Emerging economies need much more private financing for climate transition

These countries will need about $2 trillion annually by 2030 to reach that ambitious goal, according to the International Energy Agency, with the majority of that funding flowing into the energy industry. This is a fivefold increase from the current $400 billion of climate investments planned over the next seven years.

We project that growth in public investment, however, will be limited, and that the private sector will therefore need to make a major contribution toward the large climate investment needs for emerging market and developing economies. The private sector will need to supply about 80 percent of the required investment, and this share rises to 90 percent when China is excluded, as shown in an analytical chapter of our latest Global Financial Stability Report.

While China and other larger emerging economies have the necessary domestic financial resources, many other countries are missing sufficiently developed financial markets that can deliver large amounts of private finance. Attracting international investors also faces hurdles, as most major emerging market economies and almost all developing countries lack the investment-grade credit ratings that institutional investors often require. And few investors have experience in these countries and are able to take the higher risk.

Phasing out coal power plants, the single largest source of global greenhouse gas emissions (about 20 percent), is another major challenge. Most of power plants in emerging market and developing economies are still relatively young. Retiring or re-purposing them requires large amounts of private investment and public support. Some countries are highly dependent on coal and would need to develop alternative sources of energy relatively quickly.

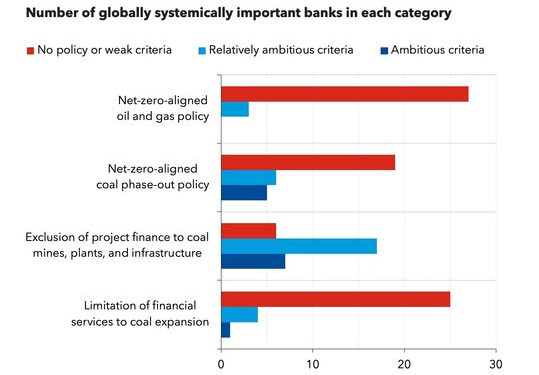

Beyond these challenges, climate policies and commitments at most major banks are still not aligned with net-zero climate targets, even when they do have policies intended to reduce emissions.

Meanwhile, though a growing number of investment funds prioritize sustainability, this isn’t having much effect on how much money is being provided for large climate needs. Only a small portion of such funds explicitly aim to create a positive climate impact. The much larger number of funds that make investment decisions based on environmental, social, and corporate governance factors don’t necessarily focus on climate issues. They typically consider ESG scores in their portfolio allocations, but these aren’t necessarily designed to reflect climate impact as we show in our latest Global Financial Stability Report. More impact-oriented investment portfolios could be quite different from the popular ESG-oriented ones.

Furthermore, lower-middle-income and low-income countries are generally not rewarded for good environmental and climate policies. Credit rating agencies’ assessments of these economies fall short of fully reflecting these countries’ preparedness to a low-carbon transition or their exposure to stranded asset risks because of high level of hydrocarbons. The financial industry still lacks clarity on what constitutes good sovereign performance on environmental issues.

A broad mix of policies is needed to create an attractive investment environment and unlock the necessary private climate finance in emerging markets and developing economies. Carbon pricing can provide an important pricing signal for investors, but it faces political hurdles of implementing it on a broad-enough scale.

A number of additional financial sector policies are necessary. Structural policies aimed at strengthening macroeconomic fundamentals, deepening capital markets, and improving governance are a fundamental part of the policies mix. They can help improve credit ratings and lower the cost capital. And they can increase the domestic financial resources available in a given country. Investors require better climate-related data to make investment decisions. Innovative financing solutions such as blended finance and securitization instruments should be employed to initiate a managed phase out of coal power production.

Policy focus

Policies need to refocus on creating climate impact rather than supporting activities that are already “green” and should consider the specific needs of emerging market and developing economies.

For example, transition taxonomies should consider activities with a potential for significant improvements in emissions over time and across sectors, including in the most carbon-intensive ones such as steel, cement, chemicals, and heavy transportation. The emission reduction targets and criteria in transition taxonomies can be connected to a country’s nationally determined contributions, long-term strategies, and decarbonization targets for specific industries.

The use of sustainability labels is still lax, and regulators and supervisors should set clear rules and tighten enforcement. They should ensure that disclosures and labels for sustainable investment funds effectively enhance market transparency and market integrity, and should ensure a better alignment with climate objectives.

Many of the policies we recommend here will take time to implement and achieve their intended effects. Meanwhile, more extensive public–private risk sharing is critical to foster climate private investments in emerging markets and developing economies. Multilateral development banks and donors can play an important role in supporting blended finance – including through a more extensive use of guarantees.

The IMF Resilience and Sustainability Facility can help by bringing together governments, multilateral development banks, and the private sector to foster the financing of climate investments. Though this tool’s $40 billion total size is small relative to global climate investment needs, reforms supported by it can help attract more private climate finance.