Kenya eyes environment levy, tax on green bonds to fund budget

Kenya’s Treasury wants to target infrastructure bond investors, motor vehicle owners and online marketplace operators, among others, with new tax measures to raise revenue and attain the lowest fiscal deficit in at least 15 years.

It’s also pushing for a special environmental tax to address pollution.

The measures were contained in a bill sent to Kenya’s national assembly and dated May 9. MPs have until the end of June to consider the proposals, which would come into effect between July and January 2025.

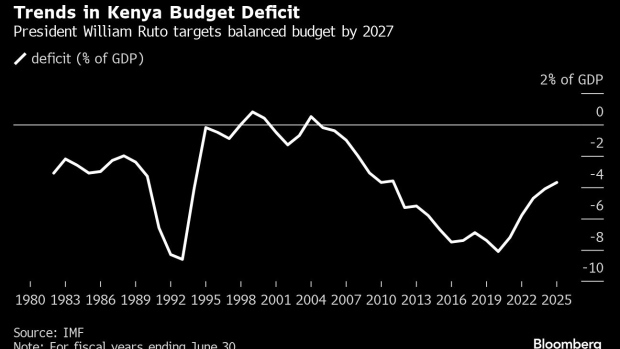

They’re meant to fund Kenya’s budget for the year that starts in July, as part of a plan to nearly double revenue collection to 25% of gross domestic product in 2030. The African nation’s budget deficit is expected to be 2.9% of GDP for the year through June 2025.

Under the wide-ranging proposals, the Treasury has called for a 5% withholding tax on interest arising from infrastructure bonds as well as green bonds. Coupons from those securities have been tax free until now, making them popular among investors. Existing infrastructure bonds with a maturity of at least three years would be exempted from paying tax.

A so-called “eco levy” would be charged on manufacturers and importers of various goods, including diapers, rubber tires and electronics to “pay for the negative environmental impacts of the goods” they produce or ship into Kenya.

Kenya also wants to target multinational companies with a levy dubbed “minimum top-up tax,” to be paid by firms whose combined effective tax rate is less than 15%. The tax would be applicable to firms which are part of a multinational group with consolidated annual turnover of at least €750 million by the parent entity.

A separate digital market-place measure that addresses significant economic presence may zero in on companies such as Uber, Netflix and Glovo, a food and grocery delivery site.