Emerging Markets Show Resilience Despite Global Monetary Tightening

Interest rates in the United States are at 20-year highs and the dollar has appreciated sharply against other world currencies. Given the dollar’s outsized role in international finance and trade—and if history is any guide—emerging markets have good reason to be concerned.

We know that rapid monetary tightening in the US and a strong dollar can lead to sudden capital flight and financial crises in the emerging world. The good news is that we have not seen an emerging market crisis.

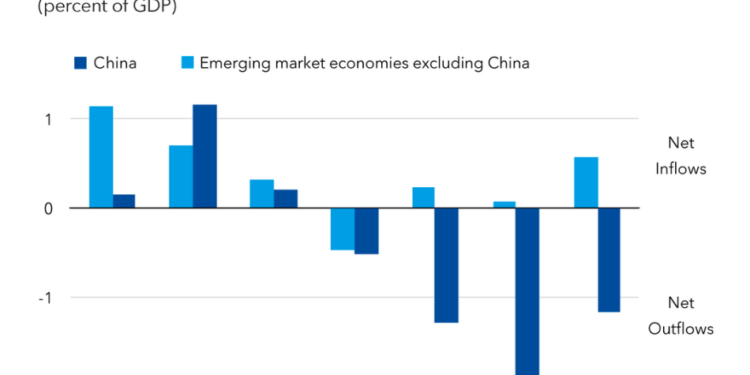

Our latest External Sector Report shows that capital flows into emerging markets have recovered from a post-pandemic low. Net capital inflows into emerging markets—excluding China—rose to $110 billion, or 0.6 percent of GDP, last year. That’s the highest level since 2018.

|

As one would expect during a period of global monetary tightening, emerging markets have seen a decline in more volatile net portfolio inflows, but net inflows of foreign direct investment have been more stable.

China is an exception. It saw net capital outflows, including negative net FDI inflows over 2022-23. Some of this may reflect multinational firms repatriating earnings. But it may also reflect shifting expectations about Chinese growth and geoeconomic fragmentation.

The fact is most emerging markets have shown resilience amid global monetary tightening. This is partly because of stronger fundamentals. Indeed, many countries are now benefiting from more robust fiscal, monetary, and financial policy frameworks, as well as more effective implementation of policies and tools.

But this is only part of the story. These patterns in net inflows mask a retrenchment of global gross capital flows—declines in both gross inflows (foreigners buying fewer assets) and gross outflows (residents buying fewer assets abroad).

In 2022-23, global gross inflows declined from 5.8 to 4.4 percent of world GDP, or from $4.5 trillion to $4.2 trillion, relative to 2017-19, in line with global gross outflows.

The decline masks large differences across countries. The US accounted for 41 percent of global gross inflows—almost double its 23 percent share in 2017-19. Gross outflows from the US have similarly increased, from 14 to 21 percent of global gross outflows. Meanwhile, global gross flows into and from China dropped considerably over that period, and there was an even more drastic decline in gross flows for financial centers.

This may be evidence of increased financial fragmentation but could also partly reflect an unwinding of some tax or regulatory strategies by large multinational corporations in financial centers, whose share of global flows has declined drastically.

Amid shrinking global flows, emerging markets must double down on recent improvements to macroeconomic frameworks, more effective policies and stronger institutions that have helped them to ride out the prospect of higher-for-longer US interest rates.

Countries also have at their disposal a variety of tools to cope with the stresses created by capital flow volatility. The IMF’s Integrated Policy Framework can help calibrate the best possible policy mix—which can also help countries navigate this strong-dollar period.