Election-Violence Risk Threatens US Dollar Dominance

The scenario of another contested presidential race riven by violence looms as an unpriced risk for investors who have long counted on US institutional integrity as a foundation for the nation’s economic strength.

Owning the world’s dominant currency has helped hold down US borrowing costs and the prices of commodities from oil to iron, along with conferring the geopolitical power of cutting American rivals out of the global financial system. Underpinning the dollar’s dominance, according to Federal Reserve Chair Jerome Powell, Treasury Secretary Janet Yellen and their predecessors: the rule of law and institutions that transcend individual politicians.

In the countdown to US election day, one fear that’s looming for some investors is a degradation of that respect. It comes amid doubts about former President Donald Trump’s willingness to concede should he lose to Vice President Kamala Harris. Trump not only continues to insist that the 2020 election was stolen from him, he recently claimed that the 2021 transition was “love and peace” despite the historic storming of the US Capitol by his supporters. The insurrection resulted in death and destruction in the American legislature’s main building.

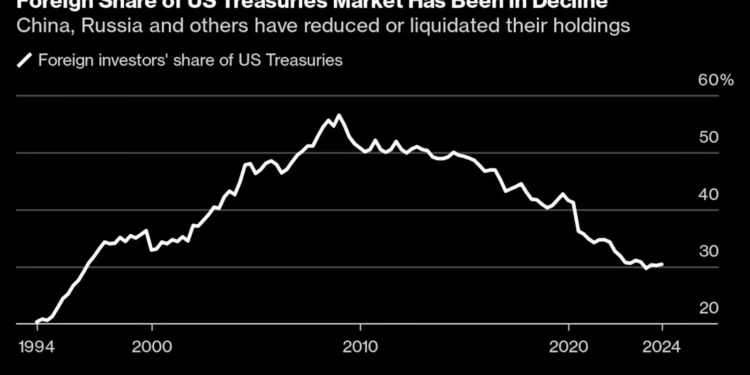

The biggest fear this time around: a fundamental reappraisal by global investors of confidence in US institutions. That’s in the context of the US being the largest net debtor in the world, a reflection of the trillions of dollars foreign governments, funds and individuals have plowed into the $28 trillion US Treasuries market and $61 trillion stock market, along with corporate bonds and other securities.

“If there’s a real question about the effective peaceful transfer of power, it could be very unsettling — not just for our investors but the business and economic activity here,” former Treasury Secretary Robert Rubin said on a Zoom call organized by the Business & Democracy Initiative Wednesday. “The strength of the dollar does depend on respect for our economy, for rule of law, and very importantly” on the Fed retaining its independence, he said.

Thierry Wizman, a three-decade Wall Street veteran who started his career at the Federal Reserve Bank of New York, worries about a scenario where uncertainty over the outcome extends through to congressional certification in January.

“The American exceptionalism narrative could end if traders lose faith in US institutions,” said Wizman, a global currency and rates strategist at Macquarie. “The way that could happen in the next few weeks is if we have an election without a definitive result for several weeks, and where people can’t trust the institutions to adjudicate any of these disputes.”

The election is also occurring against a backdrop of broader concerns about the ability of the US dollar to retain its dominance in the face of efforts by rivals to pare back its use. Earlier this month, the leaders of Russia, China, India and other emerging markets held a summit that featured further efforts to develop an independent cross-border payments system.

Even some US allies are wondering how to cope with an America where both political parties have embraced protectionism and want to bring supply chains back home. The unpredictability of a second Trump presidency could amplify their concerns.

‘Black Eye’

Almost two-thirds of investment professionals around the world surveyed by the CFA Institute expect the dollar to lose its status as reserve currency to some degree in the next five to 15 years, according to a report published last week.

Pat Toomey, the top Republican on the Senate Banking Committee until he retired from the Senate in January, highlighted his worries in an interview this month.

Another incident like the one on Jan. 6, 2021 “could damage our ability to remain the dominant reserve currency of the world,” Toomey said. “It was a very major black eye in the reputation of the US.”

A disorderly crowd broke into the US Capitol that day — storming Congress as it was meeting to certify Joe Biden as the next president, and mob members chanted “Hang Mike Pence,” then the vice president.

Trump’s Denial

One reason there’s concern about another bout of unrest after this election is Trump’s refusal to acknowledge what happened last time.

“You had a peaceful transfer of power,” Trump said in an Oct. 15 interview with Bloomberg News Editor-in-Chief John Micklethwait at the Economic Club of Chicago. “It was love and peace.”

Violence has already been a feature of the 2024 election, with Trump facing two assassination attempts, including one in July where a bullet grazed his ear. Meanwhile, the courts have become embroiled even before voting day. More than 165 lawsuits filed since 2023 — from court cases in Georgia about how votes are counted, to what kind of IDs voters can use in North Carolina, according to a Bloomberg analysis.

More than half of these cases have been filed in the seven states where polls show the race is closest between Harris and Trump.

Such groundwork — and particularly the likelihood of state-level vote recounts — “opens a window for allegations of official malfeasance, and litigation to address it,” Macquarie’s Wizman wrote in a recent note.

Previous Battles

To be sure, a clear, swift election result would eliminate that scenario next week. In the case of a Trump win, investors would also need to mull his comments in recent months pledging to maintain the dollar’s global role even as he engages in tariff threats.

In the wake of the 2020 election, financial markets were largely unfazed when Trump refused to accept the result. Going back to the 2000 election, when the George W. Bush contest against Al Gore was litigated up to the Supreme Court, delaying the result for more than a month, stocks retreated during the legal battling — though that was amid the US dot-com bust and in the run-up to a recession, making it tough to disentangle any political impact.

But things could be different this time, in part because another round of violence and widespread dismissal of an election result in coming weeks could make the Jan. 6 episode appear to be less of an isolated event.

“You can’t be complacent,” about confidence in the dollar and US Treasuries, Bank of New York Mellon Corp. Chief Executive Officer Robin Vince said in an interview with Bloomberg last week. “As is the case with many tipping points, you don’t quite know when you’re approaching it until you go over the other side.”

Vince said that “reliability of US rule of law is, for sure, an important component” of that confidence — sentiment shared by both current and former prominent economic policymakers.

Powell, the current Fed chair, is among many stewards of US economic policy who point to America’s “great democratic institutions” and the rule of law as underpinning the dollar’s status. The currency’s dominance is a “very important thing to us,” he added in a House hearing last year.

Yellen, Powell’s predecessor at the Fed and current Treasury chief, highlighted in a September interview with Politico that the smooth transfer of power in the wake of elections is “really essential to our having a democratic system” and is one element of having a strong financial system “based on strong institutions and rule of law.”

Events that undermine “the perceived stability” including “increased polarization” of US governance could erode the dollar’s status, JPMorgan Chase & Co. analyst Alexander Wise wrote in a report earlier this month laying out risks for the greenback.

Hedging Strategies

Even for those who view de-dollarization risks as modest, some long-term investors may be inclined to hedge against risks, JPMorgan’s Wise and fellow analysts wrote in an extensive recent report on the dollar. One potential strategy would be a “strategic underweight on US equities.”

They highlighted that de-dollarization “should adversely affect large financial” institutions in particular. US fixed-income securities also “would be adversely affected by a likely depreciation of the dollar” should its role in the world subside, the JPMorgan team wrote.

“The potential for uncertainty — an extremely contentious election that has become more about personalities and morals — is likely to bring” volatility in markets until a result becomes definitive, said Karen Manna, a fixed income portfolio manager at Federated Hermes, which has more than $800 billion in assets under management. The events of Jan. 6 are “in everyone’s minds in the markets.”