Emerging-market currencies hit two-month low on flight from risk

A gauge of emerging-market currencies dropped to the lowest level in more than two months as rising geopolitical tensions added to an increase in risk aversion amid a shift in the US rate outlook this week.

MSCI Inc.’s FX gauge for developing economies fell 0.2% in a third day of declines as investors sought havens such as gold and the dollar. The Hungarian forint and Israeli shekel were the worst performers.

The global repricing sparked by US price-growth data continued amid additional fears of an escalation in the conflicts in the Middle East. Separately, the intensification of Russia’s attacks on Ukraine was stoking worries that Kyiv’s military effort was nearing a breaking point.

“Geopolitics has played a seemingly secondary role for FX for a while now, but rising tensions between Iran and Israel can spill into even higher oil prices – all to the benefit of the dollar in the near term,” Francesco Pesole, a strategist at ING Bank, wrote in a note Friday.

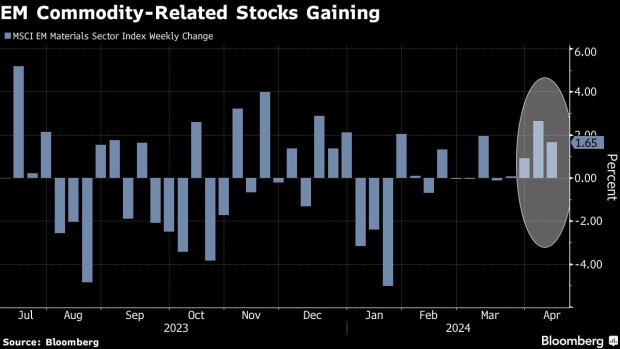

MSCI’s EM stock index fell 0.9% on the day. One outlier was the sub-index of commodity-related stocks, which was heading for a fourth week of advances on the back of higher energy and raw-material prices.

Adding to news weighing on sentiment, data showed China’s exports slumped in March, dealing a blow to hopes that booming sales abroad will offset weak demand at home and drive growth in the world’s second-largest economy.

Bond yields in eastern Europe’s biggest emerging markets reached their the highest levels so far this year on Thursday amid the global shift in rate expectations. Borrowing costs pared some of the increases Friday, with Hungary’s 10-year yield retreating from the 7% mark crossed on the previous day and Poland’s yields also trading lower.

Strategists at Bank of America said they’ve been cautious on emerging-market bonds and currencies “due to concerns about rates and crowded trades” and will await a better moment to raise exposure.

“May might be the time to raise EM risk again as it brings the last batch of data before the June FOMC,” the Bank of America analysts led by David Hauner wrote in a note. “For now, we avoid outright longs in EM FX and rates and stay cautious on spreads.”