Cocoa hits record even with Hedge Funds least bullish since 2022

Money managers have slashed their bullish bets on cocoa to the lowest in 17 months, a sign that commercial traders have played a key role in the rally that’s sent prices to a fresh record on Monday.

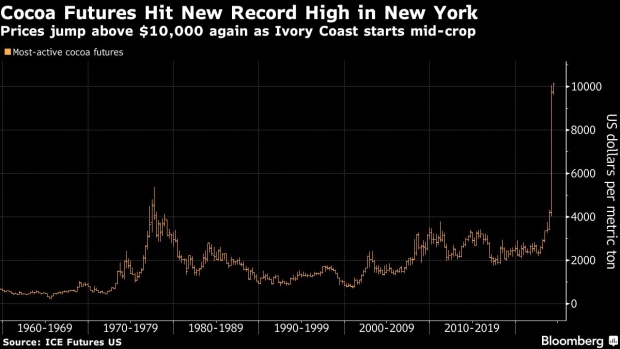

The most-active contract in New York rose as much as 4.4% to a new intraday high of $10,193 a metric ton. Futures have more than doubled this year as poor crops in key West African growers put the world on course for a third straight annual supply deficit.

Hedge funds are continuing to cut bullish bets as the price soars, with the combined net-long position in New York and London cocoa futures seeing the biggest weekly decline in more than a year.

Lower net-long wagers and reduced open interest indicate that physical buyers may be playing a role in the rally. A shrinking commercial net short is “further evidence that the rally has been fueled by commercial short covering,” analysts at the Hightower Report said in a Monday note.

New York futures have “never been more stretched,” Bloomberg Intelligence strategist Mike McGlone wrote on Monday, noting that prices are more than three times above the five-year average. “Our takeaway is that there may be extreme pain, potentially from producer hedgers getting squeezed.”

While a technical gauge shows cocoa prices may have skyrocketed too quickly, many analysts aren’t yet seeing a top to the market.

The smaller of Ivory Coast’s two harvests officially starts in April. The harvest isn’t expected to bring enough relief to tight global supplies, with the country’s regulator seeing the mid-crop ranging from 400,000 to 500,000 tons, down from as much as 620,000 tons a year earlier, Bloomberg reported last month.

Rain in the coming week “could be beneficial to the crop, but the exceptionally hot and dry conditions this year have lowered expectations for the mid-crop, which officially begins this week,” the Hightower Report analysts wrote.