Personal income tax has untapped potential in poorer countries

Many governments aiming to achieve a durable economic recovery from the pandemic must raise significant amounts of revenue in the fairest way possible. The personal income tax—levied on wages, salaries, and other income—is a suitable instrument for this challenge. In new research, we examine the scope for making greater use of this fiscal tool in developing countries, where many people earn a living at low incomes.

Still in its infancy, but growing

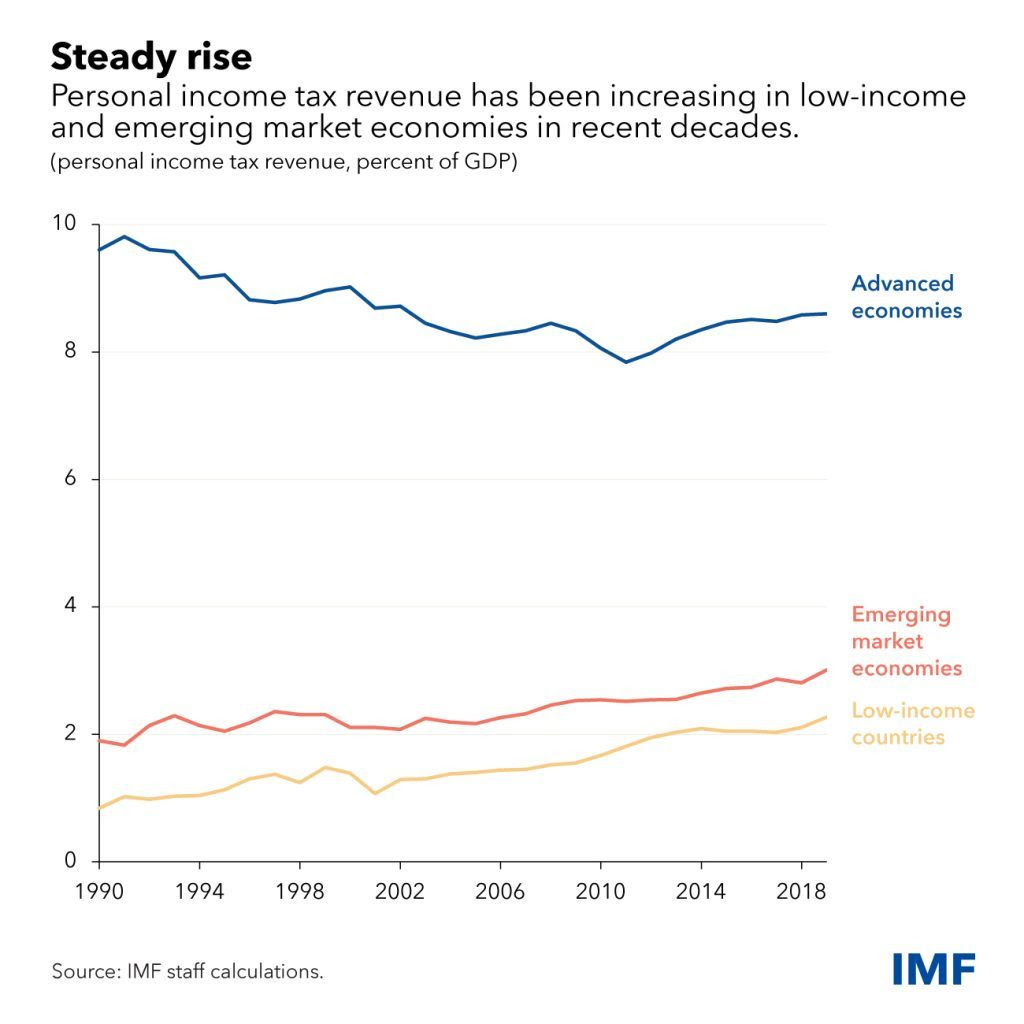

The personal income tax had become the predominant tax by the eve of World War II in many advanced economies, where it now raises approximately 9 percent of gross domestic product. In addition to bringing in revenue, it is progressive—imposing steeper rates on those with a higher income—and reduces inequality measurably.

In most emerging market and low-income countries, on the other hand, such taxes are still in their infancy. Revenue from this source averages only 2.5 percent of GDP in these countries, in part because of their narrow tax base, and it does little to lessen inequality.

But gradual changes have been taking place. In the two decades preceding the pandemic, income tax revenue more than doubled in low-income countries, rising from the equivalent of 1 percent of GDP to 2.1 percent, while emerging markets saw an increase from 2.1 percent to 3.1 percent. These were also reflected in share of the tax in overall tax intake, which went from 5 percent to 8 percent of total tax revenue in low-income countries and from 9 percent to 11 percent in emerging markets.

Our research on this progress focuses on three questions: what drives personal income tax growth, how increases affect total revenue performance, and how these levies influence income redistribution. Our findings hold important lessons for developing countries, particularly as they grapple with the post-pandemic challenge of building the capacity to raise more tax revenue.

What drives revenue growth?

