Economist Downplays Major Oil Price Spike Risk Amid Iran-Israel Conflict; Cites Global Energy Transition

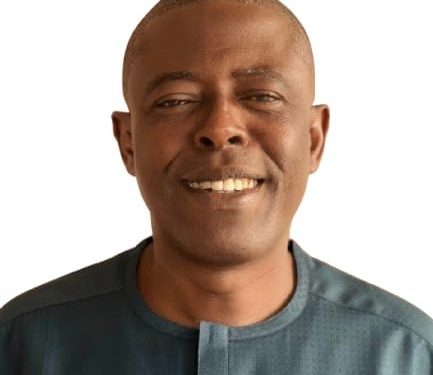

Development Economist and Chartered Accountant, Nicholas Issaka Gbana, has downplayed the likelihood of a sharp rise in global oil prices despite heightened tensions in the Middle East, particularly the Iran-Israel conflict.

Speaking during a NorvanReports and Economic Governance Platform (EGP) X Space discussion on Sunday, on the theme “Oil Wars, Broken Systems: What The Iran-Israel Conflict Really Means for Ghana’s Revenue, Reserves & Reform Path”, Mr Gbana stated that current global trends do not suggest a major spike in oil demand or prices in the short to medium term.

“I don’t think we have a major risk in the short term. The outlook does not indicate a significant spike in oil prices,” he said.

Citing structural changes in global energy consumption, Mr Gbana highlighted the accelerating shift to electric vehicles (EVs) in China and Europe as a factor weakening long-term oil demand.

“China’s oil demand has peaked. The country is scaling up big on electric vehicles. Europe is also transitioning. So, long-term outlook shows we may not see a big demand for oil,” he explained.

He also referenced global economic headwinds, including the aftereffects of former US President Donald Trump’s trade tariffs, which have slowed economic growth and consequently dampened oil prices.

Revenue Impact Minimal, but Debt Risks Persist

Touching on Ghana’s fiscal exposure to global oil shocks, Mr Gbana noted that the country’s revenue streams are not significantly dependent on petroleum-linked taxes. According to him, the bulk of tax revenues are sourced from corporate and personal income taxes, while indirect taxes and customs duties comprise smaller portions of total revenue.

“Even if oil prices rise significantly, the key risk would be inflationary – businesses facing higher costs, lower profits and consequently reduced corporate tax payments,” he observed.

However, he warned of potential fiscal pressures from Ghana’s energy sector legacy debts, particularly the deferral of a new energy sector levy that was meant to service arrears to Independent Power Producers (IPPs).

“To the extent that the levy is deferred, the debt is not being reduced as planned. The IPPs have already threatened to shut down if they are not paid,” he cautioned.

IMF Programme Constraints and Spending Adjustments

Mr Gbana also addressed how rising oil prices could intersect with Ghana’s ongoing IMF programme, especially regarding inflation management and tariff adjustments.

He cited the IMF structural benchmark on quarterly tariff adjustments, noting that if oil prices increased, the government would likely have no option but to pass on the cost to consumers.

“We are under an IMF programme with clear benchmarks. If oil prices rise, I don’t see how the government can avoid passing some of the cost to consumers,” he stated.

On expenditure, Mr Gbana explained that a sustained increase in oil prices could force the government to cut capital expenditure and delay arrears payments, given the inflexibility of salary and interest payment obligations.

“You cannot cut back on public sector salaries or interest payments. So, the government may have to reduce capital expenditure and slow down arrears clearance,” he explained.

Nonetheless, he concluded that with oil prices reverting to near pre-conflict levels, Ghana appears to have escaped the worst-case scenario.

“Thankfully, oil prices are back to almost pre-war levels and the outlook does not suggest we’ll be hit hard,” he remarked.