Economic Uncertainty Can Test the Resilience of the Foreign Exchange Market

Foreign exchange is the largest and most liquid financial market, with nearly $10 trillion changing hands daily. It’s the underpinning for global trade and finance—and its structure is changing as nonbank financial institutions, or NBFIs, assume a larger role in transactions used to manage currency risk and access to foreign funding.

The market’s central role in the international monetary and financial system makes it highly sensitive to macroeconomic developments and policy shifts—particularly those that heighten uncertainty. As we show in an analytical chapter of the Global Financial Stability Report, rising global financial or economic uncertainty typically increases investor risk aversion and boosts demand for safe-haven assets, leading to volatility and liquidity strains in foreign exchange markets.

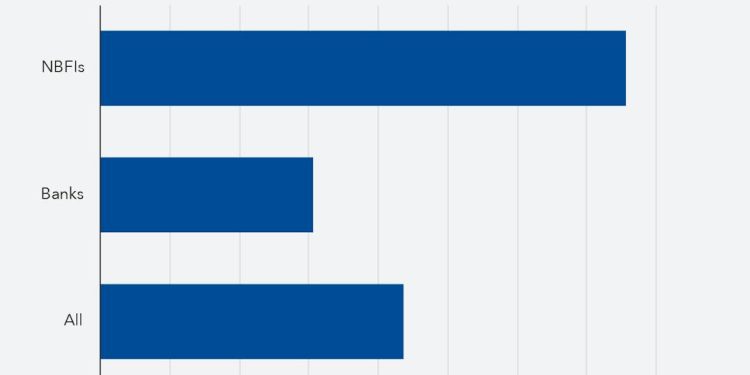

For example, dollar purchases by non-US residents tend to increase by 24 percentage points following a sharp spike in financial uncertainty—proxied by a measure of expected US stock swings—like the one during the March 2020 onset of the pandemic. Our analysis of unique data on transactions across major currencies shows that this surge in demand for safe assets is especially strong among NBFIs. Their activity, while supporting liquidity in normal times, can increase market fragility during stress episodes.

Indeed, exchange rates swing sharply, currency bid-ask spreads widen, and foreign funding and hedging costs rise during episodes of elevated uncertainty. We gauge this using a proxy known as the cross-currency basis, which reflects the cost of swapping one currency for another, with a widening basis indicating stress in currency markets. The effects illustrated by our analysis tend to be more pronounced for emerging market currencies, likely due to those being smaller markets with limited access to dollar liquidity.

Amid a shifting global economic landscape—shaped by evolving trade policies, supply chain realignments, and geopolitical tensions—the surge in uncertainty following the US tariff announcements in April revealed patterns both familiar and new. Nonresident demand for US dollars rose in spot markets, though less sharply than during previous episodes such as the pandemic shock.

Cross-country differences in trading behavior also became more evident, with some economies shifting to net selling of the dollar. Notably, hedging demand from nonresident NBFIs—aimed at protecting against future dollar depreciation—was stronger and more persistent, suggesting evolving shifts in market responses to uncertainty.

Cross-market spillovers

Stress in foreign exchange markets can also spill over to other financial assets. For example, an increase in funding and hedging costs can raise the cost of managing currency risk, potentially affecting yields and risk premiums on assets such as stocks and bonds. Higher funding costs can also erode the intermediation capacity of financial institutions, tightening financial conditions, and posing broader stability risks.

These effects are much more pronounced for countries with higher macro-financial vulnerabilities such as elevated levels of public debt or when financial institutions hold a significant amount of their assets and debts in different currencies.

Operational disruptions

Beyond sensitivity to macroeconomic shocks, foreign exchange markets are also highly exposed to operational disruptions such as technical failures, cyber incidents, power outages, and settlement risk: the possibility that one party will deliver its currency without receiving what the counterparty owes.

Our analysis shows that even relatively brief outages of currency trading platforms can significantly impair market liquidity. Similarly, settlement risk tends to increase exchange rate volatility and remains particularly relevant for emerging market and developing economies, many of which lack access to risk mitigation mechanisms, such as simultaneous settlement systems.

Strengthening resilience

Despite its deep liquidity, the FX market remains vulnerable to adverse shocks. That means policymakers should strengthen surveillance to monitor systemic risks arising from market stress. Enhancing liquidity stress tests and conducting scenario analysis are essential to assess specific funding vulnerabilities across financial institutions.

Authorities must prioritize closing data gaps and ensure that institutions maintain adequate capital and liquidity buffers. They should also establish robust crisis management frameworks that enable swift responses to shocks.

Regulators and market participants also need to improve operational resilience by investing in cybersecurity and contingency planning, so that key foreign exchange infrastructures and participants can recover quickly from disruptions.

To reduce settlement risk, broader adoption of arrangements that settle both sides of a transaction simultaneously should be promoted. Finally, transitioning to well-designed financial platforms can also help lower transaction costs, volatility, and settlement risks.

Comprehensive surveillance, stronger safeguards, and modernized platforms can reduce risk, enhance efficiency, and better position foreign exchange markets to support global finance.