eNaira, the magic bullet for Nigeria’s financial evolution

The financial inclusion concept refers to the availability for individuals and businesses of useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit, in an effective and sustainable manner.

51% of Nigerian adults use formal financial services, such as commercial banks, microfinance banks, mobile money, insurance policies, or pension accounts, according to the EFInA Access to Financial Services in Nigeria 2020 Survey.

Nigeria’s growth is largely due to the growth of banking, with 45% of its population being banked in 2020, up from 40% in 2018.

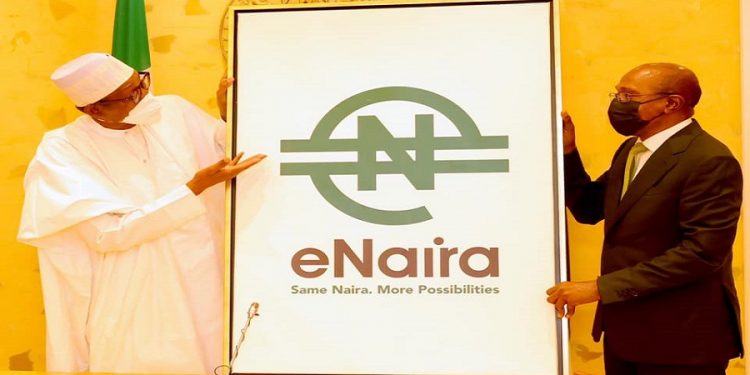

The birth of the eNaira

The eNaira was designed and implemented by public authorities and is accompanied by a strong public sector commitment.

The central bank digital currency like cash, is a liability of the central bank and is therefore not subject to credit risk, providing greater safety to end-users. As with cash, it can serve as a tangible link between the government and the central bank.

The eNaira as central bank-operated system may be able to establish fees and establish rules for the use of data that reflect public interest rather than commercial interests.

All licensed payment service providers could use a CBDC system, either if it is built from the ground up or upgraded from existing systems. Public authorities would be encouraged to reform governance and access policies of payment systems in a way that promotes security, reliability, and efficiency.

eNaira is expected to be adopted by 90 percent of Nigeria’s population, according to the International Monetary Fund, which provided technical assistance during the rollout.

It is possible that eNaira could introduce more vibrancy and innovation to the market by enabling new PSPs to enter, providing payers and payees with more tailored and compelling value propositions.

Read: What other CEOs can learn from Elon Musk’s aggressive, unorthodox Twitter takeover

Due to the nature of centralized digital assets as an open loop, they can encourage more open innovation and facilitate the introduction of new services, since CBDC-based services are assumed to be universally accepted.

The eNaira can enable payments in new contexts like the “internet of things,” and their programmability will make it possible to embed payment services into commercial and social interactions and enable their orchestration.

The eNaira design may enable users to take control of the data generated by payment transactions, which would otherwise remain the exclusive property of a few players in concentrated markets.

Why the eNaira matters

People need access to a transaction account to be able to store money and send and receive payments, which paves the way for financial inclusion.

Digital financial services often begin with payments, providing the infrastructure or “rails” upon which additional products and services can be built (for example, credit, savings, insurance).

By facilitating access to other financial services beyond payments, digital payments offer convenience and affordability not just to individuals and businesses, but also to their financial health.

Digital payments can be used by governments to increase efficiency and accountability in various payment streams, including tax payments and social transfers

Tame inflation with the eNaira

The CBN also wants to lower inflation with the launch of eNaira. By introducing digital money, the country will be able to control the inflow of foreign currency and the increase in prices. In Nigeria, inflation in 2021 reached 16% due to the depreciation of the Naira. As demand for dollars has outstripped supply, the local currency has depreciated since 2012 to around N416 per US dollar.

Customers can use their payment transaction histories to access financial services beyond payments by “porting” them.

Why the eNaira penetration is not exciting yet

Nigerians have lower levels of interest in the eNaira when compared to the crypto market, making it difficult for most to maximize the benefits of eNaira to improve their lifestyle. In order to increase awareness of eNaira’s use, the government should implement a comprehensive digital literacy programme in the country.

The CBN should also order Nigerian banks to market the CBDC more aggressively to their customers in an effort to enhance financial literacy.