes painful steps to patch up its finances by scrapping fuel subsidies and revamping a widely-criticized exchange-rate system. Angola’s kwanza is down 39% and the Kenyan shilling nearly 15%.

Nigerian President Bola Tinubu is seeking to retool the economy by scrapping fuel subsidies in place since the 1970s and diverting the money spent on them to increased investment in health services, schools and job creation. In June, the central bank overhauled the nation’s exchange-rate policies, effectively devaluing the naira.

The removal of subsidies was a “very important reform” for Nigeria, while moves to merge multiple exchange rates will also help to boost liquidity, Asante said. The next task for the government is to make sure the official FX market can function smoothly in the wake of the changes, he said.

“I believe that this will be a significant catalyst for flows back into the Nigerian market,” Asante said.

Commenting on the prospects for eurobond issuance by African nations, “darlings of the market” including Ivory Coast and Senegal will probably attract most interest from investors when the market reopens, he said. Both countries have long-term foreign debt ratings of Ba3 from Moody’s Investors Service.

“These two countries have fairly consistent high growth rates, diversified economic bases, large IMF programs with associated concessional financing and a track record for economic reforms and fiscal prudence as well as low cost of debt service,” Asante said.

New Infrastructure

As the coronavirus pandemic eased, some African countries started to seek infrastructure financing, primarily for energy and food-related projects and longer-term investment in roads, railways and hospitals, said Ferdinand Zaumu, Citigroup’s head of trade and working capital solutions in the Middle East and Africa.

“A lot of that infrastructure financing is really to solve some of the issues that came out of Covid,” Zaumu said. “The one big shift that we have seen is that the Chinese have slowed down in terms of providing financing for a lot of these infrastructures and we’ve seen a pick up from the west.”

African countries with the most financial leeway to seek infrastructure financing include Uganda, Tanzania, Rwanda, Namibia, Botswana and Mauritius, he said.