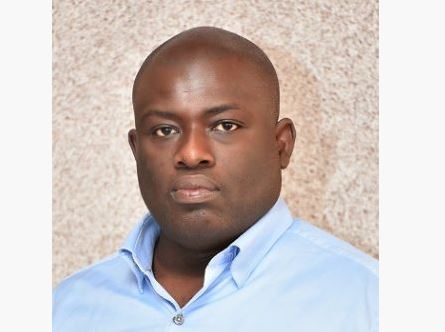

Ex-Goldman Sachs Banker Asante Berko Extradited to New York to Face Bribery Charges

Former Goldman Sachs banker Asante Berko was extradited to New York from the UK to face federal charges of orchestrating bribes to Ghanaian officials during his tenure at the investment bank.

Mr Berko arrived in New York on Monday night July 15, and made his initial court appearance on Tuesday, July 16 according to John Marzulli, a spokesman for Brooklyn US Attorney Breon Peace.

The extradition marks a significant development in a case that dates back to a 2020 indictment. Mr Berko, a former vice president at Goldman Sachs, is accused of conspiring with Ghanaian officials and others in a bribery scheme designed to benefit Goldman, himself, and a Turkish energy company seeking to construct a power plant in Ghana.

US authorities allege that Mr Berko facilitated bribes to obtain the necessary approvals for the project, with Goldman holding a 16% stake in the Turkish company. Additionally, prosecutors claim he laundered the bribe money through US financial institutions.

Mr Berko, who had been detained in the UK since his 2022 arrest at London’s Heathrow Airport, failed in his legal attempts to block the extradition. His lawyers had argued that the charges were not extradition offenses and that most of the alleged acts took place in London. However, their efforts were unsuccessful, and he was transferred to New York to face the charges.

Goldman Sachs, which has faced high-profile foreign bribery cases in the past, notably the 1MDB scandal, was not accused of wrongdoing in connection with Mr Berko’s alleged activities.

In the 1MDB case, Goldman paid over $5 billion in penalties, including a $2.3 billion fine in the US, and its Malaysian unit entered a guilty plea, marking the largest penalty in US history for violating the Foreign Corrupt Practices Act.

In 2020, the US Securities and Exchange Commission (SEC) filed a lawsuit against Mr Berko for the same conduct. He resolved the lawsuit by agreeing to pay more than $329,000 to regulators without admitting or denying the allegations.

The SEC stated that he concealed the bribery scheme from Goldman’s compliance department. Mr Berko resigned from Goldman in December 2016 and later served as managing director of Ghana’s state-owned Tema Oil Refinery Ltd., a position he relinquished following the SEC suit.