Cross-border M&A down by 24% in first quarter of 2022

Foreign mergers and acquisitions (M&A) were down by about a quarter in the first three months of 2022, as the Ukraine conflict, rising prices and global uncertainty led boardrooms to re-evaluate expansion plans.

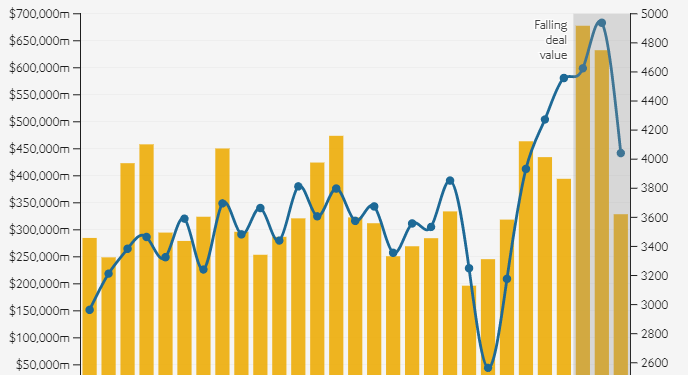

Cross-border deals worth $328.9bn were announced in the first quarter of 2022, down by 24% from the same three months of last year, according to figures from Refinitiv, a data provider owned by the London Stock Exchange Group.

This was the lowest total recorded for the first quarter of the year since 2018. The number of cross-border deals fell by 5.4% over the same period, but still stood at a near-record high of 4042.

Lucille Jones, a deals intelligence analyst at Refinitiv, tells fDi that cross border M&A is “typically a hallmark of a confident market” but over the first quarter, “geopolitical tensions mixed with concerns around rising interest rates and inflation have caused boardrooms to react with caution, leading to a slowdown in deal making.”

The decline in dealmaking around targets in foreign markets coincided with more subdued global M&A volumes — which include both cross-border and domestic deals — which fell by 17% in the first quarter, compared with the same period of 2021.

The US remained the most active global M&A market, with US-based acquirers accounting for 37% of total cross-border M&A activity.

A total of $55.6bn was announced in deals to acquire US target companies, accounting for 17% of total. The world’s largest economy was followed by the UK ($44.4bn), Netherlands ($34.1bn) and France ($19bn).

The largest deal recorded in the first quarter was Blackstone’s plan to acquire Mileway BV, a Dutch last-mile logistics company, for €21bn. The company has over 1700 assets across 10 major European countries, including the UK, Germany and Sweden.

James Seppala, Blackstone’s head of real estate in Europe, said in a statement that Mileway has the largest portfolio of last-mile logistics properties in Europe.

“Logistics is one of our highest conviction themes globally, and the sector continues to prove its resiliency and strong growth potential,” he said.

Blackstone’s planned acquisition helped the real estate sector record $49.7bn worth of cross-border deals in the first quarter of 2022. The financial sector had the largest amount of cross-border deal activity by volume ($68.3bn), followed by the high-tech industry ($62.9bn).

The second-largest deal recorded in the first quarter of 2022 was in US financial services. Canada’s Toronto-Dominion (TD) Bank announced its acquisition of First Horizon in an all-cash transaction for $13.4bn, as it accelerates its North American expansion.

Bharat Masrani, the CEO of TD, said in a statement that the deal will provide TD with “immediate presence and scale in highly attractive adjacent markets in the US, with significant opportunity for future growth across the Southeast”.

Other sectors saw significant declines in cross-border deal activity. The value of cross-borders M&A in the industrials sector fell from $66bn in the first quarter of 2021 to $25bn in the same period of 2022. Meanwhile, the healthcare industry saw foreign deal activity drop from $52bn to $22bn over the same period.