Critical minerals demand has doubled in the past five years

Investing in critical minerals will boost our chances of meeting global climate goals.

That’s the view of the International Energy Agency (IEA) in its first report on the outlook for critical minerals, in which every scenario forecasts a rapid increase in demand.

Critical minerals play vital roles in green technologies – for example in the construction of wind turbines, electric vehicles and solar panels. Demand for these technologies is rising around the world, with global battery demand one of the key factors in this growth.

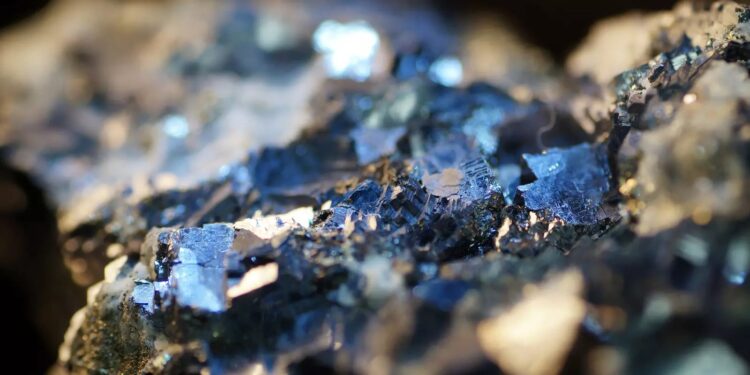

Lithium, nickel, cobalt, manganese and graphite are crucial to battery performance, longevity and energy density, according to the IEA.

Lithium, nickel, cobalt, manganese and graphite are crucial for the global battery demand.Image: IEA

Ensuring a robust supply will underpin the world’s climate goals, and help reach green targets. In fact, without them, our main strategies for decarbonization of our energy systems will likely flounder. But with a global switch from fossil fuels to critical minerals, political and environmental dangers must be carefully managed, warns a new World Economic Forum white paper, Energy Transition and Geopolitics: Are Critical Minerals the New Oil?.

Ensuring an effective energy transition

As the Forum pointed out in its Fostering Effective Energy Transition report for 2023, the energy transition will need a secure, abundant and affordable supply of critical minerals. Ensuring this will also help build resilience into the transition, it said.

Rising demand for critical minerals, driven by electric vehicle adoption.Image: IEA

The IEA report noted a marked increase in spending. Investment in critical mineral development rose 30% in 2022, after a 20% increase in 2021. Among the different minerals, lithium saw the sharpest increase in investment, a jump of 50%, followed by copper and nickel.

Even so, more needs to be done to make sure we are fit for the future.

“If all planned critical mineral projects are realized, supply in 2030 could be enough to support announced climate pledges,” the report said. “But project delays and other issues could lead to supply constraints.”

And more projects are needed to keep the goal of 1.5°C of warming in reach, it said.

The IEA – which has also launched a new online data tool to explore the topic – hosted the first-ever international summit on critical minerals and their role in clean energy transitions in September 2023.

Securing the critical minerals supply chain

The IEA report highlighted how many governments are focused on the issue, with its policy tracker identifying around 200 policies and regulations across the globe that aim to ensure adequate and sustainable mineral supplies.

These include the European Union’s Critical Raw Materials Act, the United States’ Inflation Reduction Act, Australia’s Critical Minerals Strategy and Canada’s Critical Minerals Strategy.

Some of these include restrictions on imports and exports, it said, with global export restrictions on critical raw materials seeing a fivefold increase since 2009.

Spending on critical minerals among private companies has also increased, with firms specializing in lithium development recording a 50% increase in spending.

Sub-Saharan Africa is estimated to hold about 30% of critical mineral reserves, which has the potential to transform the region, according to the International Monetary Fund.

“We are encouraged by the rapid growth in the market for critical minerals, which are crucial for the world to achieve its energy and climate goals,” said IEA Executive Director Fatih Birol. “Even so, major challenges remain. Much more needs to be done to ensure supply chains for critical minerals are secure and sustainable.”