DDEP: Finance Ministry sets offer and settlement dates for bondholders on Dec. 19 and 23

Government, through the Finance Ministry, has set the deadline for the submission of existing bonds for ‘new government bonds’ by bondholders on December 19, 2022.

Subsequently, settlement of the ‘new bonds’ by government has been set on December 23, 2022.

Eligible domestic bondholders (referring to investors in GHS denominated bonds issued by the Republic of Ghana, GHS denominated bonds issued by E.S.L.A. Plc and GHS denominated bonds issued by Daakye Trust Plc) from Monday, December 5, 2022 to December 19, 2022 are to submit their offers for the ‘new bonds’ to government.

Announcement of the acceptance of offers from eligible domestic bondholders by the government will take place on December 20, a day after the December 19, 2022 deadline set for the submission of offers.

In total, a whooping GHS 137bn in domestic bonds is expected to be exchanged for the ‘new bonds’ by government.

GHS denominated Notes and Bonds issued by the Republic of Ghana accounts for the largest portion of the domestic debt being GHS 126bn in total value.

GHS denominated bonds issued by E.S.L.A. Plc and Daakye Trust Plc account for GHS 8.3bn and GHS 2.7bn respectively of the total domestic bond value.

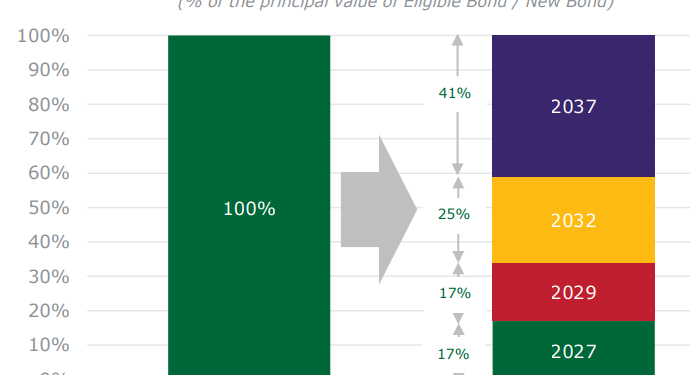

According to the Ministry, payments of principal value of the ‘new bonds’ will be made per government’s “Exchange Consideration Ratios” where 17% of principal value of bonds will be paid at end-2027; another 17% paid at end-2029; 25% paid at end-2032 and the final 41% paid at end-2037.

Annual coupons on the ‘new bonds’ government asserts, will be set at 0% in 2023; 5% in 2024 and 10% from 2025 until maturity.

The above information are entailed in the “Exchange Memorandum” published by the Ministry on behalf of the government.