Capex of top 30 miners to grow 6.2% in 2023, but decline over next two years

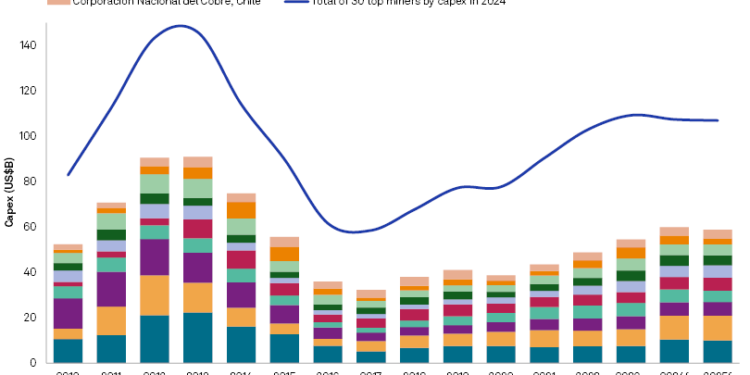

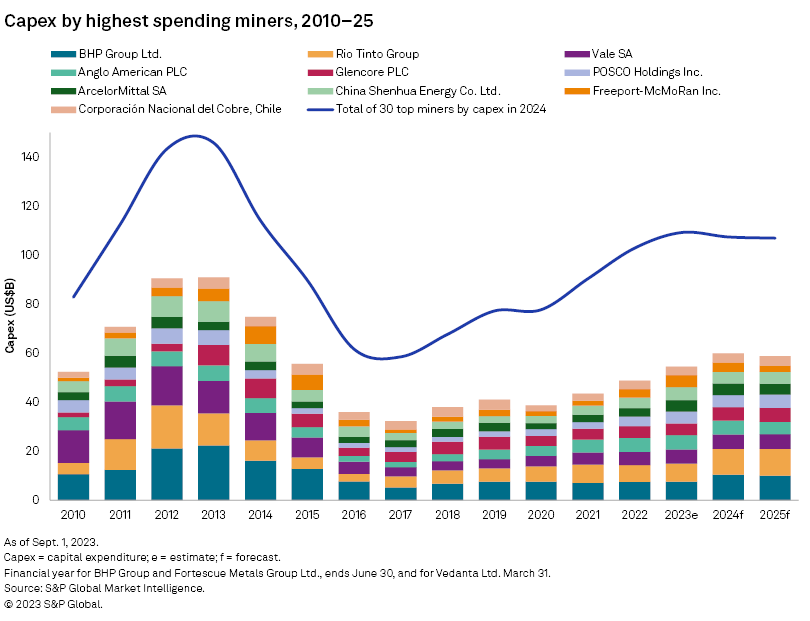

Capital expenditure of the 30 top miners globally is expected to grow 6.2% in 2023 to an estimated $109.2 billion, following increases of 13.8% in 2021 and 16.3% in 2022, says S&P Global in a research report.

However, these companies may not have reached the peak of their investment and expansion efforts, as the 2023 planned capex is still $36.5 billion short of 2013’s peak of $145.7 billion, the firm adds.

“We expect investment in the next two years will become more challenging against a backdrop of high inflation and interest rates and slowing economic activity, leading the group’s capex to decrease 1.8% in 2024 and 0.7% in 2025,” says Ying Li, a metals analyst at S&P.

S&P notes that capex of the diversified companies may go towards items such as smelters, steel production, logistics or power generation, meaning the total spend of each company is not directly comparable. This analysis focuses only on the capex for metals and mining projects.

