What’s the ‘Basel Endgame’ – and can it help us avoid another financial crisis?

Bank stability is something we often take for granted.

When we tap our cards at the coffee shop, buy something online or take money from an ATM, we’re assuming the funds are ready to go.

But when shocks occur or things go awry, banks hit the headlines and we all become acutely aware of how much trust we place in their stability and how reliant we are on the easy flow of money around the world.

It’s an indication of why regulation is so important.

Global financial crisis

As a response to the banking and financial crisis of 2007-2009, new rules were deemed to be needed, and these were laid out in the Basel III agreement, an international set of measures developed by the Basel Committee on Banking Supervision (BCBS).

Basel, Switzerland is home to the BCBS – which is made up of central bankers and banking supervisory authorities from around the world – and to the Bank for International Settlements (BIS) – the central bank for central banks.

Before the global financial crisis, many banks had far too little capital, and many of those – often household names – failed or had to be bailed out, including Bear Stearns, Lehman Brothers and Merrill Lynch. Massive government injections of funds were required in many countries to stabilize the financial system, costing billions of dollars.

Bank capital positions have improved since 2006.Image: Bank for International Settlements

The use of taxpayer money to bail out banks led to a push to regulate the sector more tightly, with the hope of preventing or limiting future turmoil in the global financial system.

Basel banking reforms and safeguards

In response came the Basel III reforms. While these were scheduled to be introduced by 2015, parts are still outstanding and the date has been extended repeatedly.

“Post the Global Financial Crisis, financial reforms have greatly bolstered the capitalization of the banking sector and have encouraged more forward-looking loan loss provisioning,” according to the BIS Annual Economic Report 2023. “Ultimately, the impact on the banking sector will depend on the extent to which its loss-absorbing capacity helps preserve investor confidence.”

Now, the final stage of the reforms – which has become known as “Basel III Endgame” – is in the offing and was expected to take effect in July 2025, nearly 20 years after the financial crisis that prompted their drafting.

Broadly speaking, the measures are designed to require banks to hold more capital, so that they have a pot to draw on in times of stress and are less likely to run out of money. This is often referred to as a “buffer”, a “capital buffer” or a “cushion”.

The bigger the bank, the greater the risk to financial stability and the greater the pot of cash they are required to hold. The reforms also limit the ability of banks to decide their risk levels for themselves. The full summary can be found here.

Objections to the Basel Endgame

In the US, the final implementation of these rules has faced some push back and, in some cases, has become political, with opposition from bankers, lobbyists and some politicians. Opponents say US banks are already robust, may be disproportionately affected and that their international competitiveness will be affected.

Others say that stricter rules will limit lending and reduce how much is allocated to green projects.

Getting banks future-ready

But it’s not just guarding against something that happened in the 2000s.

Market turmoil ricocheted around the world in March 2023, when US-based Silicon Valley Bank (SVB) failed.

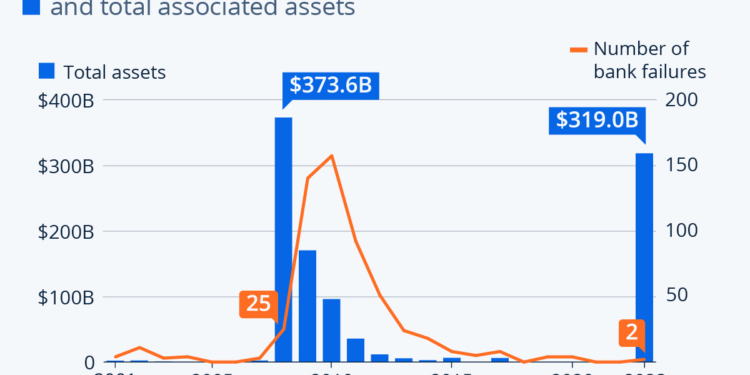

The impact of bank failures.Image: Statista

As the 16th-largest US bank by assets at the end of 2022, SVB faced challenges around rising interest rates and deposit outflows.

While there’s no suggestion that regulation could have prevented the collapse of SVB, the events catapulted banks and financial stability back into the headlines, and underscored the impact that shortcomings at individual banks can have on broader financial stability.

The World Economic Forum’s Banking and Capital Markets community is designed to bring together industry leaders to advance “resilient, sustainable, and dynamic growth within the global financial system”.

And the need to ensure banks can foster trust was a topic of discussion at the World Economic Forum’s Annual Meeting in Davos, in a session titled, Are Banks Ready for the Future?.

“The global financial system has held up well, but there is no room for complacency,” Gita Gopinath, the First Deputy Managing Director of the International Monetary Fund, told that panel.