Experts Warn of Debt Trap, Sovereign Default Risk as Nigeria’s Public Debt Surge Over 1,000% in Naira Terms

Financial experts are raising concerns that Nigeria could be entering a full-blown debt trap, where the government is forced to take on new loans just to service existing obligations.

There are also growing fears of sovereign default, the possibility that Nigeria might struggle to meet its debt obligations.

Nigeria’s fiscal position has deteriorated significantly over the past decade, with public debt rising by more than 1,000% in naira terms, driven largely by currency devaluation and persistent fiscal deficits.

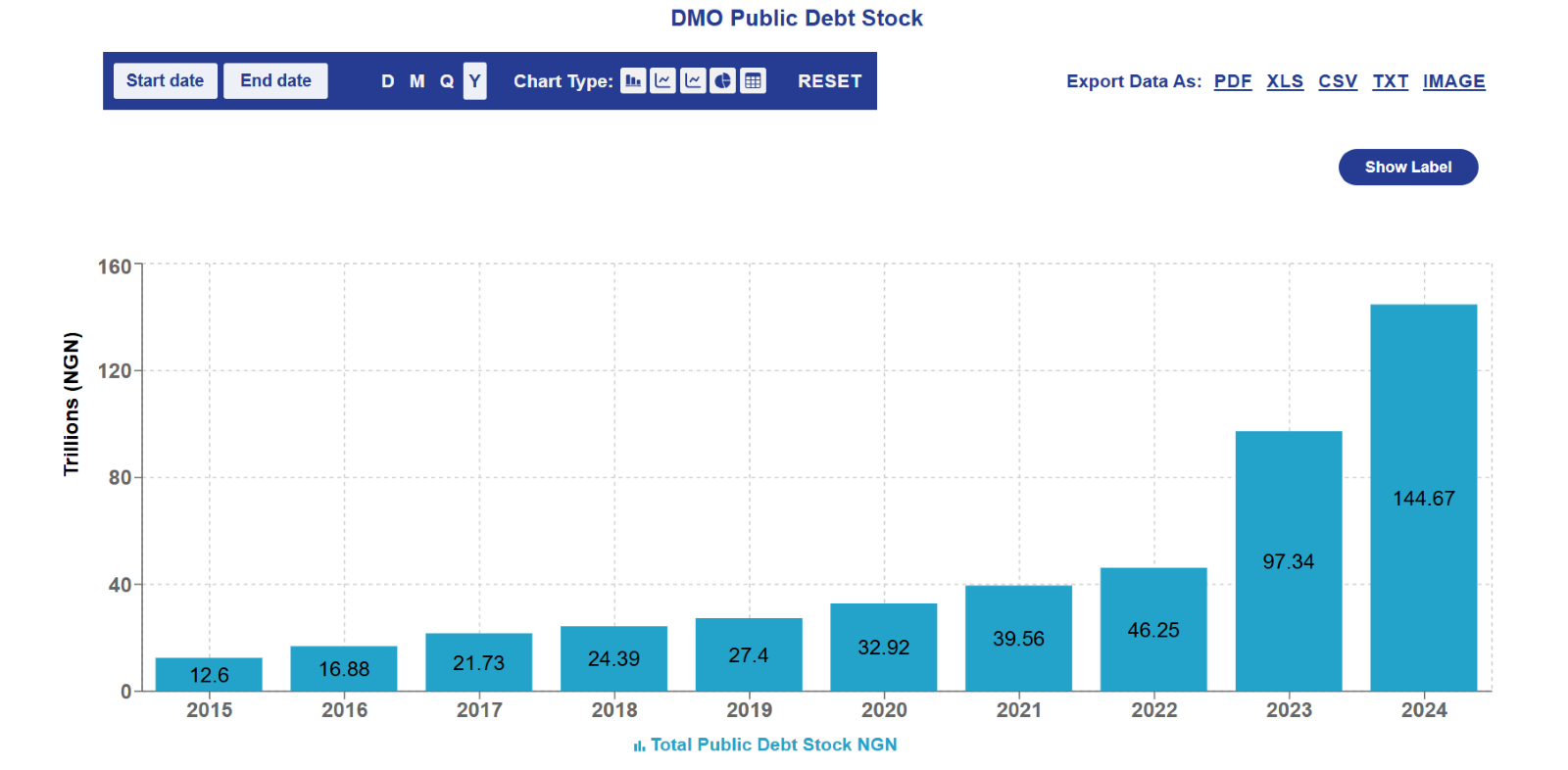

The naira value of public debt soared from N12.6 trillion in 2015 to N144.7 trillion in 2024, marking a 1,048% increase, according to data from the Debt Management Office (DMO) analyzed by Nairametrics Research.

In dollar terms, Nigeria’s debt increased by a more modest 44% over the same period, from $65.43 billion in 2015 to $94.23 billion in 2024.

