Explainer: Understanding CBN’s new guideline on import and export financing

This Central Bank of Nigeria (CBN) new guidelines on import and export financing via an eValuator system are set to effect on February 1, 202. So, let’s talk about it.

Introduction of the Policy

The Central Bank of Nigeria new guideline on imports is based on the electronic submission of invoices called the e-vouchers. This new guideline is mandatory for all imports above $10,000. These new e-Vouchers will be issued and authenticated by Authorized Dealer Banks (ADBs).

Importers of any good or service into Nigeria will have to register that good or service supplier into an electronic database. This database is updated annually. The importer of any good or service will then proceed to submit import papers to complete a Form M.

Still electronically, the price the importer will quote will be based on a “Global Price Verification Mechanism (GPM) guided by a benchmark price. The GPM will advise a benchmark price for all goods and services, which is the actual spot price advised to the importer by the supplier. See CBN Circular below in diagram one.

The Benchmark Price

The new guideline revolves around this benchmark price. If the supplier wishes to import, his quoted price on the invoice presented to his bank (ADB) should not be more than2.5% of the verified global benchmark price. If the quoted price is higher than 2.5%, Form M will be queried and not be processed either in Form M or NXP. It is the responsibility of the importer to ensure their supplier complies.

Read: Kenya ranks ahead of South Africa, Nigeria in the use of digital payments

Let me summarize this way. If you intend to import a BMW 5 Series car from BMW of Atlanta, these are the steps under the guideline.

- Go to BMW of Atlanta, obtain an Invoice

- BMW of Atlanta will register on a dedicated electronic portal provided by CBN but operated by the CBN agent service provider. This registration will cost $350 and be valid for 12 months.

- The CBN’s service provider will issue BMW of Atlanta a digital certificate. BMW of Atlanta will sign your eInvoice with this digital certificate.

- BMW of Atlanta will provide the authenticated eInvoice to you

- The CBN’s service provider will transmit BMWs eInvoice to CBN, specifically the Nigeria Single Window Portal Trade Monitoring System (TRMS)

If the BMW of Atlanta quoted price for your BMW 5 series is more than 2.5% of the benchmark price, then your Form M will not be processed.

This guideline also applies to exports; the critical difference for exporters is that the exporters from Nigeria are quoting a price as the supplier. They must quote within a 2.5% band as well.

Thus, if I am a Cassava Chip exporter and I get an order from China, I cannot quote a selling price below 2.5% of the benchmark price for cassava chips as advised by CBN. This is an important distinction. Now, let us talk about exchange rate mechanism in Nigeria.

Why is Exchange Rate Important?

When you import, you are buying Forex, in effect, you are taking Forex away from Nigeria; you “weaken” the Naira. When you export, you are bringing Forex into Nigeria and “strengthening” the Naira.

The CBN and all Central banks always promote exports; however, not all Central Banks want a strong currency. Strong export economies such as China, Germany, Switzerland, and Japan prefer a weaker currency to ensure their exports are competitive.

The CBN’s stated goal is to have a “strong” Naira to the US Dollar by words and deeds. The CBN has defended the Naira exchange value in relation to the US Dollar to ensure it does not weaken further. The CBN rightly is wary of imported inflation.

Nigeria however is also an exporting nation, she exports Crude oil, Cocoa, Cashew, and many other commodities, but Nigeria CBN also has a Capital Control policy. This means the inflow and outflow of foreign capital in and out of Nigeria is controlled and regulated.

The Exchange rate of Naira to the dollar is set by the CBN, not the interplay of Demand and Supply. Thus, Nigeria has two rates, the official NAFEX rate, which exchanges $1 to about N414 and the unofficial rate at about $1/550.

The Export v Import Gambit

Many exporters from Nigeria are willing to sell their local commodities at a discount to the international commodities market because this attracts international buyers. They, however, do not remit their Forex to the official channels but rather to the unofficial market to take advantage of the higher exchange rate. So currently, exporters can earn more from the arbitrage in selling USD to the unofficial market.

The CBN has a standing policy that exporters must repatriate all exports within 90 days for oil and gas transactions and 180 days for non-oil exports. The CBN had in January 2021 instructed banks to prohibit Nigerian exporters that fail to repatriate Forex earnings from banking services with effect from January 31, 2021.

CBN has tried sticks of sanctions and carrots of paying N5 per deposit to encourage repatriation of proceeds back to Nigeria, but this has not been successful. This policy is an export-import gambit. The exporter will have to invoice at the benchmark prices, this will enable them to earn more from the export side by selling at higher prices, but they will then remit Forex at the lower exchange rate.

The CBN objective of a “strong” Naira is thus affected by the low foreign reserves it must defend the Naira. The low reserves are a function of non-remittance of export proceeds in a timely manner as well as fall in remittances generally

Exports win, Imports lose?

This new e-Voucher guideline raises commodity prices from Nigeria and removes the advantage of lower prices from Nigerian exports, but more remittances theoretically should flow to the CBN. Importers have a more challenging time.

However, is the 2.5% not too narrow a band? When you buy a BMW in Atlanta, there are three main factors that drive your selling price

- Cost price, how much is the car worth?

- Your profit margin, how much do you want to make?

- Inflation expectation, what if will cost you to replace your stock.

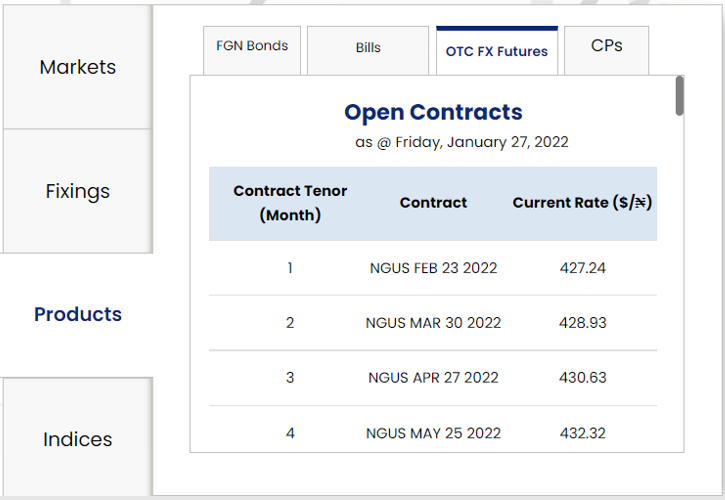

The BMW from Atlanta is sold in United States Dollars; however, you are importing to sell in Nigeria for Naira. According to the CBN, the OTC FX Future rates of the dollar to Naira for delivery in May 2022 show further weakening of the Naira to N432.32. The futures price is thus my replacement cost in 5 months.

See diagram 2 showing FMDQ quote. Thus, all traders add a margin that captures this inflation expectation. The language in the CBN circular explicitly suggests that the margin is a firm 2.5%; it implies ignoring the inflation reality. Many importers will simply no longer open Form M and will finance their imports or change destination port.

Diagram 2, FMDQ OTC FX Futures Quote

However, this policy has some good points; it allows the CBN to have a database of importers and import requests. Every time a new supplier registers, it’s a trade forecast for the CBN. It is an early notice to the Central Bank of Nigeria that will need to have forex reserves to meet that Forex demand.

This will allow more long-term planning and management of the reserves position. It will also remove the fraudulent request for FOREX on non-existent trades and overall reduce slippage.

We shall revisit this policy.