Nigeria braces for jumbo rate hike at first meeting since July

Nigeria’s central bank is expected to raise interest rates by as much as 500 basis points next month and provide clarity on foreign-exchange management that’s blamed for turning investors away.

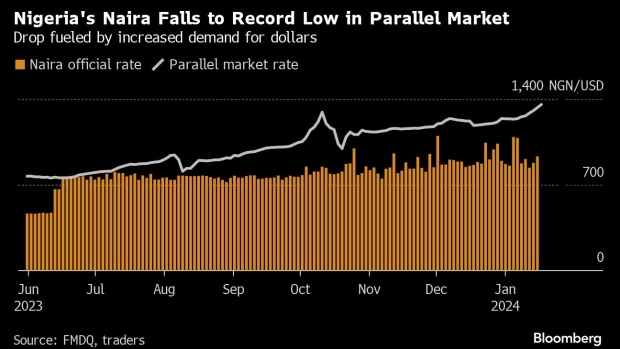

The Central Bank of Nigeria announced a monetary policy committee meeting for Feb. 26-27. It will be Governor Olayemi Cardoso’s first since taking the helm in September and there’s a lot to talk about. Nigeria’s last MPC meeting was held in July, when the central bank raised rates by less-than-forecast 25 basis points to 18.75% — since then inflation has surged and the naira has remained under pressure.

“We are looking for 200-300 basis points of rate hikes,” said Mohamed Abu Basha, head of macroeconomic analysis at EFG Hermes. “Inflation has been on the rise and as the first meeting for CBN under its new management, we think they need to hand over a decisive call to the market,” Basha said.

Cardoso set high expectations with a speech in November when he promised sweeping reforms including a switch to inflation targeting from trying to control money supply. But he’s been largely silent in public in the subsequent weeks — drawing criticism for a lack of communication — and only released the 2024 schedule for the central bank’s policy meetings late Friday.

Consumer prices in Africa’s most populous nation climbed an annual 28.9% in December. That’s the fastest pace in almost three decades, fueled by the abolition of fuel subsidies and a rapidly weakening currency that has lost around 50% of its value against the dollar after tight forex rules were relaxed in June.

“While we’re still fine-tuning our view given the changed meeting schedule, this could see anything from 300 basis points to 500 basis points of front-loaded tightening at the February meeting,” said Razia Khan, chief economist for Africa and the Middle East at Standard Chartered Bank.

“In all we expect 550 basis points of tightening in 2024, followed by easing from September once conditions allow,” she said.

Since taking office, Cardoso has hinted at a return to orthodox policies, a departure from his predecessor Godwin Emefiele, whose unorthodox approach to policy unnerved investors and led to a rapid slowdown in capital inflows into the West African nation.

President Bola Tinubu suspended Emefiele a few weeks after he took office and the former central bank chief has since been arrested and charged with crimes including fraud. He has denied wrongdoing and the trial is ongoing.

Under its new leadership, the central bank has let the naira trade in increasingly wider bands in the official market and also signaled monetary tightening by selling its short-dated OMO, or open market operation notes, at increasingly higher interest rates.

Still, tightening monetary policy would not be enough to curb inflation as long as Africa’s largest crude producer continues to deal with foreign-exchange shortages that has caused a rapid depreciation in the local currency, said Victor Aluyi, senior vice president and head investments at Sankore Investments.

“The markets are looking for a robust plan from a policy perspective that would deal with the FX challenge,” Aluyi said. “The importance of unambiguity around monetary policy and forward guidance cannot be over-emphasized.”