Ethiopia dollar bond at two-year high on IMF bailout optimism

Ethiopia’s defaulted dollar bond rose for the 12th straight day — a record run since its 2014 debut — as investors cheered news of a $1.72 billion financing package for the country and an extended deadline to agree an International Monetary Fund bailout.

By 4:35 p.m. in London, the bond was trading at 73.893 cents on the dollar, the highest level in more than two years. The $1 billion issue has been in default since December when the government missed an interest payment.

The latest gains appear to be spurred by a finance ministry statement announcing it had signed agreements with the World Bank for $1.72 billion in credits and grants. On Thursday, the Paris Club of creditor nations was said to have agreed a three-month extension to Ethiopia’s deadline for an IMF bailout. Without that extension, creditors could have declared a previously agreed debt service suspension agreement null and void.

These two developments are likely aiding sentiment, according to Nick Eisinger, co-head of emerging markets FI active at Vanguard Asset Services Ltd.

“The end-of-March timing had posed a risk that the standstill agreed with the Paris Club and other creditors would be unwound and a moratorium declared,” said Eisinger, who is optimistic that recovery rates on the bond could exceed 80 cents, well above current price levels.

“The eurobond should generate quite high recovery rates as it is only one bond and the debt burden in stock terms is not so high in Ethiopia, even if there is a need to make liquidity savings by reducing near-term payments,” he added.

Ethiopia had initiated debt restructuring efforts, including seeking relief through the Group-of-20‘s Common Framework mechanism in 2021, as a civil war in the Tigray region hit its economy. Its December eurobond default came a month after it agreed an interim debt-service suspension with official creditors.

Signing an IMF program is crucial, as it could unlock billions of dollars in concessional financing from other sources, including the World Bank and the African Development Bank, to help close the estimated $11.5 billion financing gap the country faces over the next four years.

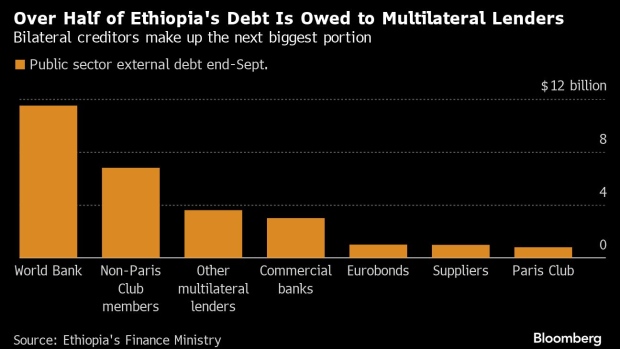

While the nation hasn’t said how much of its liabilities it wants to rework, public sector external debt totaled $27.8 billion at the end of September, finance ministry. data show.