E-Cedi to help reduce banks’ costs of operation, says Republic Bank MD

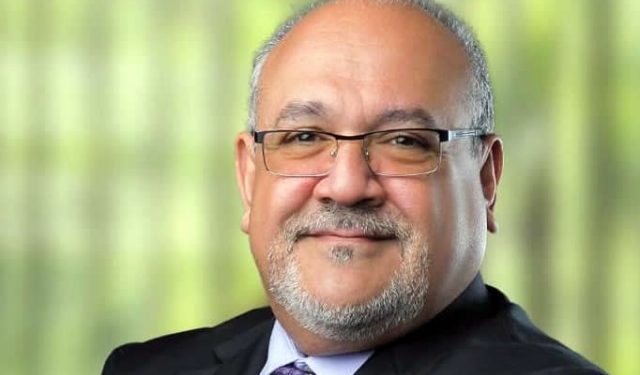

Managing Director (MD) of Republic Bank Ghana, Farid Antar, has said the digital cedi being developed by the Bank of Ghana (BoG), will help reduce the cost of operations of banks in the country.

Speaking to norvanreports in an exclusive interview on the digital currency that is currently under testing by the BoG and yet to be deployed for nationwide use, Mr Antar noted that the e-Cedi when introduced will for instance, significantly limit the transfer of physical cash to branches of banks.

“The e-Cedi will reduce costs of operations particularly with regards to the movement of cash to branches of banks thereby limiting robbery cases and loss of lives, so its not only about the dollar cost of carrying the cash around but also human life costs which is invaluable and which you can’t pay for.

“So with the e-Cedi, the costs now to be incurred will be paying to build more firewalls and resilience for our systems, but overall it should improve efficiency and operating expense of banks,” he noted.

Speaking further in the interview, Mr Antar, noted that the e-Cedi when deployed, will result in the consolidation of all digital payment channels in the country making it very easy for payments to be made across the various payment channels.

“You already have interoperability between banks and mobile networks, different types of cards and so on, and I think with the e-Cedi there will be a consolidation point where money can move across the networks (payment platforms and channels),” he said, however adding that this will come along with increased security risks.

“The e-Cedi resulting in a consolidation point for all payments will come with more risks, security hacking, fraudsters having more opportunities and we have seen this with MoMo fraud which is expanding and they trying different methods to get data of customers.

“But I believe the timing of the Ghana Card and SIM re-registration is right as this will help us all have a common identifier that is validated through an independent system. And also with the sandbox programme of the BoG, all the weaknesses of the digital cedi can be noticed and corrected before it is rolled out and becomes widespread for use,” he stated.

“The Central Bank being the originator of the e-Cedi, gives us [banks] the comfort that there is enough control, regulations and oversight in that space,” he added.

Meanwhile, a banking survey by PricewaterhouseCoopers (PwC) Ghana, has revealed that banks in the country are mostly excited about the introduction of the e-Cedi into the economy by the Bank of Ghana (BoG).

Over 70% of bank executives interviewed in the survey expressed the opinion that the use of the e-Cedi will become prominent among Ghanaians – as was the case of mobile money (MoMo) – in the next three to five years.

The bank executives however, noted that, the general acceptance of the digital currency will be based on good user experience.

“User experience will be at the core of product acceptance among the public and drive its demand, use, and penetration [sic],” said the report.