Egypt talks on IMF-led deal prolonged with $10 billion on table

An International Monetary Fund mission to Egypt has extended its visit until the end of the week for urgent talks on a potential deal that may bring in partners and exceed $10 billion. Egyptian dollar bonds rose.

The North African nation is discussing increasing its $3 billion IMF program — little of which has been disbursed — as part of a wider package that might also include the World Bank, according to people familiar with matter. Egypt is already the IMF’s second-biggest borrower after serial defaulter Argentina.

It isn’t clear if the IMF is asking for an immediate flotation of the Egyptian pound to sign off on a deal. Oil-rich Gulf nations that joined Egypt’s previous rescues aren’t expected to be part of any new pact, according to the people.

The IMF didn’t provide a comment in time for publication. Egyptian officials and the World Bank couldn’t be reached for comment.

Egypt bonds due in Feb. 2026 increased Thursday 0.9 cents to 82 cents on the dollar, the highest on a closing basis in almost a year. Other notes due in 2025, 2027, 2028 and 2048 also jumped.

Egypt’s yields are still around 14%, a high level relative to most other sovereigns and meaning the government’s effectively locked out of the international bond market.

A breakthrough would go a long way toward pulling Egypt from its worst economic crisis in decades as the war between Israel and Hamas next door adds to the urgency of stabilizing the economy of the Middle East’s most populous nation.

The deal that’s taking shape would broadly cover what Moody’s Investors Service estimates is Egypt’s external funding gap in the 2024 and 2025 fiscal years. Hard currency remains scarce, and the government is all but shut out of international bond markets.

The IMF has delayed two reviews of Egypt’s existing program — which it secured more than a year ago — waiting for authorities to allow a more flexible exchange rate and make good on other promises before handing over more funds.

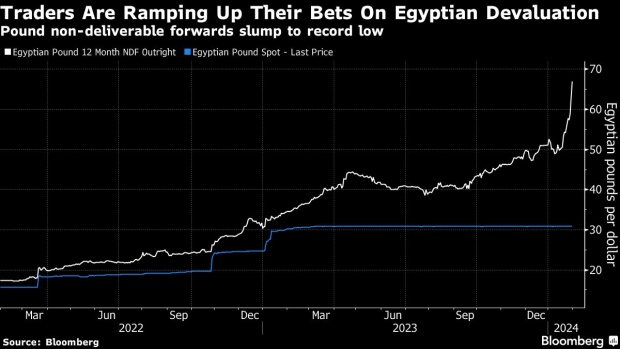

Egypt’s central bank has devalued the pound three times since early 2022, leading it to lose half its value against the dollar. But while the pound’s official rate has held around 30.9 per dollar since March, it’s trading between 65 and 70 on the black market this week, underscoring the dire shortage of foreign exchange in the country.

Traders are meanwhile rushing to raise their bets for another round of depreciation ahead of Egypt’s interest-rate decision on Thursday. In the non-deliverable forwards market, the pound’s 12-month contract has slumped past 66, a record low.

Though most economists surveyed by Bloomberg expect the central bank to keep its benchmark deposit rate at 19.25%, Morgan Stanley and Goldman Sachs Group Inc. predict a steep increase.

“The authorities’ preferred strategy is to bring the parallel rate under control before unifying the exchange rate,” said Farouk Soussa, an economist at Goldman. “This means bringing demand for dollars down through tighter policies and increasing supply through external borrowing. When the parallel rate is at a more reasonable level, the unification of the currency becomes easier through a devaluation.”

On top of disruptions in trade and tourism from the Israel-Hamas war, Egypt is now having to contend with a slump in revenues from Suez Canal, a critical source of foreign currency for the government’s coffers. Many ships are avoiding the waterway to protect themselves from attacks in the Red Sea launched by Yemen’s Houthi militants.

The ongoing discussions between Egypt and the Washington-based lender cover the reforms that Egypt needs to enact to complete the delayed reviews. That includes tightening monetary and fiscal policies alongside a move toward a flexible exchange rate regime.

In a sign that Egypt is making some headway toward meeting some of those goals, the cabinet on Wednesday approved a proposal to slash spending on state investments and halt new projects until at least July.

“It is critical for the authorities to rebuild confidence through a pack of reforms and positive signals to the market,” said Laure de Nervo, the main Egypt analyst at Fitch Ratings.