Countries setting new FDI records in 2023

A few countries have registered more greenfield foreign direct investment (FDI) announcements in the first eight months of 2023 than any previous calendar year on record due to projects in the electric vehicle (EV), semiconductor and energy sectors.

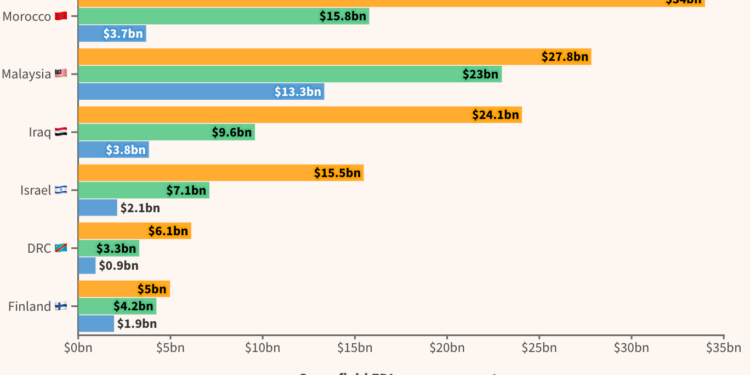

Between January and August, six countries – Morocco, Malaysia, Iraq, Israel, Democratic Republic of Congo and Finland – recorded planned greenfield FDI projects worth more than any twelve-month period in the past, according to preliminary fDi Markets figures dating back to 2003.

FDI into these six outperforming countries in 2023 is also ahead of the annual average FDI capital expenditure (capex) recorded in the decade before the pandemic.

Another five countries – Saudi Arabia, Chile, Ukraine, Botswana and Slovenia – have recorded their largest announced FDI since before the global financial crisis ended in 2009.

Morocco was the top outperforming FDI destination. In 2023, the Kingdom has so far attracted almost $34bn worth of greenfield FDI projects, double the previous all-time high of $15.8bn set in 2008, according to fDi Markets.

The North African country has seen an influx of inward investment from Chinese companies, particularly in the electric vehicle (EV) supply chain. It has also attracted major FDI projects in renewable energy, chemicals and tourism.

Notably, Chinese battery maker Gotion High-Tech has signed an agreement with Morocco’s government to establish its first African gigafactory in the country. Zhejiang-based mining giant Huayou Cobalt also plans to invest Dh200bn ($19.5bn) into a EV battery components factory.

Malaysia was the second outperforming country with about $28bn worth of FDI projects in 2023, more than double the annual average recorded in the decade before the pandemic.

The southeast Asian country recorded 5 mega projects with capex of at least $1bn across the automotive, internet infrastructure and semiconductor sectors. Chinese carmaker Geely Holding Group announced the largest project with plans to invest $10bn into a production hub in Tanjung Malim

Alongside US-based Amazon and Vantage Data Centres plans to build new campuses in Malaysia, American chipmaker Texas Instruments will also expand its footprint with two new assembly and test factories in Kuala Lumpur and Melaka.

Iraq was the third best performing country with $24bn worth of FDI – a whopping six times the annual average recorded between 2010 and 2019. This was largely due to major projects in the fossil fuel sector, including from the UK’s Shell, Hong Kong’s United Energy Group and the UAE’s Crescent Group.

Three Qatari companies have signed agreements with the Iraqi National Investment Commission to develop projects worth $9.5bn. These include the construction of two power plants and the development of two new integrated cities.

Meanwhile Israel was the fourth outperforming FDI destination due to Intel’s plans to invest $15bn into a new chip factory in Kiryat Gat. This planned investment was announced in June before before the latest conflict erupted between Israel and Palestinian militant group Hamas in the Gaza Strip in early October.

A number of major metals and mining projects helped resource-rich Democratic Republic of Congo post inbound FDI pledges worth $6.1bn – almost double its previous record of $3.31bn set in 2022. This includes Canada’s Ivanhoe Mines plans to invest $2.91bn into the expansion of its Kamoa-Kakula copper mining complex.

Finland was the only European country to make it into this FDI outperformer analysis with almost $5bn worth of capital expenditure recorded. The vast majority of this was made up by Norway’s Blastr Green Steel project in Inkoo, where it will establish a green steel plant and hydrogen production facility.