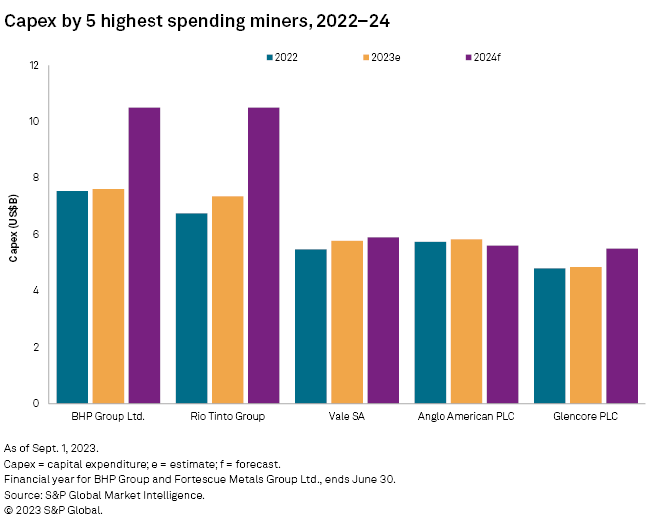

According to S&P, the highest capital budget spend in financial year 2023 is expected to come from BHP at $7.6 billion. The world’s biggest miner has increased its capex outlook for fiscal 2024 to $10 billion from a previous management projection of $9 billion. Capex for stage 1 of the Jansen mine in Canada was $647 million in fiscal 2023, and the project was 26% complete as of the close of the financial year. BHP expects its capex for stage 1 to increase to approximately $1.0 billion in fiscal 2024 and total capex for the project to reach $5.7 billion.

BHP also increased capex guidance to $11 billion per year for the medium term, of which approximately $4 billion in aggregate will be channeled to operational decarbonization before the end of 2030. The company approved a number of potential projects to begin in the next few years and will give an update on investment for its Escondida copper mine in Chile and iron ore operations in Western Australia, which will account for 71% of the total development capex in fiscal 2023–24, S&P estimates.

Following closely in second is Rio Tinto, whose latest 2023 capex guidance is set $7.4 billion — including about $1.5 billion in growth capital — to be used to ramp-up projects, including Guinea’s vast Simandou iron ore deposit, the underground expansion of Oyu Tolgoi copper-gold mine in Mongolia and Argentina’s Salar del Rincon lithium project.

Rio Tinto’s investment over the next two years is starting to tilt more toward growth, with its total capital investments guidance for 2024 and 2025 set at up to $10 billion, which S&P says could vary depending on the rate of development at Simandou. It is worth noting, however, that even with the company’s capital spending growing a projected 42.8% in 2024, putting it three times higher than the 2016 low, it is still below the 2012 peak.

Anglo American trimmed its 2023 capex outlook to $6.0 billion in midyear reporting from previous guidance of $6.0 billion to $6.5 billion. This includes growth spending of $1.5 billion, of which $700 million is planned for the Woodsmith polyhalite project in the UK. The company’s share of the ramp-up associated with the Quellaveco copper mine in Peru is planned at approximately $100 million in 2023. S&P expects that capex will average $5.3 billion per year in 2024 and 2025, with sustaining capital planned to remain between $4 billion and $5 billion each year.

Vale’s capex totalled $5.5 billion in 2022 but was 8% higher than guidance due to investment in some projects in Brazil, namely the Sol do Cerrado solar energy complex, the Serra Sul iron ore expansion, the Capanema and Tubarao Briquette iron ore projects, and the Salobo III copper project expansion.

The company plans to spend approximately $6 billion in 2023 on projects, including the Onca Puma mine’s second furnace, the Thompson phase 1 part of Manitoba Division and the construction of Voisey’s Bay underground mine expansion, the continuing ramp-up of the Serra Sul operation, as well as the Morowali nickel project in Indonesia.

Rounding out the top 5 biggest spending miners between 2022-2024 is Glencore, which is due to invest approximately $4.8 billion this year. Capex at Glencore’s industrial assets is expected to average $5.6 billion per year between 2023 and 2025, with $1.1 billion per year for metals portfolio expansion activities, $3.2 billion per year for sustaining metals assets, and $1.3 billion per year for supporting the continued operations of the energy portfolio in line with the climate commitment, S&P says.

Key investment projects for Glencore over the next few years include the desalination project at the Collahuasi copper joint venture in Chile, the extension of Sudbury integrated nickel operations in Canada, the Zhairem zinc project in Kazakhstan, and the commissioning of Canadian Raglan phase 2 in 2024 and that of Onaping Depth in 2025.