Domestic Debt Exchange: Gov’t to set up Financial Stability Fund; provide liquidity support to banks, pension funds, others

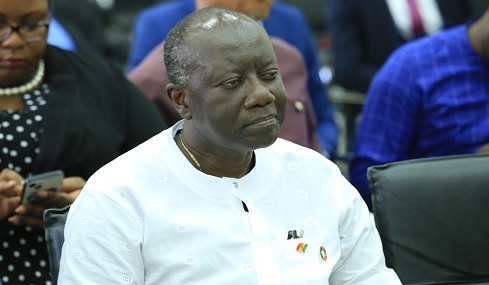

Minister for Finance, Ken Ofori-Atta, has revealed plans by government to set up a Financial Stability Fund (FSF) with the sole purpose of minimizing the impact of government’s domestic debt exchange programme on the financial sector.

According to the Finance Minister, the FSF established with the help of development partners will provide liquidity support banks, pension funds, insurance companies, fund management companies in the country.

This, he noted in a televised address on Sunday, December 4, 2022, is to ensure that the financial institutions meet their obligations to the Investing public.

“Government recognizes that our financial institutions holds a substantial proportion of these bonds. As such the potential impact of this exchange on the financial sector has been assessed by their respective regulators.

“Working together, these regulators have pout in place appropriate measures and safeguards to minimize the potential impact on the financial sector and to ensure that financial stability is preserved.

“A Financial Stability Fund is being established by government with the help of development partners to provide liquidity support to banks, pension funds, insurance companies, fund managers and collective investment schemes to ensure that they are able to meet their obligations to clients as they fall due,” quipped the Finance Minister.

The Finance Minister’s assertion of liquidity being provided to banks in the country, reiterates an earlier assertion made by the Governor of the Bank of Ghana, Dr Ernest Addison who speaking on the impact of government’s debt exchange programme on the Capital Adequacy Ratio (CAR) of banks said, “Banks in the country have enough buffers to withstand the impact of any debt restructuring by government, but should it become necessary to provide the banks with liquidity to remain solvent, the Central Bank will do just that”.

A local debt restructuring programme will significantly affect the CAR of banks in the country given their high exposure to government debt securities.

Between 60% to 70% of investment portfolios held by banks in the country are tied to government debt securities, mainly short term debt instruments.

The Domestic Debt Exchange Programme, the Finance Minister noted in the televised address, will today, Monday December 5, 2022 be launched by government.

Under the programme, domestic bondholders will be required to exchange their existing debt instruments for new ones.

According to the Finance Minister, existing bonds as of December 1, 2022 will be exchanged for a set of four (4) new bonds maturing 2027, 2029, 2032 and 2037.

The annual coupon on the new bonds will be set at 0% in 2023, 5% in 2024 and 10% from 2025 until maturity.

To minimise the impact of the debt exchange programme on investors, the Finance Minister averred treasury bills are completely exempted from the programme and all holders will be paid the full value of their investments on maturity.

Additionally, there will be no haircut on the principal value of bonds.