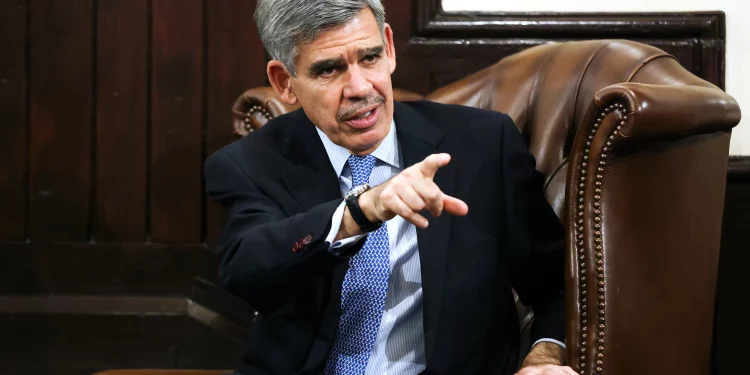

Economist Mohamed El-Erian says the everything bubble is over

Wednesday’s decision by the Federal Reserve to hike interest rates by 75 basis points was its biggest hike since 1994, and economists are starting to digest what a paradigm change it is.

One of the world’s most prominent Fed watchers, Mohamed El-Erian, chief economic adviser of financial services firm Allianz and president of Queens’ College at Cambridge, says it’s part of a “great awakening” for central banks, as several others took action this week.

For instance, the Swiss National Bank imposed a 50 bps increase, its first since 2007, and the Bank of England initiated a more modest hike of 25 bps. The European Central Bank (ECB) recently announced at an emergency monetary policy meeting that it would initiate its first rate hike in over a decade next month and continue with another in September.

Before this spate of dramatic hikes, central banks had been significantly leading investors astray, he said on CNBC’s Squawk Box on Thursday.

“It’s about time we exit this artificial world of predictable massive liquidity injections, where everybody gets used to zero interest rates, where we do silly things where there is investing in parts of the market we shouldn’t be investing in, or investing in the economy in ways that don’t make sense,” he said. “We are exiting that regime, and it’s going to be bumpy.”

El-Erian is referring to the fact that for most of the past 14 years, monetary policy in the U.S. and internationally has been consistently loose, with the Fed and other central banks setting interest rates low and letting money flow to commercial banks by buying up assets and stocks. (Some critics argue that the 1990s were also extraordinarily loose.)

That spurred economic growth in the face of several economic crises but also led to multiple economic bubbles—from housing to crypto to VC-backed subsidies for things like cheap Uber prices—existing at once. Now, all those bubbles are poised to dissipate as banks tighten their policies and stop the free flow of cash.

The impetus for the shift was obvious. Last Friday, the Bureau of Labor Statistics revealed that the inflation rate for all consumer goods increased in May to 8.6%, after a slight decrease to 8.3% in April, following a peak of 8.5% in March.

“8.6% is a day of reckoning,” said El-Erian. “You cannot ignore 8.6% inflation.” Wednesday’s 75 bps hike followed two previous increases this year, a 25 bps hike in March and a 50 bps hike in May.

Thursday’s comments are not the first the economist has made about inflation this week. On Sunday, he appeared on CBS’s Face the Nation to explain that expert predictions had been too optimistic with regard to inflation. “And I fear that it’s still going to get worse,” he said. “We may well get to 9% at this rate.”

On Squawk, El-Erian said the Swiss National Bank’s interest rate hike was actually more significant than the Fed’s. “The Swiss National Bank always fights a strong currency,” he said. “For it to get ahead of the ECB and hike not 25, but 50, shows you that we are in the midst of a secular change.”

In terms of the U.S. specifically, El-Erian said there are three tests to determine whether the Fed has gotten control of inflation. The first is to ask if financial conditions have tightened, which El-Erian said they have. The second is to ask whether they’ve tightened in an orderly way; El-Erian said it’s been slightly disorderly.

The third is to ask whether the bank has been leading or lagging with regard to its approach to inflation. “As long as the Fed lags the process, it’s going to be problematic for markets,” he said.