Cross-border M&A reaches all-time high of $2.1 trillion in 2021

Foreign mergers and acquisitions (M&A) reached their highest level on record in 2021, as companies pursued transformational takeovers amid readily available and cheap financing, and booming stock markets.

Cross-border deals worth more than $2.1tn were agreed worldwide in 2021, up by 69% from a year earlier and comfortably above the previous record of $1.8tn set in 2007, according to figures from Refinitiv, a data provider owned by the London Stock Exchange Group. The number of cross border deals rose by 38% to an all-time high of 17,849 last year.

The surge in dealmaking aimed at targets in foreign markets coincided with record breaking global M&A volumes — which includes both cross-border and domestic deals — that rose by 64% to reach more than $5.8tn.

These record figures were driven in part by more than 180 mega-deals worth at least $5bn, as buyers sought acquisitions far surpassing anything they had attempted before. These included Australian biotech company CSL’s acquisition of Swiss drugmaker Vifor Pharma for almost $12bn, and Oracle’s $28.3bn takeover of Cerner, a health information supplier.

Meanwhile, AT&T and Discovery decided to merge their media assets into a new publicly traded company, as part of their battle for subscribers in the ongoing streaming war. The mega media deal is worth $43bn and is expected to close in the first half of 2022.

Newly popularised models of financing helped to boost global M&A figures. Some 332 special-purpose acquisition company (SPAC) deals — companies created to bring a privately held business to the public stock market — were announced, for companies valued at a combined $591bn, equivalent to about 10% of global deals by value.

Read: ICUMS rakes in GHS 16.08bn in 2021

The value of private equity-backed deals in 2021 also more than doubled to reach $1.19tn, compared with a year earlier. This included US fund KKR’s plan to bring Telecom Italia private in a deal worth over $38bn, making it one of the largest private equity buyouts of a European company ever attempted.

The US held onto its crown as the largest inbound destination for M&A in 2021, as well as being home to the most active investors. More than 2700 deals worth almost $500bn were struck in the world’s largest economy, an increase of 69% in the deal volume recorded in 2020, according to Refinitiv figures.

The UK was the only other major economy that came close to the US in 2021, with 1900 deals worth over $330bn, followed by Germany ($98.2bn), Australia ($95.7bn) and the Netherlands ($84.7bn).

Publicly listed UK companies became targets of foreign buyout firms due to their shares often trading at a discount compared with the US and Europe. Notably, British supermarket giant Morrisons was purchased for £7bn by US private equity group Clayton Dubilier & Rice.

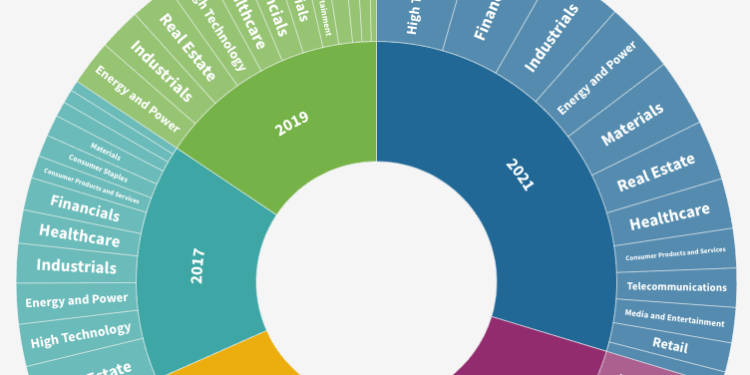

The most sought after companies by foreign buyers in 2021 were in the high-tech sector, in which cross-border deals worth more than $320bn were recorded. The financials sector has the second-highest cross-border deal value ($277bn), which included US-based payments firm Square agreeing to buy Australian ‘buy now, pay later’ company Afterpay in a $29bn all-stock transaction.

Dealmaking is expected to be strong in 2022 too. In a recent survey of more than 2000 CEOs across the globe undertaken by consultancy EY, 59% of respondents said they expect their companies to pursue acquisitions in the next 12 months — up from 48% at the start of 2021.

“Deals will remain a key lever in CEOs’ investment toolkit,” Andrea Guerzoni, EY’s global vice chair for strategy and transactions said in a statement. “Coming off a record-breaking run for M&A, many CEOs will be focusing on integrating assets acquired over the past 12 months, but CEO acquisitive intensions should ensure continued deal activity at high levels in 2022.”