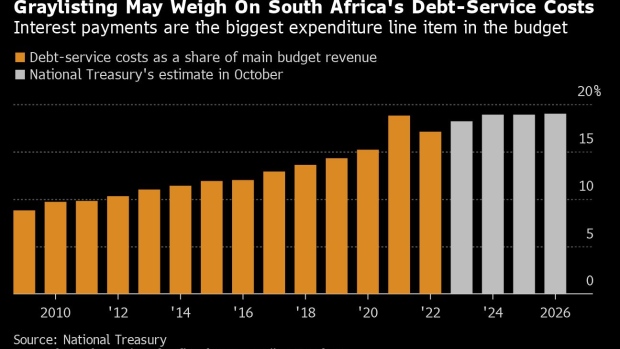

Dirty-money rating risks boosting costs for South African banks, state companies

South Africa’s government and state-owned companies will find it harder to borrow money, while banking and asset-management fees may increase if the country is added to a global watchdog’s list of nations with shortcomings in tackling illicit financial flows.

The Financial Action Task Force, which polices compliance with anti-money laundering and terror-financing measures, will decide whether to include South Africa on its so-called “gray list” during meetings scheduled for Feb. 20-24. That’s after an evaluation carried out in 2019, following an era of endemic graft, found Africa’s most industrialized economy lacking in all 11 of its effectiveness measures to combat dirty-money flows.

The classification will mean increased financial oversight and put South Africa on par with the likes of Syria, the Democratic Republic of Congo and South Sudan. It will also weigh on the reputation of a nation which has a flagging economy, a 32.9% jobless rate and a full-house of junk credit ratings. Governance and policy failures have also forced President Cyril Ramaphosa to declare a state of disaster over electricity-supply constraints.

The immediate impact of graylisting is likely to be muted because South Africa’s myriad problems mean international banks already place the country in a higher risk category and as markets have already priced in the move, according to Peter Attard Montalto, head of capital markets research at Intellidex. A 2022 report by the research firm showed a “high probability” of the country being added to the list.

While graylisting may increase the government’s foreign-funding costs and weigh on trade flows, it’s unlikely to “significantly” affect South Africa’s creditworthiness, said S&P Global Ratings analysts Samira Mensah, Zahabia Gupta and Omega Collocott.

State firms like power utility Eskom Holdings SOC Ltd. and ports and rail operator Transnet SOC Ltd. may face more severe consequences.

“Key state-owned enterprises have already been undermined by misappropriation of public funds and mismanagement, and a graylisting could raise investor concerns that concerted efforts to improve governance and oversight may prove ineffective against rooting out corrupt practices within the largest state-owned enterprises,” S&P’s analysts said. South Africa’s domestic markets aren’t big enough to meet the funding needs of its largest public companies, they said.

Upon graylisting, South African holders of offshore accounts will automatically be considered higher risk clients by financial firms with operations outside the country, triggering more onerous due diligence processes and increased costs that may be passed on to clients. Compliance costs for riskier clients are as much as four times higher than for standard risk customers, said Werner Alberts, deputy chief executive of Capital International Group.

Share Intelligence

In December, Ramaphosa signed into law two pieces of legislation that were seen as important in addressing deficiencies flagged by the watchdog. South African and US authorities recently committed to share financial intelligence related to the illegal wildlife trade and overlapping investigations into high-level corruption, drug trafficking and transnational criminal organizations.

Still, there are concerns about South Africa’s ability to prosecute beneficiaries of illicit financial flows. Law enforcement agencies were hollowed out during so-called state capture and there are indications it won’t fulfill all the requirements to avert the listing, Business Day reported, citing Shamila Batohi, the head of the National Prosecuting Authority.

Finance Minister Enoch Godongwana is “hopeful” the regulatory amendments will stand in the country’s favor, though authorities are studying how Mauritius got itself off the list in less than two years, he said last month.

While the Indian Ocean island nation employed international consultants to project manage efforts to reverse its graylisting, there’s a high risk that “zero-ish impact” on day one will see South African politicians prioritize national elections in 2024 over of getting off the list, Montalto said.

Remaining on the list for more than 18 or 24 months may lead to “very serious issues” including less access to dollars, and may affect trade and foreign investment, said Richard Wainwright, Investec Bank Ltd.’s chief executive officer.