However, the real cost of that debt to the Nigerian economy has been significantly inflated by the sharp 697% depreciation of the naira, which fell from N192.63/$ to N1,535.32/$ during the period.

This currency depreciation means Nigeria now spends significantly more in local currency to service foreign debt, even when the actual dollar obligations remain unchanged. Domestic debt also contributes heavily to the burden, including borrowings through FGN bonds, savings bonds, and treasury bills.

The public debt trajectory is already rising in 2025, with President Bola Tinubu requesting Senate approval for a new $21.5 billion external borrowing plan as part of the 2025–2026 borrowing strategy. In addition, the President is seeking a ¥15 billion Japanese loan and a €51 million grant, indicating continued reliance on external financing.

Expert commentary on Nigeria’s public debt

Vice Chairman at Highcap Securities, David Adonri, stated that, “FGN’s public debt has continued to skyrocket. In just two years of this administration, the debt has doubled what the previous administration accumulated in eight years,” says Adonri.

“While the naira-denominated debt may be covered with Ways and Means (central bank financing) at the risk of hyperinflation, escalating foreign debt must be extinguished with hard currency, which may not be available when needed. That is the real threat; a sovereign default could occur if this pace of foreign borrowing continues unchecked. We are already in a debt trap, borrowing new funds to pay old debts. If the federal government doesn’t de-leverage soon, insolvency could be imminent.”

Head of Research at Afrinvest, Damilare Asimiyu, stated that, “The current administration has improved revenue somewhat. Gross revenue rose to N34 trillion in 2024, but only N9.44 trillion was retained for the federal budget, while the rest went to states and revenue-generating agencies,” Asimiyu explains.

“However, spending is growing faster. The FG spent around N25 trillion in 2024, leading to a deficit of N15.6 trillion. DMO data shows FG borrowed N46 trillion in 2024 alone, raising its debt to N133 trillion. The national debt hit N144 trillion.”

“The exchange rate collapse has magnified our debt profile. With the naira falling from N187/$ in 2014 to N1,550/$ in 2024, the naira cost of each dollar of debt has multiplied more than 15-fold. Although USD debt forms just 38% of our total debt, it is the most volatile portion.”

“We need to borrow responsibly for infrastructure and growth projects, not just to cover consumption/recurrent spending or repay existing debt. Otherwise, the future is in jeopardy if borrowing continues at this pace and revenue growth remains depressed.”

Chief Compliance & Risk Officer at Zigma-Alpha Asset Management, Ayegbeni Kanabe

“Debt is not inherently bad, but it must be tied to economic projects with clear impact and transparent repayment plans,” says Kanabe.

“The issue is not debt alone, it is misapplied or poorly utilized loans. If loans are used efficiently and targeted at projects that drive productivity, repayment becomes manageable.”

“The government must also communicate the economic importance of debt-financed projects to the public. Citizens need to know how the debt improves their lives, and not just see figures rising annually without visible development.”

Key factors that have contributed to Nigeria’s rising public debt

1. Exchange rate devaluation

One of the most significant drivers of Nigeria’s public debt, especially in naira terms, is the sharp depreciation of the naira.

The exchange rate fell from N192.63/$ in 2015 to N1,535.32/$ in 2024, a 697% devaluation. As a result, even if external debt remains flat in dollar terms, its naira value explodes, making debt servicing more expensive.

2. Persistent budget deficits

Nigeria has consistently spent more than it earns, especially due to heavy recurrent expenditure.

These deficits are financed by borrowing; the 2025 budget carries a significant projected deficit of N13.39 trillion, to be financed through borrowing.

3. Low revenue mobilization

Although gross revenue has grown, the revenue was N34 trillion in 2024, according to the CBN statistical bulletin, but the federal government retained only N9.44 trillion for the budget.

Weak tax collection and over-reliance on oil revenue have undermined the ability to fund budgets without debt.

4. Escalating debt servicing costs

As debt grows, so do debt servicing obligations. Debt service increases from N8 trillion in 2024 to a projected N16 trillion in 2025. Servicing both local and external debt now consumes a significant share of the national budget.

5. Over-reliance on external borrowing

About 48.59% of Nigeria’s total debt is external, mainly in USD and other hard currencies.

Foreign borrowing has grown under successive administrations, often for budget support, infrastructure, or project finance.

This makes Nigeria vulnerable to global interest rate hikes and exchange rate movements.

Outlook

Without urgent reforms, Nigeria’s public debt is expected to continue rising in 2025.

Already, the president has requested the Senate to approve a new $21.5 billion external borrowing plan. Key recommendations include:

- Improving revenue generation, especially through taxation and export diversification;

- Reducing budget deficits by cutting non-essential spending;

- Avoiding debt for recurrent expenditure;

- And most importantly, ensuring that debt is tied to productive investments.

If these steps are not taken, Nigeria may face a debt crisis that undermines macroeconomic stability, investor confidence, and the ability to fund essential public services.