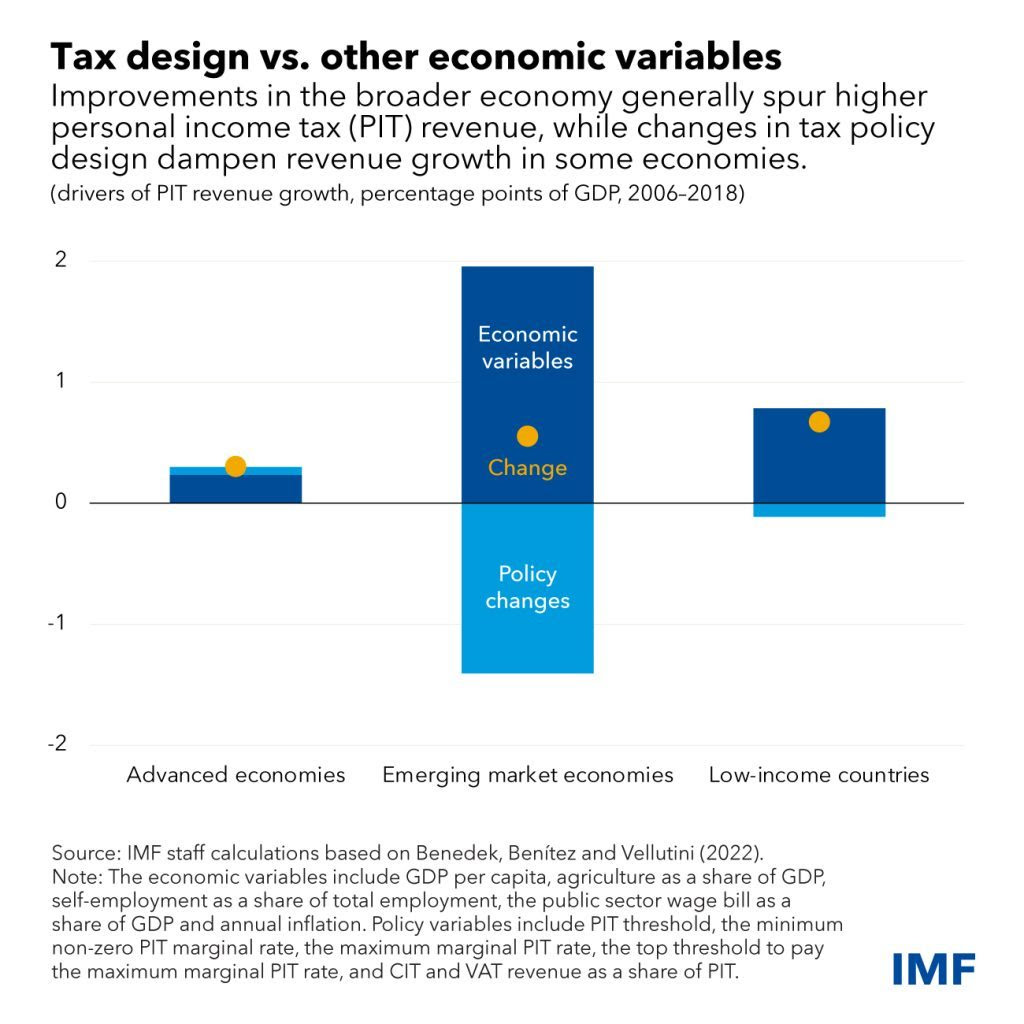

In examining the progress of the personal income tax in developing countries, we distinguish between observable tax policy changes and broader economic changes. Policy changes have targeted top and bottom statutory rates as well as the level of exempt income. Remarkably, we find that this hasn’t contributed much to the increase in revenue in low-income countries.

And in emerging market economies, this shift has sometimes actually reduced revenue. This is the case in part because many emerging markets have introduced flat tax systems with low rates and those with progressive schedules have reduced rates over the last two decades.

Economic variables, on the other hand, played a very important role. We looked at increases in per capita incomes and the size of the public-sector wage bill and the reduction in the size of the informal sector, as measured by the share of self-employed workers in the labor force and the share of agriculture in the economy. These developments have clearly been the driving force behind the growth in personal income tax revenues. As economies develop, we can expect this tax to take on greater importance.

Improvements in tax administration also potentially play a role in boosting revenues, though that also extends to other taxes. Moreover, the accelerated shift into digitalized services because of the pandemic can pave the way for better income tax design and enforcement.

What about the redistributive impact of the income tax in developing countries? To explore this, we separate the effects of policy design from the size of the population covered by the tax. Interestingly, the design of this tax in low-income countries is typically progressive; it is instead the narrow coverage that makes the overall contribution to redistribution very small compared to that seen in advanced economies.

In emerging markets, however, it’s not progressive. It would seem, then, that there is significant potential to improve inclusion in this latter group of countries (several of which have a flat income tax).

Is there scope to increase personal income tax revenue in the post-pandemic recovery?

To answer this question, we look at how additional revenue is raised from alternative sources. Here again, there is a large difference between advanced economies, where additional revenue is predominantly sourced from the income tax, and low-income countries, where it plays a much more modest role.

Other taxes will likely have to play a significant role, therefore, in raising revenue over the medium term, with the value-added tax and other indirect taxes remaining the main contributors.

But income taxes can still be important for inclusive growth if properly designed and revenues well spent. Our research—together with the history of the tax in advanced economies—shows that the personal income tax should evolve into a more significant source of revenue as countries develop.