Europe’s gas rush spurs $223 billion of new polluting investment

Europe’s demand for gas is driving $223 billion in new investment to produce the fuel globally during the next decade, according to a new study that casts a spotlight on the region’s broad carbon footprint even as it tries to rein in emissions.

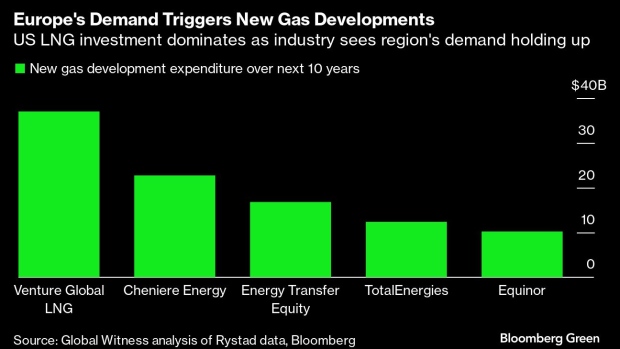

Two US liquefied natural gas companies — Venture Global LNG Inc. and Cheniere Energy Inc. — are set to lead spending on new developments going forward, climate activist group Global Witness said in its report, which analyzes data from Rystad Energy. Industry heavyweights TotalEnergies SE and Equinor ASA are also high on the list.

Overall, the fossil fuel industry is set to invest $1 trillion in gas production for Europe through 2033, it said.

The findings add to indications that Europe’s gas demand is set to continue its upward trajectory — despite efforts to slash emissions — as it rebuilds its energy framework after Russia cut most supplies in the fallout of war in Ukraine. Europe’s consumption of the fuel is forecast to grow by 3% this year — slightly higher than the global average, though lower than the world-leading 4% rate in Asia, according to the International Energy Agency.

Although gas produces less pollution than other fossil fuels, its projects worldwide are under increasing scrutiny for their effects on climate change, raising questions about which facilities will ultimately get built.

The Biden administration on Friday halted approval of new US licenses to export LNG while it studies the climate effects, a move that could disrupt billions of dollars in investment. The Global Witness study was compiled before that decision.

Europe relies heavily on imported gas from the US and Qatar, the world’s top LNG suppliers. It’s also looking to boost production within its own borders to serve as a bridge during the energy transition. Germany, the region’s largest economy, is considering support for a massive expansion of its fleet of gas plants, which could ultimately burn hydrogen.

‘Dangerous Path’

“Europe is hurtling down a dangerous path by doubling down on fossil gas,” said Dominic Eagleton, senior fossil fuels campaigner at Global Witness. He called on the European Commission to set 2035 as a phase-out date for the fuel.

Forecast production for Europe would lead to 6.6 billion tons of carbon dioxide entering the atmosphere until 2033 — equivalent to more than two decades-worth of France’s annual emissions, according to the group.

Its study analyzes forecast operating and capital expenditures for gas production, compiled by researcher Rystad. The report covers demand and projects for all of Europe, not just EU nations, excluding Russia. Top spenders on total gas infrastructure for the region include some of the world’s biggest oil and gas companies, it said.

Europe has generally been at the forefront of regional efforts to tame climate change. Next month the commission, the EU’s executive branch, will put forward its recommendation for an emissions-cut target of 90% by 2040, while acknowledging that fossil fuels will still continue to play a role, according to people familiar with the matter.

The question is whether the deals signed by energy companies match up to those ideals. In the run-up to the COP28 climate summit in Dubai last year, the EU declared it will push for a global phase-out of fossil fuels well before 2050. Two days later Shell Plc signed a 27-year agreement to buy Qatari LNG for the Netherlands. TotalEnergies signed a similar contract.

Global Witness’ analysis shows that those two companies, alongside Exxon Mobil Corp., Equinor and Eni SpA are set to spend a total of $144 billion on the gas supplies Europe needs over the next decade.